filmov

tv

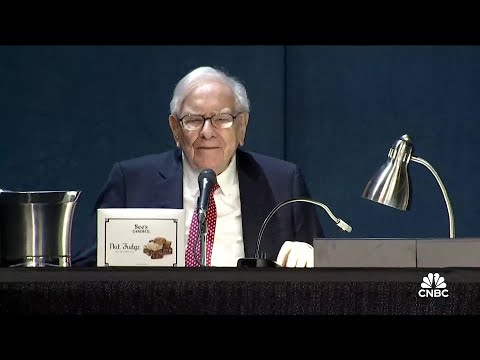

Warren Buffett and Charlie Munger on Risk and Probability

Показать описание

Warren Buffett's views on risk are well-known in the investing community. He believes that risk and return are closely related, and that investors should be willing to accept a higher level of risk in order to achieve higher returns.

Warren, CEO of Berkshire Hathaway and vice Chairman , Charlie Munger, well known because of their long term value investing.

Warren Buffet is an American billionaire, business man and worlds no.1 stock market value investor. He, away from wall street crowd, practiced his investing psychology in Omaha, Nebraska. He is also known as oracle of Omaha.

Charlie Munger, right hand of warren buffet , is vice chairman of Berkshire Hathaway. He is well known because of this rational thinking. He is author of must read business book " Poor Charlie's Almanack"

Goal of this channel is to provide you insights about value investing of different successful investors. Learn about how great investors invested in past and how they are investing now.

Warren, CEO of Berkshire Hathaway and vice Chairman , Charlie Munger, well known because of their long term value investing.

Warren Buffet is an American billionaire, business man and worlds no.1 stock market value investor. He, away from wall street crowd, practiced his investing psychology in Omaha, Nebraska. He is also known as oracle of Omaha.

Charlie Munger, right hand of warren buffet , is vice chairman of Berkshire Hathaway. He is well known because of this rational thinking. He is author of must read business book " Poor Charlie's Almanack"

Goal of this channel is to provide you insights about value investing of different successful investors. Learn about how great investors invested in past and how they are investing now.

Warren Buffett & Charlie Munger: 100 Years of Financial Wisdom in 4 Hour - Investing/Market Anal...

Warren Buffett on his friendship with Charlie Munger: We never had any doubts about the other person

Warren Buffett Accidentally Calls Greg Abel “Charlie” at Berkshire Hathaway Shareholders Meeting

Warren Buffett Jokes About Charlie Munger's Costco Obsession

The Best Collections of Warren Buffett & Charlie Munger - Stock Market

Charles Munger Interview: The Power of Partnership with Warren Buffett

Watch Warren Buffett and Charlie Munger preside over full 2023 Berkshire Hathaway annual meeting

Warren Buffett & Charlie Munger: Diversification

Warren Buffett & Charlie On ELON MUSK

Warren Buffett and Charlie Munger share their 100-year vision for Berkshire

Watch CNBC's full interview with Warren Buffett, Charlie Munger and Bill Gates

Warren Buffett, Charlie Munger on Berkshire Hathaway's unique management style

Warren Buffett and Charlie Munger on why they work so well as partners

Warren Buffett and Charlie Munger on how to avoid mistakes in life and business

Warren Buffett and Charlie Munger on picking winning stocks, businesses and more: Yahoo Finance

Bill Ackman Asks Warren Buffett and Charlie Munger How To Analyze Financial Statements

Bill Gates, Charlie Munger, Warren Buffett on the socialism versus capitalism debate

If you offered me all the bitcoin in the world for $25, I wouldn’t take it, says Warren Buffett

Buffett kicks off 2024 Berkshire Hathaway annual meeting after emotional tribute to Charlie Munger

Charlie Munger on Why is Warren Buffett Richer? | Daily Journal 2019【C:C.M Ep.69】

Charlie Munger: 'We have a rising young man here named Warren Buffett' (2008)

Charlie Munger Roasting People NON-STOP

Charlie Munger's Most Iconic Moments

Billionaire Warren Buffett On His Successful Relationship With Charlie Munger

Комментарии

3:59:35

3:59:35

0:07:28

0:07:28

0:00:38

0:00:38

0:01:29

0:01:29

3:12:45

3:12:45

0:35:16

0:35:16

5:16:37

5:16:37

0:07:16

0:07:16

0:02:03

0:02:03

0:04:50

0:04:50

2:06:07

2:06:07

0:01:10

0:01:10

0:02:32

0:02:32

0:05:17

0:05:17

2:30:04

2:30:04

0:07:01

0:07:01

0:09:27

0:09:27

0:06:47

0:06:47

0:04:28

0:04:28

0:01:01

0:01:01

0:04:48

0:04:48

0:04:42

0:04:42

0:06:39

0:06:39

0:02:09

0:02:09