filmov

tv

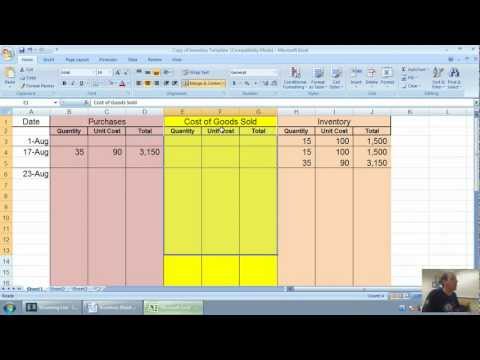

Accounting - Unit 6 - Part 1 - Inventory

Показать описание

This video series introduces the basics of accounting for inventory under a PERPETUAL inventory system. In the first video of the series, we go over basic journal entries and discuss differences between FIFO, LIFO, Weighted Average and Specific Unit ID methods.

This video and the attached worksheet were prepared by Tony Bell of Thompson Rivers University (TRU) - I encourage educators to freely use, edit and modify these videos and the attached worksheet - they are available under Creative Commons Licenses.

This video and the attached worksheet were prepared by Tony Bell of Thompson Rivers University (TRU) - I encourage educators to freely use, edit and modify these videos and the attached worksheet - they are available under Creative Commons Licenses.

Accounting - Unit 6 - Part 1 - Inventory

Ch 1 Theoretical Framework | Unit 6 | CA Foundation Accounts | June 2024 | CA Parag Gupta

I.Com Part 1 Accounting, ch 6 - Basics of Bill of Exchange - 1st year Accounting

Volume and Activity Based Costing || ABC System || BBS 2nd Year Account Chapter 6 || TU Solutions

Accounting Policies | CA CMA Foundation Chapter 1 Unit 6

Accounting - Unit 6 - Part 2 - FIFO Inventory

I.Com Part 1 Accounting, Ch 6, Bill of Exchange Question on 1 - 1st year Accounting

CMA Foundation - Paper 2 ‐ Financial Accounting - Unit 1.8, 1.9 and 1.10

Full Financial Accounting Course in One Video (10 Hours)

11th ACCOUNTANCY CHAPTER 6 EXERCISE SUM 1

Bank reconciliation statement // Accounting for cash and internal control // part-1 // bbs 1st year#

Financial Statement of a Company | Corporate Accounting Chapter 6 | BCom/BBA

Jaiib UNIT-6 ACCOUNTING STANDARD REMEMBERING TRICKS

CA FOUNDATION ACCOUNTS CHAPTER 2 UNIT 6

#A/L#Accounting #unit 6 #vol 01

CIA Part 1 | Unit 6 - Controls Application

Introduction to Economics | Unit 6 Part 1 | GDP & GNP | Economics 101 | Basic Economics

Lesson 6. Dual impact of Transactions - Part 01 | Business and Accounting Studies | Grade 10

The Regrets of An Accounting Major @zoeunlimited

11th ACCOUNTANCY CHAPTER 6 EXERCISE SUM 2

Rectification of Errors - 1 | Ch 2 Unit 6 | CA Foundation Accounts June 2024 | CA Parag Gupta

I com -1 |Chap #6 |Exer#1 | Bills of Exchange | Principles of Accounting by Sohail Afzal & M Ari...

Business & Accounting Studies | Grade 10 | Tamil Medium | Dual Impact of Transactions | Lesson 6

11 Accountancy - Chapter 6 - Subsidiary book 1 - Sum 1

Комментарии

0:13:07

0:13:07

0:28:53

0:28:53

0:20:35

0:20:35

0:58:16

0:58:16

0:09:46

0:09:46

0:12:27

0:12:27

0:19:44

0:19:44

1:17:03

1:17:03

10:01:51

10:01:51

0:03:01

0:03:01

0:17:58

0:17:58

0:34:22

0:34:22

0:08:43

0:08:43

0:10:27

0:10:27

0:24:44

0:24:44

0:48:45

0:48:45

0:32:32

0:32:32

0:49:35

0:49:35

0:00:37

0:00:37

0:03:20

0:03:20

1:35:23

1:35:23

0:12:01

0:12:01

0:20:59

0:20:59

0:07:24

0:07:24