filmov

tv

Python Quants Tutorial 12 - Derivative Analytics - Calibrating an Opti | Refinitiv Developers

Показать описание

In this second part of the Derivative Analytics tutorial we build upon the ease with which the Eikon Data API allows you to work with Options Chains by showing how to calibrate an options pricing model. We will show that this model is capable of approximating prices observed in the real world. We combine the Merton (1976) characteristic function with the Lewis (2001) integration function and finally evaluate the integral via numerical quadrature. To conclude, we compare the model-based prices to those observed in the markets and draw some conclusions. #Eikon #API #Quant #Python #MachineLearning #DataDevelopers #Refinitiv

- Retrieving options data based on chain RICs

- Implementing Merton (1976) Jump-Diffusion Model in Python to calculate a modelled option valuation

- Calibration of the model, based on the Root Mean Squared Error (RMSE), analysis of the results

- Retrieving options data based on chain RICs

- Implementing Merton (1976) Jump-Diffusion Model in Python to calculate a modelled option valuation

- Calibration of the model, based on the Root Mean Squared Error (RMSE), analysis of the results

Python Quants Tutorial 12 - Derivative Analytics - Calibrating an Opti | Refinitiv Developers

Python Quants Tutorial 13 - Deep Learning - Financial Time Series Predict | Refinitiv Developers

Quant Platform 2.0 | The Python Quants

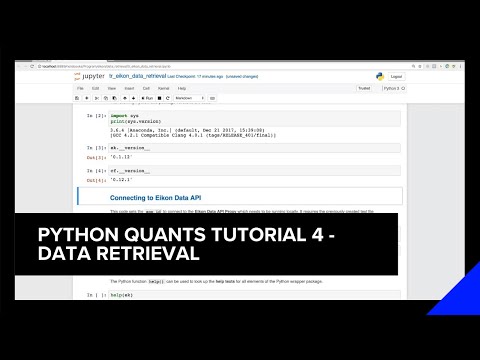

Python Quants Tutorial 4 - Data Retrieval | Refinitiv Developers

Python Quants Tutorial 11 - NLP -Sentiment Scoring for News | Refinitiv Developers

Python Quants Tutorial 1 - Getting Started on Windows | Refinitiv Developers

1 Year of Coding #programming #comedy #coding

Quant Finance with Python and Pandas | 50 Concepts you NEED to Know in 9 Minutes | [Getting Started]

I can't STOP reading these Machine Learning Books!

Be a Python Pro with Enumerate

Most Asked Coding Interview Question (Don't Skip !!😮) #shorts

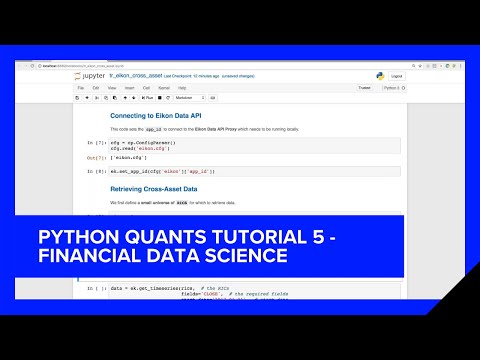

Python Quants Tutorial 5 - Financial Data Science | Refinitiv Developers

700% Profit In ONE Trade Using A Secret Indicator 🤯 #shorts

Data Engineer vs Data Scientist #shorts

Algorithmic Trading – Machine Learning & Quant Strategies Course with Python

Genius Trader Doesn't Believe in Technical Analysis #trading

Quant Analysis Course in Python - Probability Distribution of Stock Returns

Algorithmic Trading Python for Beginners - FULL TUTORIAL

The Regrets of An Accounting Major @zoeunlimited

ChatGPT Makes Me Rich: My AI Trading Bot Story

Don’t Become a Data Scientist If

Stop Making Physical Flashcards #shorts #study #revision #gcse #alevel

Simple Interest and Compound Interest Formulas 📖📖

I Found An AMAZING Trend Following Strategy #shorts

Комментарии

0:18:29

0:18:29

0:17:21

0:17:21

0:11:46

0:11:46

0:15:31

0:15:31

0:14:18

0:14:18

0:10:23

0:10:23

0:00:19

0:00:19

0:09:01

0:09:01

0:00:26

0:00:26

0:00:55

0:00:55

0:00:32

0:00:32

0:23:37

0:23:37

0:00:22

0:00:22

0:01:00

0:01:00

2:59:20

2:59:20

0:00:18

0:00:18

0:34:46

0:34:46

3:00:48

3:00:48

0:00:37

0:00:37

0:00:59

0:00:59

0:00:27

0:00:27

0:00:14

0:00:14

0:00:14

0:00:14

0:00:54

0:00:54