filmov

tv

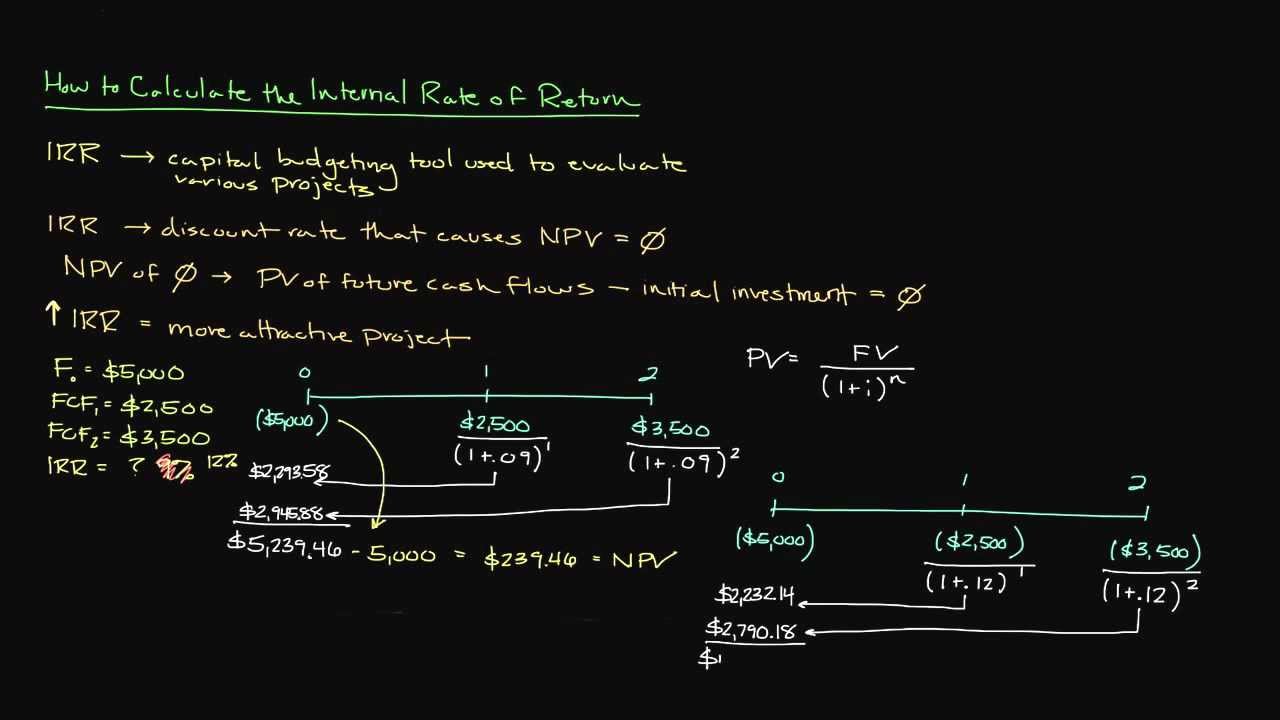

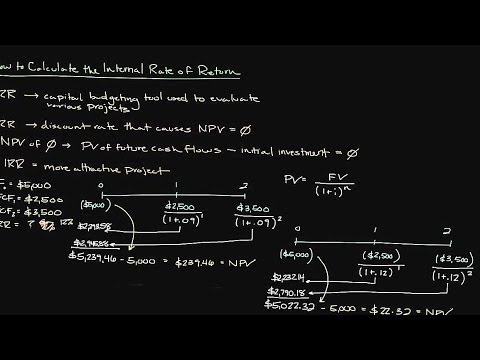

How to Calculate the Internal Rate of Return | Part 1

Показать описание

The Internal Rate of Return, or IRR for short, is the discount rate that causes the net present value to equal zero. As a type of capital budgeting tool, the IRR allows managers and business owners the ability to weight a variety of different capital budgeting projects.

The video provides a brief description and purpose of IRR in addition to showing how to calculate the internal rate of return. It is recommended that viewers have an understanding of the time value of money and how to calculate both the present value and NPV prior to learning IRR. The following videos are resources that will detail these topics.

How to Calculate Internal Rate of Return (IRR) for Real Estate Investing

Internal Rate Of Return (IRR) - Excel |How To Calculate IRR in Excel |What Is IRR |#excel#investment

How to Calculate IRR in Excel

How to Calculate Internal Rate of Return “IRR”

Excel 2013 Tutorial - How to Calculate an Internal Rate of Return

How to Calculate the Internal Rate of Return | Part 1

How to Calculate NPV and IRR in Excel

How to Calculate Internal Rate of Return (Monthly) - 30 Second CRE Tutorials

🔧 Problem 4-44 MACHINES AND MECHANISMS APPLIED KINEMATIC ANALYSIS Myszka ANGULAR DISPLACEMENT 🔧...

How to Calculate the Internal Rate of Return, or IRR, in Microsoft Excel

How to calculate the internal rate of return (IRR)

How to calculate IRR by calculator

IRR | How to calculate IRR in excel | IRR calculation in excel | Internal rate of return in excel..

How to Calculate Internal Rate of Return (Annual) - 30 Second CRE Tutorials

How to Calculate the Internal Rate of Return | Part 2

How to Calculate IRR Using the HP12C Financial Calculator

How to calculate Internal Rate of Return using IRR function in Excel - Office 365

016: How to Calculate the Internal Rate of Return (IRR)

How to calculate Xirr | Detail video on channel #Shorts

How to Calculate IRR (using trial and error)

How To Calculate Internal Rate of Return

How to Calculate IRR Using the BAII Plus

How To Calculate The Interior Angles and Exterior Angles of a Regular Polygon

🔴 EASIEST IRR Internal Rate of Return, How to Calculate IRR Formula and Calculation (Idiot Proof!)...

Комментарии

0:21:08

0:21:08

0:00:12

0:00:12

0:02:22

0:02:22

0:08:23

0:08:23

0:01:28

0:01:28

0:05:15

0:05:15

0:04:28

0:04:28

0:00:31

0:00:31

0:11:18

0:11:18

0:01:14

0:01:14

0:10:00

0:10:00

0:04:19

0:04:19

0:00:22

0:00:22

0:00:28

0:00:28

0:05:47

0:05:47

0:05:23

0:05:23

0:05:09

0:05:09

0:04:15

0:04:15

0:00:30

0:00:30

0:06:02

0:06:02

0:04:31

0:04:31

0:07:09

0:07:09

0:13:13

0:13:13

0:08:59

0:08:59