filmov

tv

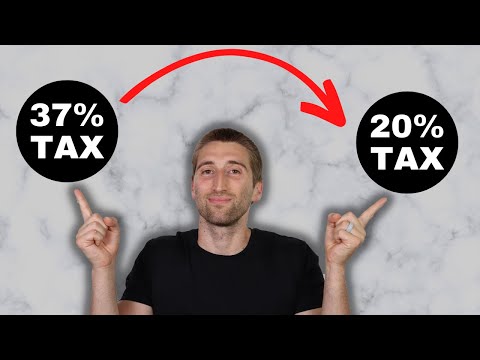

Dividends, Ordinary and Qualified

Показать описание

If you own stock in an corporation or mutual fund, you will most likely receive some dividends. This video describes the different types of dividends, how they're taxed, and where they are reported on the tax return. You'll also find out what types of other forms, schedules, or worksheets you'll need to complete when you receive dividends to assure you pay the minimum amount of tax on them.

Additional Information and Resources:

The Tax Geek on Twitter: @taxgeekusa

Other images via Wikimedia Commons

Intro Music: "Bluesy Vibes" - Doug Maxwell - YouTube Audio Library

Background and Outro Music: "A Walk in the Park" - Track Tribe via YouTube Audio Library

DISCLAIMER: This video is for educational and informational purposes only. It is not intended to render tax advice or investment advice for individual situations. If you have questions regarding your particular situation, please consult with a qualified tax or investment professional.

The information in this video is current as of date of publication, and is subject to changes enacted by Congress or the IRS.

Additional Information and Resources:

The Tax Geek on Twitter: @taxgeekusa

Other images via Wikimedia Commons

Intro Music: "Bluesy Vibes" - Doug Maxwell - YouTube Audio Library

Background and Outro Music: "A Walk in the Park" - Track Tribe via YouTube Audio Library

DISCLAIMER: This video is for educational and informational purposes only. It is not intended to render tax advice or investment advice for individual situations. If you have questions regarding your particular situation, please consult with a qualified tax or investment professional.

The information in this video is current as of date of publication, and is subject to changes enacted by Congress or the IRS.

Dividends, Ordinary and Qualified

Qualified Dividends vs. Ordinary Dividends (U.S. Tax)

IMPORTANT Difference Between Qualified & Ordinary Dividends!

Qualified Dividends vs. Non Qualified Dividends

57.1% TAX savings - Qualified vs Non-qualified Dividends (SCHD, JEPI)

You will regret investing for qualified dividends. Here's why

Qualified Dividends vs Ordinary Dividends - How Are They Taxed? (Understand Their Tax Differences!)

Dividend Taxes: Everything Investors Need to Know

How Are Dividends Taxed 2021 - (Qualified Dividends, Ordinary Dividends, Return of Capital)

Sneaky IRS Rule For Qualified and Ordinary Dividends

How Dividends Are Taxed | Qualified Dividends and Ordinary Dividends

How to Pay $0 in Taxes on Dividends!

TAX FREE Dividends: Highest Yielding Tax Free Funds

Tax Form 1099-DIV Dividends & Capital Gains || Ordinary vs. Qualified Dividends

Qualified Dividends vs. Ordinary Dividends

Understanding Qualfied vs Non-Qualified Dividends

Qualified Dividends Fully Explained (How To Pay Less Tax On Dividends) |Dividend Income Investing

Make Sure That Your Dividends Are Qualified!

DIfference Between Ordinary Dividends & Qualified Dividends

Qualified vs Ordinary Dividends - Talking Money

What Is The Difference Between Qualified Dividends And Ordinary Dividends

🚨💰HOW ARE DIVIDENDS TAXED? (in 50sec.)

Qualified Dividends Explained

Form 1099-DIV Qualified Dividends

Комментарии

0:06:19

0:06:19

0:03:29

0:03:29

0:06:52

0:06:52

0:10:37

0:10:37

0:14:15

0:14:15

0:06:58

0:06:58

0:02:41

0:02:41

0:14:07

0:14:07

0:08:15

0:08:15

0:15:18

0:15:18

0:06:55

0:06:55

0:09:21

0:09:21

0:10:41

0:10:41

0:08:16

0:08:16

0:00:47

0:00:47

0:06:28

0:06:28

0:12:57

0:12:57

0:08:39

0:08:39

0:07:21

0:07:21

0:03:08

0:03:08

0:11:14

0:11:14

0:00:48

0:00:48

0:00:31

0:00:31

0:00:46

0:00:46