filmov

tv

SAVINGS: Will you pay tax on the interest you earn?

Показать описание

Interest rates on savings have been getting better and better this year, and look set to rise even more. The bad news is this could mean you're more likely to pay tax on the interest you earn.

W A T C H N E X T

#savings #interestrates #taxfree

00:00 The personal savings allowance

01:46 Start to Save tax-free allowance

02:29 Cash ISAs tax-free allowance

03:07 Premium Bond tax-free allowance

03:16 What happens when rates rise or you save more?

06:50 Warning: Fixed rate and regular savers

07:45 How to avoid tax on your interest

MORE

(You'll also get a free Quidco bonus for signing up)

A B O U T A N D Y

DISCLAIMER

Content in these videos does not constitute regulated financial advice. Any offers mentioned were correct at the time of filming.

W A T C H N E X T

#savings #interestrates #taxfree

00:00 The personal savings allowance

01:46 Start to Save tax-free allowance

02:29 Cash ISAs tax-free allowance

03:07 Premium Bond tax-free allowance

03:16 What happens when rates rise or you save more?

06:50 Warning: Fixed rate and regular savers

07:45 How to avoid tax on your interest

MORE

(You'll also get a free Quidco bonus for signing up)

A B O U T A N D Y

DISCLAIMER

Content in these videos does not constitute regulated financial advice. Any offers mentioned were correct at the time of filming.

SAVINGS: Will you pay tax on the interest you earn?

Do I Need To Pay Tax On My Savings?

Personal Savings Allowance | how to pay tax on your savings income

Cash Deposit in Bank Income Tax Malayalam |CA Subin VR

How Does Savings Account Interest Work?

ACCOUNTANT EXPLAINS: How to Pay Less Tax

Incredibly Simple Tax Saving Strategies (The Rich Do This)

DON’T PAY Tax on Investments ✋(Shares & Funds in the UK)

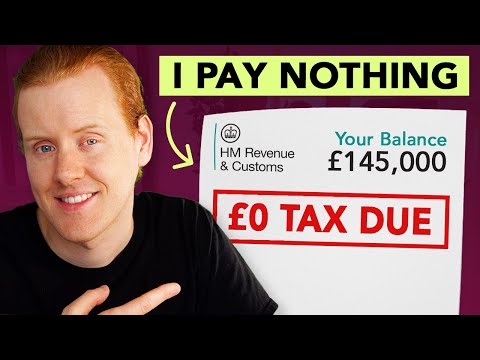

How Big Earners Reduce their Taxes to Zero

UK Income Tax Explained (UK Tax Bands & Calculating Tax)

The #1 Dividend ETF for TAX Savings +19.5% (DO THIS NOW)

Common TFSA (Tax Free Savings Account) mistakes to avoid!

Ultimate Guide to Tax Free Investments

Tax Benefits of Buying a Home 2024 | Tax Benefits of Owning a Home | Tax Savings for Homeowners

The Consequences Of New Wealth Tax…

TFSA, Explained - Everything You Need To Know About The Tax Free Savings Account For Beginners

Secret Way To Save Tax !

How To Pay Less Tax In The UK (LEGALLY!)

Tax Strategies for High Income Earners to Help Reduce Taxes

Here's how to pay 0% tax on capital gains

My Accountant Explains How To Save Tax | Property Investing & Buy-To-Let Tax

The end of tax free savings.

4 Income Sources NOT Taxed In Retirement - Tax Efficient Withdrawal Strategy

Income Tax Rules on Saving Bank Account 2022 | Income Tax on Saving Account | Banking Baba

Комментарии

0:12:49

0:12:49

0:08:58

0:08:58

0:01:22

0:01:22

0:04:33

0:04:33

0:01:50

0:01:50

0:08:42

0:08:42

0:09:17

0:09:17

0:12:24

0:12:24

0:13:37

0:13:37

0:09:54

0:09:54

0:10:36

0:10:36

0:16:31

0:16:31

0:16:04

0:16:04

0:06:25

0:06:25

0:00:51

0:00:51

0:15:44

0:15:44

0:00:56

0:00:56

0:13:55

0:13:55

0:30:37

0:30:37

0:02:05

0:02:05

0:21:36

0:21:36

0:12:21

0:12:21

0:07:29

0:07:29

0:08:05

0:08:05