filmov

tv

Accounting Rate of Return (ARR)

Показать описание

Accounting Rate of Return (ARR) is the average net income an asset is expected to generate divided by its average capital cost, expressed as an annual percentage.

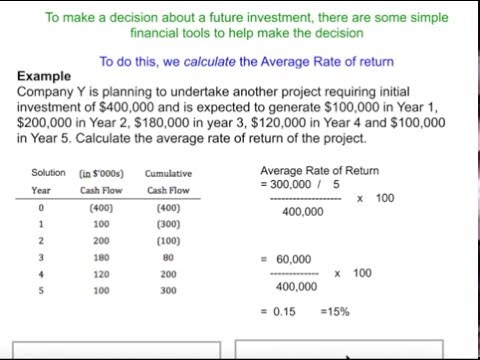

Accounting Rate of Return (ARR) | Explained with Example

Accounting Rate of Return (ARR)

#3 Average Rate of Return (ARR) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

Accounting Rate of Return (ARR)

Average Rate of Return (ARR) | A-Level & IB Business

Accounting rate of return

Accounting rate of return ARR: Capital Investment Decisions

Accounting Rate of Return (ARR) | Example 2 | Explained with Example

#5 Calculation of ARR(Average Rate of Return) Investment Decision BCOM

Accounting Rate Of Return (ARR)

ACCA F9 - Accounting Rate of Return - ARR

Average Rate of Return (ARR) Calculation

[#3] ARR (Accounting / average rate of return) method in capital budgeting | solved by kauserwise®

Accounting Rate of Return, Capital Budgeting techniques, Business Finance bcom, ARR method, ARR,

15. ARR (Accounting Rate of Return) Introduction from Capital Budgeting Chapter from Financial Mgmt

Accounting Rate if Return (ARR)

How to calculate Accounting Rate of Return (ARR) in Excel spreadsheet

Accounting Rate of Return (ARR)

What Is the Accounting Rate of Return (ARR)?

Accounting Rate of Return ARR Demonstration Problem

Average Rate of Return (ARR)

Accounting Rate of Return (ARR)

Investment Appraisal Techniques – Accounting Rate of Return (ARR)

Accounting Rate of Return ARR

Комментарии

0:10:18

0:10:18

0:03:38

0:03:38

0:15:54

0:15:54

0:02:29

0:02:29

0:04:20

0:04:20

0:07:47

0:07:47

0:08:33

0:08:33

0:11:59

0:11:59

0:06:44

0:06:44

0:10:47

0:10:47

0:07:36

0:07:36

0:02:50

0:02:50

![[#3] ARR (Accounting](https://i.ytimg.com/vi/SPQU_5ntsl0/hqdefault.jpg) 0:37:36

0:37:36

0:17:37

0:17:37

0:17:50

0:17:50

0:00:16

0:00:16

0:07:31

0:07:31

0:04:56

0:04:56

0:03:31

0:03:31

0:03:21

0:03:21

0:05:56

0:05:56

0:09:53

0:09:53

0:13:51

0:13:51

0:03:30

0:03:30