filmov

tv

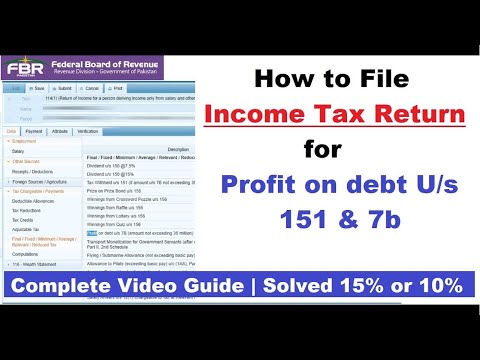

How to add bank profit in income tax return | How to add profit on debt in income tax return of 2024

Показать описание

How to add bank profit in income tax return

How to add profit on debt in income tax return 2024

Profit less than five million & profit more than five million, both are discussed

How to add profit on debt in income tax return 2024

Profit less than five million & profit more than five million, both are discussed

How to Add Bank Profit and Tax Under section 151in Income Tax Return

Bad News Tax on Banks Profit and non filer not Eligible for banks saving accounts 2024

Use your Bank Account Carefully, if you File Income Tax Return

How Does Savings Account Interest Work?

How to File Profit on debt ( 151 & 7b) Income Tax Return Online in Pakistan| Bank Profit | TY - ...

How to File Tax Return For Profit on Debt u/s 151 & 7B I Bank Profit on Saving I Full Concept 20...

How do you calculate your net profit margin?

Easy Paisa Aur Jazz Cash Account Se Profit Lena Halal Hey Ya Nahe| Mufti Tariq Masood

Phonepe Unable to add Account Problem Solve | Phonepe Unable to add bank Account Problem Solve

How to Enter Bank Account Profit in Income Tax Return | How to Fill Income Tax Return Year 2020

How to add Loan in income tax return

Limit of Cash Deposit in Saving Bank Account | Income Tax Cash Deposit Limit

12000 ki Side Income 🤑🤑

$7 investment $80 profit 😎 Live Bitcoin Trading With 125X Leverage #scalping #futurestrading

biggest profit in BANKNIFTy options @art of trading #shorts

Income tax mistake 11/20 Not validating bank account in IT portal #taxfiling #taxtips #taxconsultant

How to Pre Validate,add bank account in income tax e filing portal in 2023-24 for Income tax refund

Which bank Account has Highest Profit rates in Pakistan | Highest Profitable Saving Accounts 2023

Profit on Saving Account, Behbood Certificates & Pensioner Income Tax Return 2022 #FBR #pakista...

How To Do A Bank Reconciliation (EASY WAY)

📊BANK-NIFTY 1,50000+ PROFIT WITH FUN 💵 #shorts #youtubeshorts #viralvideo #ipl #banknifty #profit...

Income Tax on Cash Deposit in Current Account? Cash Deposit Limit in Current Account #shorts #reels

The Ultimate Guide About Profit Distribution With Your Business Partner

Easy Small Business Bookkeeping Spreadsheet | Income Expense Tracker | Profit & Loss Statement

Комментарии

0:06:22

0:06:22

0:09:59

0:09:59

0:01:49

0:01:49

0:01:50

0:01:50

0:12:31

0:12:31

0:14:13

0:14:13

0:00:20

0:00:20

0:00:39

0:00:39

0:03:18

0:03:18

0:09:16

0:09:16

0:01:01

0:01:01

0:00:17

0:00:17

0:00:58

0:00:58

0:00:10

0:00:10

0:00:13

0:00:13

0:00:15

0:00:15

0:04:41

0:04:41

0:09:38

0:09:38

0:22:59

0:22:59

0:17:02

0:17:02

0:01:00

0:01:00

0:00:19

0:00:19

0:05:56

0:05:56

0:00:18

0:00:18