filmov

tv

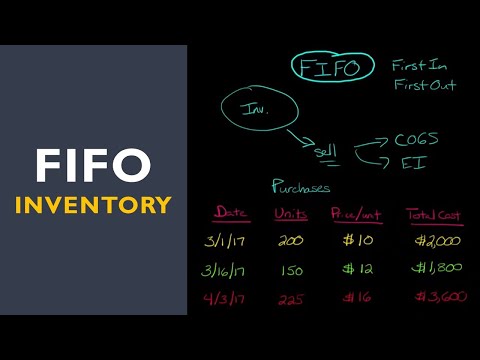

FIFO Inventory Cost Flow Assumption -- First In First Out Cost Flows Explained

Показать описание

Inventory cost flow methods help managers track the cost of goods sold. However, a company’s inventory costs can go up and down. For example, the cost of inventory at the beginning of a quarter could change by the end of a quarter. So in financial accounts, managers must decide how to assume cost flows. That is, regarding inventory costs on income statements, companies must decide to reflect either the newest or oldest inventory costs. Or, they could chose to use an average.

In fact, under the U.S. GAAP (Generally Accepted Accounting Principles), accountants use three primary methods to assume inventory cost flows:

• FIFO: First In, First Out

• LIFO: Last In, First Out

• Average cost methods

If they use the FIFO method, they use the oldest costs. If they use the LIFO method, they use the newest ones. Which method is best? A company should use the approach that best reflects their periodic income.

Basically, FIFO best accounts for the actual flow of physical inventory. FIFO starts with the cost of the oldest inventory. Then, this cost is multiplied by the number of items the company sold. This final number is the cost of the inventory.

Accountants use two different methods to accountant for the cost of goods sold and final inventory. The difference relates to when (and in some ways, how) companies track their inventory. With perpetual inventory systems, companies constantly track their sales and purchases with the help of automated inventory entries. In contrast, companies who use periodic inventory systems only update their inventory balances in accounting statements after physical inventory counts are completed. By comparing their original inventory units to their new inventory units, they can determine the cost of the goods they sold for that period.

So to figure out the cost of goods (COGS) sold during a certain period, companies who use a period inventory system and FIFO will start with a beginning inventory. Then, they add purchases to determine the cost of the goods available for sale. Next, they subtract the ending inventory from the physical count to finally calculate the cost of goods (COGS) sold.

The use of FIFO versus LIFO impacts gross profit. For example, FIFO demonstrates the highest gross profit when prices are increasing. That is, when prices are going up, companies are selling their oldest—and therefore cheapest—inventory first. Thus, using the FIFO method yields the highest net income. By comparison, using the LIFO method during a period of rising prices would lead to lower net income because it would reflect a higher cost of inventory.

From time to time, companies may consider switching from a FIFO to LIFO method, or vice versa. However, this can have serious impacts in financial accounts. In fact, when a company switches, they should restate their previous financial statement to reflect the changes.

Additionally, companies should keep in mind that the use of FIFO versus LIFO has tax implications, too. After all, if FIFO results in higher gross profits when prices are rising, that also means that the company will have higher income tax expenses.

In fact, under the U.S. GAAP (Generally Accepted Accounting Principles), accountants use three primary methods to assume inventory cost flows:

• FIFO: First In, First Out

• LIFO: Last In, First Out

• Average cost methods

If they use the FIFO method, they use the oldest costs. If they use the LIFO method, they use the newest ones. Which method is best? A company should use the approach that best reflects their periodic income.

Basically, FIFO best accounts for the actual flow of physical inventory. FIFO starts with the cost of the oldest inventory. Then, this cost is multiplied by the number of items the company sold. This final number is the cost of the inventory.

Accountants use two different methods to accountant for the cost of goods sold and final inventory. The difference relates to when (and in some ways, how) companies track their inventory. With perpetual inventory systems, companies constantly track their sales and purchases with the help of automated inventory entries. In contrast, companies who use periodic inventory systems only update their inventory balances in accounting statements after physical inventory counts are completed. By comparing their original inventory units to their new inventory units, they can determine the cost of the goods they sold for that period.

So to figure out the cost of goods (COGS) sold during a certain period, companies who use a period inventory system and FIFO will start with a beginning inventory. Then, they add purchases to determine the cost of the goods available for sale. Next, they subtract the ending inventory from the physical count to finally calculate the cost of goods (COGS) sold.

The use of FIFO versus LIFO impacts gross profit. For example, FIFO demonstrates the highest gross profit when prices are increasing. That is, when prices are going up, companies are selling their oldest—and therefore cheapest—inventory first. Thus, using the FIFO method yields the highest net income. By comparison, using the LIFO method during a period of rising prices would lead to lower net income because it would reflect a higher cost of inventory.

From time to time, companies may consider switching from a FIFO to LIFO method, or vice versa. However, this can have serious impacts in financial accounts. In fact, when a company switches, they should restate their previous financial statement to reflect the changes.

Additionally, companies should keep in mind that the use of FIFO versus LIFO has tax implications, too. After all, if FIFO results in higher gross profits when prices are rising, that also means that the company will have higher income tax expenses.

0:11:00

0:11:00

0:08:38

0:08:38

0:14:38

0:14:38

0:05:44

0:05:44

0:04:08

0:04:08

0:04:58

0:04:58

0:07:29

0:07:29

0:08:40

0:08:40

0:05:38

0:05:38

0:47:16

0:47:16

0:36:18

0:36:18

0:11:15

0:11:15

0:06:39

0:06:39

0:10:40

0:10:40

0:11:59

0:11:59

0:23:18

0:23:18

0:10:36

0:10:36

0:05:11

0:05:11

0:02:41

0:02:41

0:08:48

0:08:48

0:09:17

0:09:17

0:16:23

0:16:23

0:10:29

0:10:29

0:25:29

0:25:29