filmov

tv

ACH Transfer App: Top Choices for Instant & Secure ACH Payments in 2024

Показать описание

In 2024, the landscape of ACH transfer apps is diverse, offering a range of options tailored to meet different financial needs. These apps have revolutionized how we manage money, emphasizing convenience, instant speed, and security. Popular options like Melio, Venmo, Zelle, and PayPal allow users to send and receive money electronically, enhancing financial management and reducing transaction fees.

Key highlights include Melio's seamless integration for business payments, MoneyGram's extensive network for international transfers, Remitly's unique home delivery service, Cash App's investment features, PayPal's Buyer Protection for secure online purchases, Revolut's global spending solutions, and Western Union's reliability in cash sending. Venmo and Zelle stand out for their quick mobile and bank-to-bank transfers.

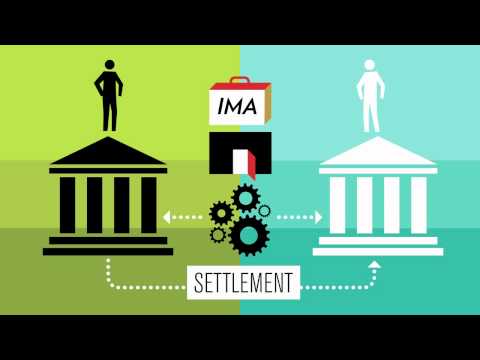

Understanding ACH transfers is crucial; they offer a secure, efficient way to move money between banks governed by NACHA. These transfers reduce the need for paper checks and in-person banking, streamlining financial transactions. Apps for ACH transfers offer several advantages, including reduced transfer time, lower fees, enhanced security, and convenience.

Security is paramount in ACH transfer apps, with measures in place to protect against unauthorized access and fraud. When selecting an app, it's essential to consider security features, compliance with regulations, and integration with other financial tools.

Comparing fees across different ACH apps is also essential for cost-effective financial management. Some apps offer free transfers, while others may charge per transaction or require minimum balance fees. Understanding these costs helps in making informed decisions and ensuring efficient financial operations.

In conclusion, the plethora of ACH transfer apps in 2024 offers individuals and businesses unprecedented control and efficiency in managing finances. These apps cater to various financial needs, from domestic to international transactions and investment opportunities to secure online purchases. Choosing the right app involves assessing features, security measures, and fees to align with personal or business financial strategies, ensuring a seamless and cost-effective financial management experience.

00:00 Introduction

00:12 Best ACH transfer apps in 2024

01:16 Introduction to Melio ACH processing

01:46 Melio's benefits

02:33 Understanding ACH transfers

03:30 Final words

#achtransfer #moneytransfer #ach #payment

Комментарии

0:03:37

0:03:37

0:01:29

0:01:29

0:01:41

0:01:41

0:08:19

0:08:19

0:05:06

0:05:06

0:11:02

0:11:02

0:11:49

0:11:49

0:01:39

0:01:39

0:00:50

0:00:50

0:03:39

0:03:39

0:01:52

0:01:52

0:03:49

0:03:49

0:01:48

0:01:48

0:03:32

0:03:32

0:03:44

0:03:44

0:10:30

0:10:30

0:05:20

0:05:20

0:01:24

0:01:24

0:01:28

0:01:28

0:03:31

0:03:31

0:03:35

0:03:35

0:03:21

0:03:21

0:03:43

0:03:43

0:02:24

0:02:24