filmov

tv

Using our SPIA Calculator – Laddering Strategies

Показать описание

Watch and Enjoy,

Stan The Annuity Man

Free Annuity Owner’s Manuals

Free Annuity Calculators and Live Rate Feeds

Book a Free 30-minute Call with Stan The Annuity Man

Key Moments in this Episode

========================

4:03 Life Only & Joint Life Only

4:56 2 Ways to Run the Quote

6:26 Life Expectancy Drives the Price

7:19 Laddering Income

10:06 Summary

Other Resources

ALL THINGS ANNUITIES

LISTEN/WATCH FUN WITH ANNUITIES PODCAST

JOIN THE ANNUITY LOVERS FACEBOOK GROUP

CONNECT WITH STAN

Call Stan The Annuity Man: 800-509-6473

#StanTheAnnuityMan

#Annuity

#TheAnnuityMan

Using our SPIA Calculator – Laddering Strategies

SPIA Calculator: 2 Ways to Find the Best Quote

Retirement Annuities--Should you Buy an Income Annuity (SPIA) in Retirement

Immediate Annuity Calculator- 'immediate annuity calculator'

The HUGE Mistake That 99% of Annuity Owners Make

Use Our Annuity Calculators- Stan The Annuity Man

Annuity Calculator Secrets and Tips

Income Annuity Calculator: See Your Lifetime Income Potential

What Is A SPIA? #retirement #annuity #investing #investment #taxes #taxadvice

IRA Annuity Calculator

How to descale your Express Anti-calc steam generator? | Tefal

Retirement Annuity Calculator | How To Use It

Darth Gator loves his exercise!🐊🙌🏻 #alligator

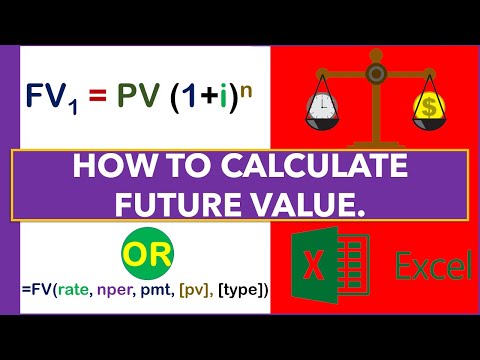

How to Calculate the Future Value in Excel

How to RESET SOFTWARE? - BMW E90 E91 E92 E93

Fidelity's Guaranteed Income Annuity Calculator

Annuity Calculator - Calculatorservice.com - Free online Calculators

Apple Watch as a SPYING Device 😳😱

Defer 2 SPIA (MYGA-2-SPIA): Shootin' It Straight with Stan

Free Annuity Calculator | Let's Customize Your Policy

CFP® Explains: My FAVORITE Fixed Annuity

What's a Single Premium Immediate Annuity (SPIA)?

IS THAT FELIX WITHOUT ANY BODYGUARDS ⁉️😳 #felix #straykids #skz #felixskz #australia

Best FREE Retirement Calculators

Комментарии

0:11:17

0:11:17

0:09:31

0:09:31

0:37:19

0:37:19

0:10:46

0:10:46

0:05:35

0:05:35

0:00:06

0:00:06

0:09:47

0:09:47

0:10:26

0:10:26

0:01:00

0:01:00

0:11:24

0:11:24

0:01:31

0:01:31

0:09:26

0:09:26

0:00:13

0:00:13

0:00:23

0:00:23

0:02:07

0:02:07

0:07:35

0:07:35

0:01:07

0:01:07

0:00:19

0:00:19

0:13:59

0:13:59

0:09:02

0:09:02

0:02:58

0:02:58

0:00:51

0:00:51

0:00:07

0:00:07

0:10:30

0:10:30