filmov

tv

Accounting Rate of Return (ARR) | Example 2 | Explained with Example

Показать описание

In this lesson, we go through a second example of the Accounting Rate of Return (ARR). We explain what it is, why it is calculated, and the formula for the Accounting Rate of Return (ARR) when you are given uneven cash flows as well as a thorough example. We show how to go from cash flows to profits. We also go through the advantages and disadvantages of the Accounting Rate of Return (ARR).

Timestamps:

Accounting Rate of Return Definition: 00:00

Interpret / Analyze the Accounting Rate of Return: 01:02

Accounting Rate of Return Formula: 01:42

Advantages and Disadvantages of the Accounting Rate of Return: 09:15

We also offer one-on-one tutorials at reasonable rates.

Connect with us:

Timestamps:

Accounting Rate of Return Definition: 00:00

Interpret / Analyze the Accounting Rate of Return: 01:02

Accounting Rate of Return Formula: 01:42

Advantages and Disadvantages of the Accounting Rate of Return: 09:15

We also offer one-on-one tutorials at reasonable rates.

Connect with us:

Accounting Rate of Return (ARR) | Explained with Example

Accounting Rate of Return (ARR)

#3 Average Rate of Return (ARR) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

Accounting Rate of Return (ARR)

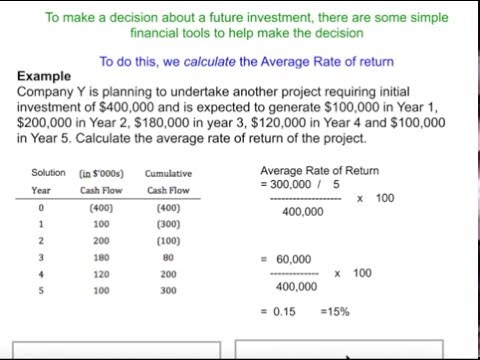

Average Rate of Return (ARR) | A-Level & IB Business

Accounting rate of return

Accounting rate of return ARR: Capital Investment Decisions

Accounting Rate of Return (ARR) | Example 2 | Explained with Example

Calculation of ARR(Average Rate of Return) Investment Decision BCOM

Accounting Rate Of Return (ARR)

ACCA F9 - Accounting Rate of Return - ARR

Average Rate of Return (ARR) Calculation

[#3] ARR (Accounting / average rate of return) method in capital budgeting | solved by kauserwise®

Accounting Rate of Return, Capital Budgeting techniques, Business Finance bcom, ARR method, ARR,

15. ARR (Accounting Rate of Return) Introduction from Capital Budgeting Chapter from Financial Mgmt

Accounting Rate if Return (ARR)

How to calculate Accounting Rate of Return (ARR) in Excel spreadsheet

Accounting Rate of Return (ARR)

What Is the Accounting Rate of Return (ARR)?

Accounting Rate of Return ARR Demonstration Problem

Average Rate of Return (ARR)

Accounting Rate of Return (ARR)

Investment Appraisal Techniques – Accounting Rate of Return (ARR)

Accounting Rate of Return ARR

Комментарии

0:10:18

0:10:18

0:03:38

0:03:38

0:15:54

0:15:54

0:02:29

0:02:29

0:04:20

0:04:20

0:07:47

0:07:47

0:08:33

0:08:33

0:11:59

0:11:59

0:06:44

0:06:44

0:10:47

0:10:47

0:07:36

0:07:36

0:02:50

0:02:50

![[#3] ARR (Accounting](https://i.ytimg.com/vi/SPQU_5ntsl0/hqdefault.jpg) 0:37:36

0:37:36

0:17:37

0:17:37

0:17:50

0:17:50

0:00:16

0:00:16

0:07:31

0:07:31

0:04:56

0:04:56

0:03:31

0:03:31

0:03:21

0:03:21

0:05:56

0:05:56

0:09:53

0:09:53

0:13:51

0:13:51

0:03:30

0:03:30