filmov

tv

Why This Popular Trading Strategy Is So Risky

Показать описание

In 2021, options activity hit a record high, with nearly 9.9 billion contracts traded. That was more than 32 percent higher than the previous record set in 2020. This increase in volume can be traced back to the meme stock mania as millions of new investors jumped into the stock market during the pandemic. Options trading is a popular strategy among institutional investors to hedge their risk in the markets, but if it’s not executed carefully, it can lead to devastating losses. Watch the video above to learn how options trading took off and why the strategy can be so risky.

“The idea that I used social media to promote GameStop stock to unwitting investors and influence the market is preposterous,” Keith Gill told Congress.

Gill — who goes by DeepF------Value on Reddit and Roaring Kitty on YouTube — testified in front of the U.S. House of Representatives’ Committee on Financial Services in February 2021. He became an influential figure online and is credited with helping inspire the epic GameStop short squeeze. Gill would screenshot his investment portfolio, showing his winnings from his GameStop position.

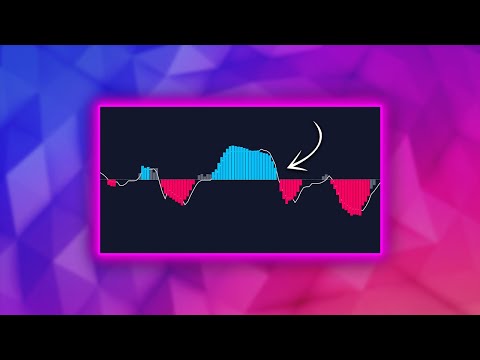

A lot of Gill’s portfolio consisted of what are called options contracts.

Options are an investment strategy that gives a trader the right to buy or sell a security.

“It’s best to think of options as an insurance product,” said Chris Murphy, co-head of derivative strategy at Susquehanna Financial Group.

Over the past two years, options have become increasingly popular among individual investors using brokerage platforms such as Robinhood.

“Twenty years ago, if you wanted to trade an option, you needed to maybe call up a broker on the phone, you needed to pay a significantly high amount of commission,” Murphy said. “So there’s much easier access to options markets, and the use of options has pretty much just grown alongside of that.”

If used properly, options can be a good way to hedge risk. But they can also be risky.

“Options are the kinds of bets where you can lose everything,” said Joshua Mitts, associate professor of law at Columbia Law School. “Unlike a share of stock, where you might see your portfolio go down by 5[%] or 10% in value, when you buy and sell options, you can lose all of your money.”

“[Options] in and of themselves are not bad tools,” said JJ Kinahan, chief market strategist at TD Ameritrade. “Fire is a wonderful tool. If you don’t know how to use it, it’s going to end poorly.”

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

#CNBC

Why This Popular Trading Strategy Is So Risky

“The idea that I used social media to promote GameStop stock to unwitting investors and influence the market is preposterous,” Keith Gill told Congress.

Gill — who goes by DeepF------Value on Reddit and Roaring Kitty on YouTube — testified in front of the U.S. House of Representatives’ Committee on Financial Services in February 2021. He became an influential figure online and is credited with helping inspire the epic GameStop short squeeze. Gill would screenshot his investment portfolio, showing his winnings from his GameStop position.

A lot of Gill’s portfolio consisted of what are called options contracts.

Options are an investment strategy that gives a trader the right to buy or sell a security.

“It’s best to think of options as an insurance product,” said Chris Murphy, co-head of derivative strategy at Susquehanna Financial Group.

Over the past two years, options have become increasingly popular among individual investors using brokerage platforms such as Robinhood.

“Twenty years ago, if you wanted to trade an option, you needed to maybe call up a broker on the phone, you needed to pay a significantly high amount of commission,” Murphy said. “So there’s much easier access to options markets, and the use of options has pretty much just grown alongside of that.”

If used properly, options can be a good way to hedge risk. But they can also be risky.

“Options are the kinds of bets where you can lose everything,” said Joshua Mitts, associate professor of law at Columbia Law School. “Unlike a share of stock, where you might see your portfolio go down by 5[%] or 10% in value, when you buy and sell options, you can lose all of your money.”

“[Options] in and of themselves are not bad tools,” said JJ Kinahan, chief market strategist at TD Ameritrade. “Fire is a wonderful tool. If you don’t know how to use it, it’s going to end poorly.”

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

#CNBC

Why This Popular Trading Strategy Is So Risky

Комментарии

0:13:26

0:13:26

0:07:06

0:07:06

0:13:15

0:13:15

0:07:22

0:07:22

0:09:54

0:09:54

0:09:12

0:09:12

0:09:49

0:09:49

0:16:42

0:16:42

0:12:07

0:12:07

0:32:21

0:32:21

0:13:23

0:13:23

0:20:02

0:20:02

0:18:26

0:18:26

0:01:58

0:01:58

0:14:47

0:14:47

0:12:50

0:12:50

0:01:00

0:01:00

0:01:01

0:01:01

0:01:00

0:01:00

0:00:44

0:00:44

0:21:29

0:21:29

0:00:41

0:00:41

0:11:29

0:11:29

0:21:06

0:21:06