filmov

tv

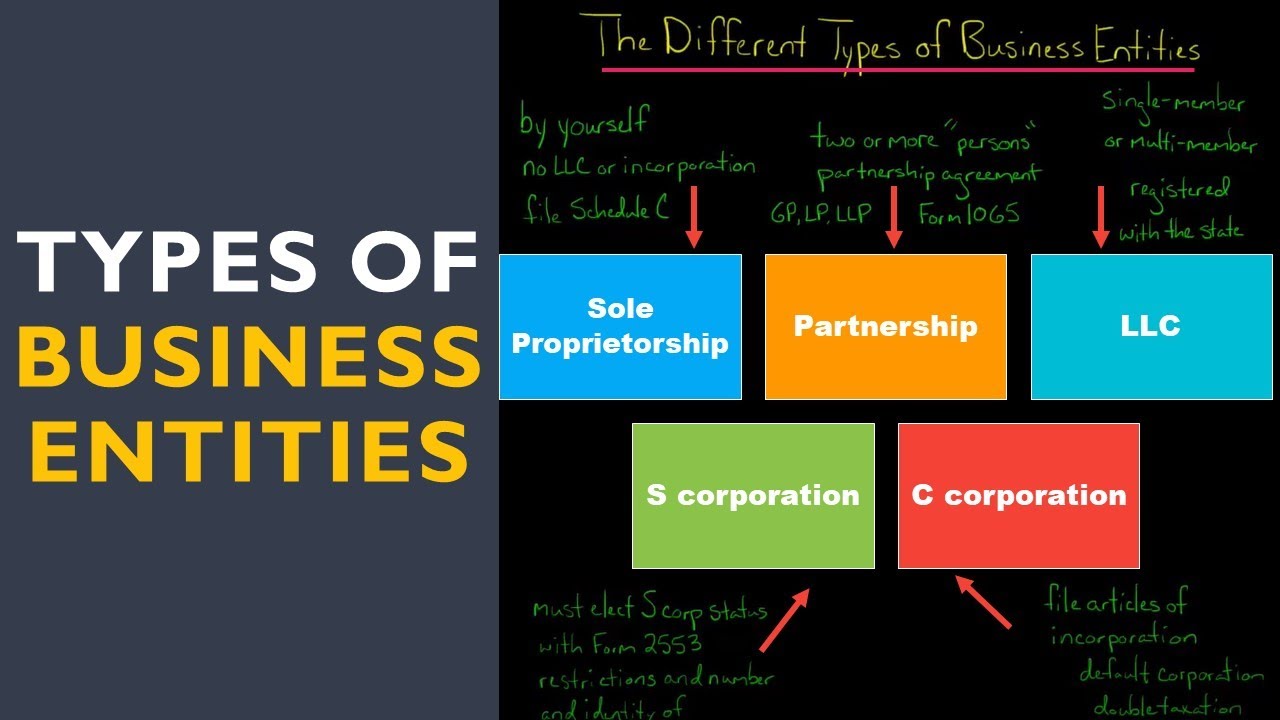

The Different Types of Business Entities in the U.S.

Показать описание

If you're starting a business in the U.S., you can choose from several entity types:

Sole proprietorship: the business has one owner and is not an LLC or a corporation. The owner would report the profit or loss of the business on Schedule C and file this along with their personal income tax return (the 1040).

Partnership: the business is owned by two or more persons. The partnership files Form 1065 to report its profit or loss, with each partner being taxed on their share of the profit or loss on their personal tax returns.

C corporation: a corporation is a separate legal entity created by filing articles of incorporation in one of the fifty U.S. states. The owners (shareholders) are shielded from personal liability for the corporation's debts, but the corporation is subject to double taxation (the corporation is taxed on its profits, and then shareholders are taxed on dividends they receive from the corporation).

S corporation: after forming a C corporation, shareholders may elect for the corporation to be treated as an S corporation. This eliminates double taxation (S corporations are a flow-through entity with shareholders taxed on their proportionate share of the corporation's profit or loss). However, there are restrictions on the number and identify of S corporation shareholders.

LLC: a single person or multiple people can form an LLC in any of the fifty U.S. states. An LLC is a noncorporate entity that provides the limited liability of a corporation but may be taxed as a partnership (if the LLC has multiple owners) or a sole proprietorship (if the LLC has a single owner).—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Sole proprietorship: the business has one owner and is not an LLC or a corporation. The owner would report the profit or loss of the business on Schedule C and file this along with their personal income tax return (the 1040).

Partnership: the business is owned by two or more persons. The partnership files Form 1065 to report its profit or loss, with each partner being taxed on their share of the profit or loss on their personal tax returns.

C corporation: a corporation is a separate legal entity created by filing articles of incorporation in one of the fifty U.S. states. The owners (shareholders) are shielded from personal liability for the corporation's debts, but the corporation is subject to double taxation (the corporation is taxed on its profits, and then shareholders are taxed on dividends they receive from the corporation).

S corporation: after forming a C corporation, shareholders may elect for the corporation to be treated as an S corporation. This eliminates double taxation (S corporations are a flow-through entity with shareholders taxed on their proportionate share of the corporation's profit or loss). However, there are restrictions on the number and identify of S corporation shareholders.

LLC: a single person or multiple people can form an LLC in any of the fifty U.S. states. An LLC is a noncorporate entity that provides the limited liability of a corporation but may be taxed as a partnership (if the LLC has multiple owners) or a sole proprietorship (if the LLC has a single owner).—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:08:11

0:08:11

0:08:16

0:08:16

0:06:30

0:06:30

0:03:00

0:03:00

0:14:56

0:14:56

0:01:22

0:01:22

0:04:34

0:04:34

0:10:42

0:10:42

0:00:38

0:00:38

0:03:21

0:03:21

0:34:11

0:34:11

0:03:00

0:03:00

0:20:46

0:20:46

0:05:59

0:05:59

0:30:10

0:30:10

0:13:04

0:13:04

0:03:26

0:03:26

0:13:15

0:13:15

0:01:46

0:01:46

0:10:06

0:10:06

0:00:09

0:00:09

0:03:44

0:03:44

0:04:55

0:04:55

0:03:30

0:03:30