filmov

tv

We Make $190,000/Year and We Live Paycheck to Paycheck!

Показать описание

Next Steps:

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

Product Links:

We Make $190,000/Year and We Live Paycheck to Paycheck!

We both made 10 dollars!

‼️Las 3 MEJORES MOTOS Doble Propósito -Adventure - Naked NX 190 | XR 190 | CB 190

How we hug with almost a 2 foot height difference😂 #couples #coupleshorts #heightdifference

We Have $190,000, What Should We Do With It?

We paid € 190,000 for our first home in Portugal. #portugal #diyhome #renovation #retireearly

ABANDONED Mercedes 190C Gets First Wash in 30 Years! Ultimate Barn Find Restoration

Joe Cocker & Jennifer Warnes - Up Where We Belong - An Officer and a Gentleman 1982 (classic cin...

How To Make Progressive House + Logic Pro X Template | Live Electronic Music Tutorial #190

The Inside Of Kit Kats Are NOT What You Think 😯

I'm Afraid We Can't Live On $500,000!

We are a professional LED display manufacturer in Shenzhen, Guangdong#ledscreen

Używany Lexus UX 250h, czyli mały, ale nie wariat! (TEST PL/ENG 4K) | CaroSeria

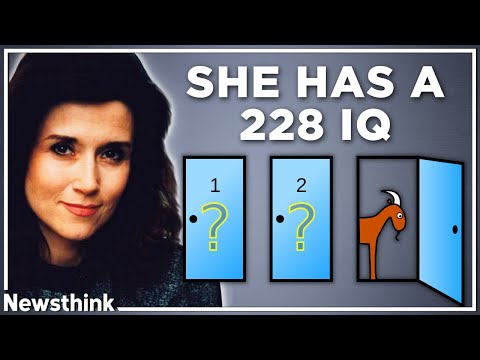

The Simple Question that Stumped Everyone Except Marilyn vos Savant

She treated him like ATM, left when contract expired. He regretted not saying loved earlier

Insanely sleepable 😴 This is how we roll at Haven Tents. #camping #hammock #hammockcamping

Squid Game: How we find out the old man is the master mind #squidgame #squidgamenetflix #squidgames

Homemade Mayonnaise in less than 2 minutes with 3 INGREDIENTS ONLY #Shorts

'We Made $190,000 and don't know what to do with it' | BetterWealth Q&A

Así nos fue en la FRONTERA de CHILE 🇨🇱 La primera aventura de la CARRETERA AUSTRAL 🚐

What year can we cure aging - Aubrey De Grey - Longevity Escape Velocity

Will Stimulus Checks Send Bitcoin to New All-Time Highs?

If you can imagine it, we can make it! #diamond #labgrowndiamondring #engagementgifts #ring

we’re so productive here👩💻 #duolingo #funny #languagelearning

Комментарии

0:09:14

0:09:14

0:00:16

0:00:16

0:16:53

0:16:53

0:00:21

0:00:21

0:05:09

0:05:09

0:00:59

0:00:59

0:01:00

0:01:00

0:01:00

0:01:00

0:34:26

0:34:26

0:00:22

0:00:22

0:08:46

0:08:46

0:00:18

0:00:18

0:33:10

0:33:10

0:07:06

0:07:06

1:42:28

1:42:28

0:01:00

0:01:00

0:01:00

0:01:00

0:00:15

0:00:15

0:52:26

0:52:26

0:32:26

0:32:26

0:35:24

0:35:24

0:15:57

0:15:57

0:00:05

0:00:05

0:00:25

0:00:25