filmov

tv

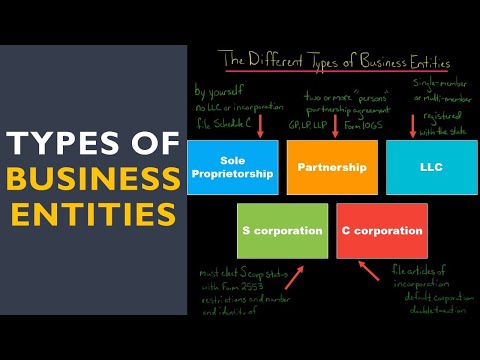

What business entity should I choose? Corporation, S-Corp, LLC, or Partnership?

Показать описание

How will you decide?

You are on the right track to consider these various options, because each carry certain advantages that may be of benefit to your business. Corporations were originally formed to provide liability protection to investors; you could lose what you put in, but that was the extent of your exposure. Corporations were treated in law as “persons” and held to have an existence separate from their shareholders which justified this treatment. Corporations were the first tool to protect personal assets and shield the business owner from personal liability.

However, if corporations were persons, they could be taxed. This led to the issue of “double taxation”: as a shareholder of a corporation, you were not only taxed on the income (dividends, etc.) that you earned from the corporation, but the corporation itself was also taxed on such income.

Naturally, savvy businesspeople – and their accountants and tax lawyers – sought a way around this double tax treatment. They fastened on the partnership, which is a group of individuals bound by contract but not an entity separate in itself. Therefore, the partnership itself was not subject to tax; only the partners were taxed on the income.

The partnership idea seemed great! Less taxation, brilliant! From a legal standpoint, the partnership is not separate from the partners, and therefore, when something happens (as it always does)… each partner is liable for his or her share of the damages. A partnership offered potentially better tax treatment but sacrificed personal liability protection.

Then some clever lawyers had an idea: what about an entity that was taxed like a partnership… but treated like a corporation when it came to liability? The best of both worlds, right?

In response, the following hybrids were created in an ongoing effort to realize this dream:

• S-Corp. Wonderful idea: a full-on corporation taxed like a partnership. Mission accomplished, right? Well… not quite. The law imposes strict limits on how many investors you can have – and of what kind – and otherwise burdens this good idea with requirements that reduce its utility. A common misconception is that the S-Corp is a separate type of entity. S-Corp is a tax designation, not an entity type. In a separate blog, we will address this misconception in more detail.

• Limited Partnership (LP). This is the S-Corp, in reverse – an actual partnership, taxed like a partnership, but with corporate protections for all the limited partners, i.e., the folks who put in the money but don’t do the work. It also proved to be somewhat awkward to administer for most businesses – and nearly all small businesses – but it continues to be popular in certain industries, e.g., oil & gas, private equity, etc.

• Limited Liability Company (LLC). These hybrids are the result of continuous efforts to combine – or shall we say, refine – the benefits of both S-Corps and LP’s. The LLC is like a corporation in that it provides liability protection for investors (called “Members”); one is only liable up to the limit of her investment. However, it may elect to be taxed like a partnership – meaning that there is only one level of taxation. Furthermore, it is also a creature of contract, meaning that the members collectively decide on how the business and affairs of the company are to be managed and the collective rights and obligations of each member.

There are a number of considerations that go into the selection of one form of business entity versus another. The trend in the law and in the business community is toward the LLC because it provides liability protection, single-taxation, and maximal flexibility in administration. Next week, we will post a detailed blog and video on the Limited Liability Company to describe how the LLC structure can benefit you and your business.

You are on the right track to consider these various options, because each carry certain advantages that may be of benefit to your business. Corporations were originally formed to provide liability protection to investors; you could lose what you put in, but that was the extent of your exposure. Corporations were treated in law as “persons” and held to have an existence separate from their shareholders which justified this treatment. Corporations were the first tool to protect personal assets and shield the business owner from personal liability.

However, if corporations were persons, they could be taxed. This led to the issue of “double taxation”: as a shareholder of a corporation, you were not only taxed on the income (dividends, etc.) that you earned from the corporation, but the corporation itself was also taxed on such income.

Naturally, savvy businesspeople – and their accountants and tax lawyers – sought a way around this double tax treatment. They fastened on the partnership, which is a group of individuals bound by contract but not an entity separate in itself. Therefore, the partnership itself was not subject to tax; only the partners were taxed on the income.

The partnership idea seemed great! Less taxation, brilliant! From a legal standpoint, the partnership is not separate from the partners, and therefore, when something happens (as it always does)… each partner is liable for his or her share of the damages. A partnership offered potentially better tax treatment but sacrificed personal liability protection.

Then some clever lawyers had an idea: what about an entity that was taxed like a partnership… but treated like a corporation when it came to liability? The best of both worlds, right?

In response, the following hybrids were created in an ongoing effort to realize this dream:

• S-Corp. Wonderful idea: a full-on corporation taxed like a partnership. Mission accomplished, right? Well… not quite. The law imposes strict limits on how many investors you can have – and of what kind – and otherwise burdens this good idea with requirements that reduce its utility. A common misconception is that the S-Corp is a separate type of entity. S-Corp is a tax designation, not an entity type. In a separate blog, we will address this misconception in more detail.

• Limited Partnership (LP). This is the S-Corp, in reverse – an actual partnership, taxed like a partnership, but with corporate protections for all the limited partners, i.e., the folks who put in the money but don’t do the work. It also proved to be somewhat awkward to administer for most businesses – and nearly all small businesses – but it continues to be popular in certain industries, e.g., oil & gas, private equity, etc.

• Limited Liability Company (LLC). These hybrids are the result of continuous efforts to combine – or shall we say, refine – the benefits of both S-Corps and LP’s. The LLC is like a corporation in that it provides liability protection for investors (called “Members”); one is only liable up to the limit of her investment. However, it may elect to be taxed like a partnership – meaning that there is only one level of taxation. Furthermore, it is also a creature of contract, meaning that the members collectively decide on how the business and affairs of the company are to be managed and the collective rights and obligations of each member.

There are a number of considerations that go into the selection of one form of business entity versus another. The trend in the law and in the business community is toward the LLC because it provides liability protection, single-taxation, and maximal flexibility in administration. Next week, we will post a detailed blog and video on the Limited Liability Company to describe how the LLC structure can benefit you and your business.

0:12:02

0:12:02

0:20:03

0:20:03

0:08:11

0:08:11

0:14:56

0:14:56

0:03:02

0:03:02

0:07:07

0:07:07

0:12:18

0:12:18

0:04:24

0:04:24

0:05:08

0:05:08

0:03:38

0:03:38

0:30:03

0:30:03

0:07:19

0:07:19

0:09:16

0:09:16

0:07:10

0:07:10

0:12:20

0:12:20

0:12:14

0:12:14

0:06:30

0:06:30

0:02:27

0:02:27

0:02:32

0:02:32

0:02:09

0:02:09

0:11:59

0:11:59

0:10:52

0:10:52

0:06:16

0:06:16

0:04:52

0:04:52