filmov

tv

Price Action Trading For Intraday | Power Of Stocks | English Subtitle

Показать описание

POS Traders Club:-

----------------------------

You Can Open a Trading account from the below links:-

----------------------------

----------------------------

Imp Learning Playlist:-

-----------------------------

----------------------------

IMP

Disclaimer: My videos, presentations, and writing are only for educational purposes and are not intended as investment advice. I cannot guarantee the accuracy of any information provided.#Powerofstocks,#Learnwithme

----------------------------

You Can Open a Trading account from the below links:-

----------------------------

----------------------------

Imp Learning Playlist:-

-----------------------------

----------------------------

IMP

Disclaimer: My videos, presentations, and writing are only for educational purposes and are not intended as investment advice. I cannot guarantee the accuracy of any information provided.#Powerofstocks,#Learnwithme

Four Price Action Secrets (The Ultimate Guide To Price Action)

Price Action Trading For Intraday | Power Of Stocks | English Subtitle

Price Action Free Masterclass | Learn Stock Market Trading

Price Action Is Hard (Until You See This)

Price Action Trading Strategy Extended Crash Course

Price Action Trading Strategy Basics

How To Predict Reversals

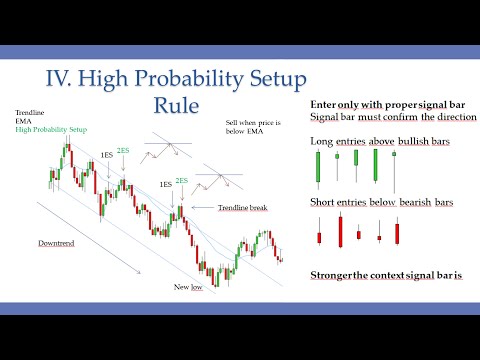

Price Action Trading Guide | 5 Rules For price action trading

Today Intraday option trading 💰| Option trading kaise kare ?| Price action | #nifty #optiontrading...

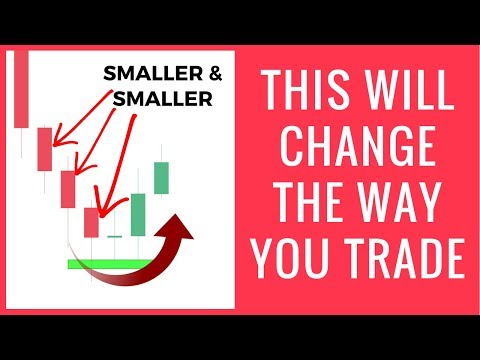

Best Price Action Trading Strategy That Will Change The Way You Trade

How to start Price Action Trading? Price Action Strategies |

Price Action Trading Strategy That Works (Must Watch)

15 Best Price Action Strategies After 15 Years of Trading (The Holy Grail)

I Found An AMAZING Trend Following Strategy #shorts

Advance Price Action Trading Strategies | Only Price Action Strategies You Need

The ONLY Price Action Trading Strategy you will EVER need (Can’t unsee this…)

Price Action Trading Was Hard, Until I Found This 'Momentum Tactic' (Strategies Included)

The ONLY Price Action Trading Strategy You Will Ever Need (Can’t Unsee This…)

Price Action MASTERCLASS for beginners | Price Action Trading Strategies in Share Market | In Hindi

5 Price Action Rules EVERY Trader NEEDS To Know

How to Read chart Like a Pro In Intraday Trading |Price Action Trading

Pure 'PRICE ACTION Mastery' Course🔥 | 3+ Hours of Price action Content 🤯

Intraday and Price action Trading FREE Course worth 1 Lakh! Ft. @InvestForWealth | Abhishek Kar Pods

The ONLY Candlestick Pattern Guide You'll EVER NEED

Комментарии

0:08:11

0:08:11

0:17:18

0:17:18

0:30:54

0:30:54

0:08:54

0:08:54

0:29:34

0:29:34

0:05:10

0:05:10

0:01:00

0:01:00

0:05:57

0:05:57

0:02:08

0:02:08

0:10:17

0:10:17

0:09:46

0:09:46

0:00:54

0:00:54

0:32:21

0:32:21

0:00:54

0:00:54

0:09:06

0:09:06

0:10:33

0:10:33

0:15:07

0:15:07

0:19:21

0:19:21

0:19:18

0:19:18

0:31:16

0:31:16

0:11:07

0:11:07

3:27:38

3:27:38

2:19:50

2:19:50

0:11:45

0:11:45