filmov

tv

Oil, LNG & Renewables: Energy's New Era

Показать описание

Oil, LNG & Renewables: Energy's New Era

The BI Energy Exchange from March 13 offers insights into different aspects of the global energy landscape, focusing on oil prices, LNG demand, and Europe's energy transition.

Salih Yilmaz emphasized the overall upbeat outlook on oil prices and demand, along with OPEC+ unity. However, he noted less optimism for the EV and energy transition outlook. Respondents to their survey indicated that the majority believe the key driver of oil prices in the near future will be OPEC+ policy, with other significant factors being China's demand, non-OPEC+ supply growth, and Federal Reserve interest rate outlooks.

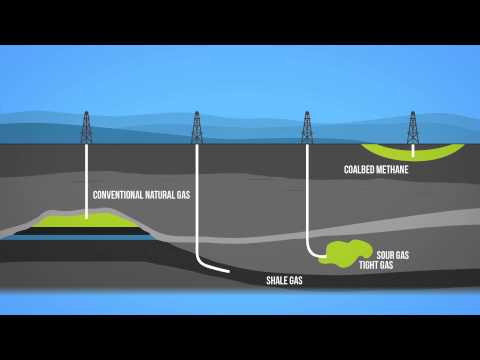

Talon Custer focused on the role of gas and LNG in the energy transition, highlighting the significant role they will play for decades to come. He pointed out the 11% compound annual growth rate (CAGR) for U.S. LNG supply through 2029 and suggested a reasonable growth expectation for global LNG demand is in the low to mid-single digits annually through 2030.

Patricio Alvarez provided insights into Europe's energy transition, noting the potential peak of gas demand earlier in the millennium and highlighting the return of European gas prices to long-term averages. He pointed out the significant increase in European gas storage levels, suggesting a stable outlook for gas prices in the short term but indicating a potential peak in European gas demand.

Rob Barnett's comments reflect an optimistic view on the future of solar+storage and wind energy, emphasizing their potential to contribute substantially to a more sustainable and cleaner energy mix. He suggests that the continued technological advancements, combined with supportive policies and decreasing costs, will further enhance the attractiveness of these renewable energy solutions in the global energy landscape.

Join our mailing list here:

#ENERGY #OIL #GAS #OOTT #LNG #Power #Renewables #Commodities #Wind #Solar #solarenergy #solarpower #Europe #Climate #Emissions #EquityResearch #EnergyTransition #Brent #BloombergIntelligence #4Q #CleanPower #CleanEnergy

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2022 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer's individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber's compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.

The BI Energy Exchange from March 13 offers insights into different aspects of the global energy landscape, focusing on oil prices, LNG demand, and Europe's energy transition.

Salih Yilmaz emphasized the overall upbeat outlook on oil prices and demand, along with OPEC+ unity. However, he noted less optimism for the EV and energy transition outlook. Respondents to their survey indicated that the majority believe the key driver of oil prices in the near future will be OPEC+ policy, with other significant factors being China's demand, non-OPEC+ supply growth, and Federal Reserve interest rate outlooks.

Talon Custer focused on the role of gas and LNG in the energy transition, highlighting the significant role they will play for decades to come. He pointed out the 11% compound annual growth rate (CAGR) for U.S. LNG supply through 2029 and suggested a reasonable growth expectation for global LNG demand is in the low to mid-single digits annually through 2030.

Patricio Alvarez provided insights into Europe's energy transition, noting the potential peak of gas demand earlier in the millennium and highlighting the return of European gas prices to long-term averages. He pointed out the significant increase in European gas storage levels, suggesting a stable outlook for gas prices in the short term but indicating a potential peak in European gas demand.

Rob Barnett's comments reflect an optimistic view on the future of solar+storage and wind energy, emphasizing their potential to contribute substantially to a more sustainable and cleaner energy mix. He suggests that the continued technological advancements, combined with supportive policies and decreasing costs, will further enhance the attractiveness of these renewable energy solutions in the global energy landscape.

Join our mailing list here:

#ENERGY #OIL #GAS #OOTT #LNG #Power #Renewables #Commodities #Wind #Solar #solarenergy #solarpower #Europe #Climate #Emissions #EquityResearch #EnergyTransition #Brent #BloombergIntelligence #4Q #CleanPower #CleanEnergy

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2022 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer's individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber's compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.

0:36:41

0:36:41

0:00:32

0:00:32

0:47:54

0:47:54

0:03:08

0:03:08

0:04:14

0:04:14

0:01:47

0:01:47

0:00:53

0:00:53

0:02:31

0:02:31

1:15:44

1:15:44

0:03:39

0:03:39

0:01:45

0:01:45

0:05:20

0:05:20

0:01:01

0:01:01

0:03:13

0:03:13

0:00:17

0:00:17

0:01:28

0:01:28

0:07:21

0:07:21

0:00:57

0:00:57

0:42:26

0:42:26

0:01:01

0:01:01

0:07:31

0:07:31

0:01:11

0:01:11

0:09:15

0:09:15

0:13:44

0:13:44