filmov

tv

What is an Options Contract in Finance? | What is a Call Option? | What is a Put Option? Derivatives

Показать описание

What are Financial Options?

What are Financial Options?

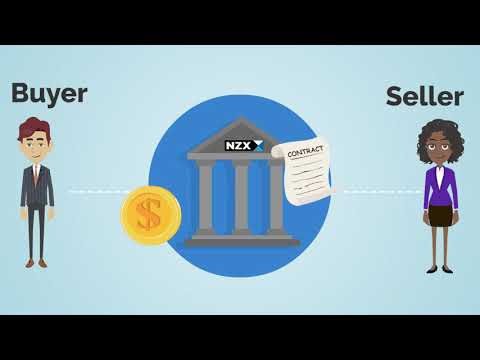

Options are a financial derivative sold by an option writer or seller to an option buyer. They are typically purchased through a broker. The contract gives the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at an agreed-upon price during a certain period of time or on a specific date. The agreed upon price is called the strike price. American options can be exercised any time before the expiration date of the option, while European options can only be exercised on the expiration date (also known as exercise date). Exercising an option means utilizing the right to buy or the sell the underlying security.

What is a call option?

Call options provide the option buyer with the right to buy an underlying security at the strike price. The buyer of a call option is bullish and wants the price of the stock to go up. Conversely, the option seller (or writer) has to sell the underlying security to the option buyer, at the strike price, in the event that the stock's market price is above the strike price at expiration.

An option writer who sells a call option believes that the underlying stock's price will drop or stay the same relative to the option's strike price during the life of the option, as that is how they will reap maximum profit. The writer's maximum profit is the premium received when selling the option.

What are Financial Options?

Options are a financial derivative sold by an option writer or seller to an option buyer. They are typically purchased through a broker. The contract gives the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at an agreed-upon price during a certain period of time or on a specific date. The agreed upon price is called the strike price. American options can be exercised any time before the expiration date of the option, while European options can only be exercised on the expiration date (also known as exercise date). Exercising an option means utilizing the right to buy or the sell the underlying security.

What is a call option?

Call options provide the option buyer with the right to buy an underlying security at the strike price. The buyer of a call option is bullish and wants the price of the stock to go up. Conversely, the option seller (or writer) has to sell the underlying security to the option buyer, at the strike price, in the event that the stock's market price is above the strike price at expiration.

An option writer who sells a call option believes that the underlying stock's price will drop or stay the same relative to the option's strike price during the life of the option, as that is how they will reap maximum profit. The writer's maximum profit is the premium received when selling the option.

Комментарии

0:02:42

0:02:42

0:06:07

0:06:07

0:05:46

0:05:46

0:05:02

0:05:02

0:14:50

0:14:50

0:01:55

0:01:55

0:07:31

0:07:31

0:05:49

0:05:49

0:19:03

0:19:03

0:01:28

0:01:28

0:10:16

0:10:16

0:03:07

0:03:07

0:16:23

0:16:23

0:05:06

0:05:06

0:13:02

0:13:02

0:08:08

0:08:08

0:01:05

0:01:05

0:05:48

0:05:48

0:06:39

0:06:39

0:06:18

0:06:18

0:04:37

0:04:37

0:33:55

0:33:55

0:13:26

0:13:26

0:10:37

0:10:37