filmov

tv

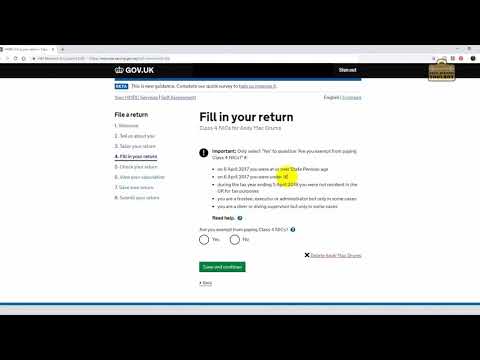

How To File Self Assessment Tax Return 💷📄

Показать описание

In this video a step by step walkthrough of the filing of my self assessment tax return for the tax year 2021-2022.

Need Tax help? Try Simply Tax ⬇️

OFFICIAL Gov UK Tax Site ⬇️

Get a bonus £10 CASHBACK when you sign up for the Amex Platinum Cashback Everyday Credit Card, like me, here: ⬇️

How To Apply For A UTR Number ⬇️

How To Create A Government Gateway ID ⬇️

If you found this video helpful please:

LIKE 👍

SHARE⏩

SUBSCRIBE ➕

COMMENT 💬

Thank you,

Tesh, The Form Filler 🖋️

Disclaimer

I do not provide personal financial advice and I am not a qualified licensed financial advisor.

All information found here, including any, opinions, views, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal financial advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor before making any financial decisions. Any decisions made on the basis of any information found in this video, expressed or implied herein, are committed at your own risk, financial or otherwise.

Need Tax help? Try Simply Tax ⬇️

OFFICIAL Gov UK Tax Site ⬇️

Get a bonus £10 CASHBACK when you sign up for the Amex Platinum Cashback Everyday Credit Card, like me, here: ⬇️

How To Apply For A UTR Number ⬇️

How To Create A Government Gateway ID ⬇️

If you found this video helpful please:

LIKE 👍

SHARE⏩

SUBSCRIBE ➕

COMMENT 💬

Thank you,

Tesh, The Form Filler 🖋️

Disclaimer

I do not provide personal financial advice and I am not a qualified licensed financial advisor.

All information found here, including any, opinions, views, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal financial advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor before making any financial decisions. Any decisions made on the basis of any information found in this video, expressed or implied herein, are committed at your own risk, financial or otherwise.

Комментарии

0:03:32

0:03:32

0:46:47

0:46:47

0:48:57

0:48:57

0:14:35

0:14:35

0:04:16

0:04:16

0:04:08

0:04:08

0:05:51

0:05:51

0:14:18

0:14:18

1:24:05

1:24:05

0:09:54

0:09:54

0:46:27

0:46:27

0:12:42

0:12:42

0:14:59

0:14:59

0:17:30

0:17:30

0:03:49

0:03:49

0:02:12

0:02:12

0:02:51

0:02:51

0:01:20

0:01:20

0:15:37

0:15:37

0:33:16

0:33:16

0:16:41

0:16:41

0:13:20

0:13:20

0:01:44

0:01:44

0:05:01

0:05:01