filmov

tv

My 7 Steps To Becoming A Serious Investor On A $37,000 Salary | Making it Work

Показать описание

Through weekly video essays, "Making It Work" showcases how *real* people have upgraded their personal or financial lives in some meaningful way. Making your life work for you doesn't mean getting rich just for the sake of it. It means making the most of what you have to build a life you love, both in your present and in your future. And while managing money is a crucial life skill

for everyone, there's no one "right way" to go about it — you have to figure out what works best for *you,* full stop.

Video by Grace Lee

Based on an essay by Meghan Koushik

Read the original essay here:

Video narration by Michelle Silber

The Financial Diet site:

My 7 Steps To Becoming A Serious Investor On A $37,000 Salary | Making it Work

Roxie Nafousi’s Seven Steps To Becoming Your Best Self | This Morning

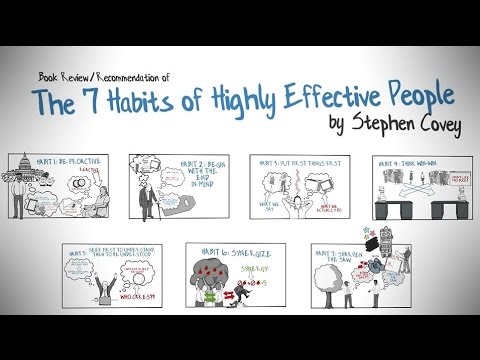

THE 7 HABITS OF HIGHLY EFFECTIVE PEOPLE BY STEPHEN COVEY - ANIMATED BOOK SUMMARY

7 Steps to become a Game Developer in 2024!

I’m getting into Wildlife Photography + My 7 Steps for Picking a Lens

The First Step For Network Marketing Success

How To Become A Millionaire - The Truth No One Tells You

How to be a SUCCESSFUL Real Estate Agent in 7 Steps | Ryan Serhant

7 Ways to Maximize Misery 😞

How to Get a Girlfriend in 7 Steps

The 7 Steps to become a MINIMALIST | OneMinuteWeekly

7 Steps on How I Became A Morning Person

Follow The 7 Steps To Success!

7 Steps to Make Millions in Any Industry

Do THIS When You Get Paid | 7 Steps When You Get Paid - Minority Mindset

Dave Ramsey's Speech Will Change Your Financial Future (MUST Watch!)

7 Steps to Achieve Financial Freedom | Brian Tracy

7 things that (quickly) cured my procrastination

7 Steps To Become A Dental Hygienist **SAVE TIME AND MONEY**

How to Become a Professional Photographer [7 Steps to Maximise Your Chances of Success]

7 Steps To Build Muscle (For SKINNY GUYS)

HAIR WASHING HACK THAT WILL SAVE YOUR HAIR #shorts #YouTubePartner #haircareroutine

I'm 22, How Do I Become Wealthy?

🔵 TD Jakes - 7 Steps to a Turnaround (Make It Happen!) - Motivational Video!

Комментарии

0:06:38

0:06:38

0:07:36

0:07:36

0:06:43

0:06:43

0:13:49

0:13:49

0:19:03

0:19:03

0:09:06

0:09:06

0:04:07

0:04:07

0:13:57

0:13:57

0:07:17

0:07:17

0:10:24

0:10:24

0:01:00

0:01:00

0:05:44

0:05:44

0:09:17

0:09:17

0:07:26

0:07:26

0:21:20

0:21:20

0:30:47

0:30:47

0:06:21

0:06:21

0:13:30

0:13:30

0:13:44

0:13:44

0:21:34

0:21:34

0:13:55

0:13:55

0:00:35

0:00:35

0:06:04

0:06:04

0:51:27

0:51:27