filmov

tv

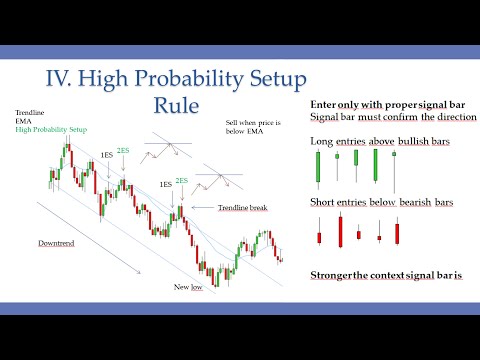

Interpreting Intraday Price Movements

Показать описание

In this video, we dive deep into the world of options trading, covering everything from technical analysis to risk management strategies. Whether you're a day trader or prefer longer-term trades, you'll learn how to effectively use different timeframes to your advantage. We discuss how to set up trades with a solid reward-to-risk ratio, essential for maximizing profits while minimizing losses. Learn how to identify trends, control points, and patterns that can help you make smarter decisions.

00:00 – Intraday Price Movements

00:41 - Chart Timeframes

02:04 – Market Analysis Skills Training

02:40 - Long Position Trading Guidelines

03:43 – Risk Reward Ratio Ranges

05:44 – Day Trading Allure

07:45 – Overnight Risk Can Be Controlled

08:07 – Futures Trading Caution

10:06 – Trends and Patterns

11:21 - Chart Plan

13:00 – Signal To Exit

14:36 – Long Entry Signal

16:47 – Reversal Trade

18:19 – Stops

20:00 – Bad Trade

21:44 – Trail or Laddered Trail Stop

24:13 – Cup and Handle Pattern Formed

22:13 - Going Short

25:13 – Exit Points

28:20 – Learn patterns!

31:41 – Remove Risk

John Locke has been working with options for 20+ years and has built himself up as a leader in the stock options trading industry. Having trained now hundreds of traders, his natural ability to teach complex topics with clarity and passion has made him invaluable to the trading community.

*The result shown is from real-time, hypothetical trades such as those shown in the Options Trading for Income weekly webinar or Trading With The PROS biweekly webinars. Simulated trades are believed to be represented as accurately as possible, however, live results may have been different. The result is shared as an example for educational purposes ONLY.

00:00 – Intraday Price Movements

00:41 - Chart Timeframes

02:04 – Market Analysis Skills Training

02:40 - Long Position Trading Guidelines

03:43 – Risk Reward Ratio Ranges

05:44 – Day Trading Allure

07:45 – Overnight Risk Can Be Controlled

08:07 – Futures Trading Caution

10:06 – Trends and Patterns

11:21 - Chart Plan

13:00 – Signal To Exit

14:36 – Long Entry Signal

16:47 – Reversal Trade

18:19 – Stops

20:00 – Bad Trade

21:44 – Trail or Laddered Trail Stop

24:13 – Cup and Handle Pattern Formed

22:13 - Going Short

25:13 – Exit Points

28:20 – Learn patterns!

31:41 – Remove Risk

John Locke has been working with options for 20+ years and has built himself up as a leader in the stock options trading industry. Having trained now hundreds of traders, his natural ability to teach complex topics with clarity and passion has made him invaluable to the trading community.

*The result shown is from real-time, hypothetical trades such as those shown in the Options Trading for Income weekly webinar or Trading With The PROS biweekly webinars. Simulated trades are believed to be represented as accurately as possible, however, live results may have been different. The result is shared as an example for educational purposes ONLY.

Комментарии

0:33:09

0:33:09

0:10:53

0:10:53

0:06:43

0:06:43

0:17:18

0:17:18

0:08:11

0:08:11

0:03:52

0:03:52

0:11:45

0:11:45

0:04:37

0:04:37

0:27:08

0:27:08

0:14:21

0:14:21

0:23:33

0:23:33

0:25:48

0:25:48

0:15:39

0:15:39

1:17:35

1:17:35

0:08:54

0:08:54

0:07:06

0:07:06

0:44:46

0:44:46

0:00:15

0:00:15

0:19:29

0:19:29

0:08:35

0:08:35

0:31:16

0:31:16

0:23:55

0:23:55

0:00:59

0:00:59

0:11:45

0:11:45