filmov

tv

Mathematical Models of Financial Derivatives: Oxford Mathematics 3rd Year Student Lecture

Показать описание

Our latest student lecture features the first lecture in the third year course on Mathematical Models of Financial Derivatives from Sam Cohen where students learn that the aim of any financial model is not to make money but to avoid being exploited.

We are making these lectures available to give an insight in to the student experience and how we teach Maths in Oxford. All first and second year lectures are followed by tutorials where students meet their tutor to go through the lecture and associated problem sheet and to talk and think more about the maths. Third and fourth year lectures are followed by classes.

We are making these lectures available to give an insight in to the student experience and how we teach Maths in Oxford. All first and second year lectures are followed by tutorials where students meet their tutor to go through the lecture and associated problem sheet and to talk and think more about the maths. Third and fourth year lectures are followed by classes.

Mathematical Models of Financial Derivatives: Oxford Mathematics 3rd Year Student Lecture

Pricing Options with Mathematical Models | CaltechX on edX | Course About Video

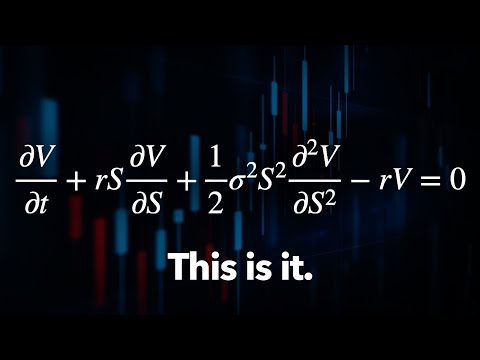

The Trillion Dollar Equation

Math for Quantatative Finance

NEWYES Calculator VS Casio calculator

Derivatives Explained in One Minute

20. Option Price and Probability Duality

Binomial Options Pricing Model Explained

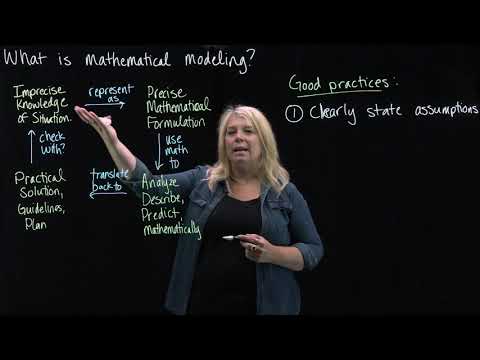

What is Mathematical Modeling?

Warren Buffett: Black-Scholes Formula Is Total Nonsense

Introduction to the Black-Scholes formula | Finance & Capital Markets | Khan Academy

Financial Derivatives - Binomial Option Pricing - The One-Period Model Formula

A $16B hedge fund CIO gives an easy explanation of quantitative trading

The Advantages of a Mathematical Model for Investing

Mathematical Finance: L8 - Binomial model with one trading period

Stock Prices as Stochastic Processes

Option Pricing Binomial Model

Mathematical Finance L 1: Basics of financial engineering

19. Black-Scholes Formula, Risk-neutral Valuation

BEST DEFENCE ACADEMY IN DEHRADUN | NDA FOUNDATION COURSE AFTER 10TH | NDA COACHING #shorts #nda #ssb

Mathematical Modeling and Computation in Finance - Cornelis W. Oosterlee, TU Delft/CWI - PART I...

Predicting Stock Price Mathematically

The Easiest Way to Derive the Black-Scholes Model

Human Calculator Solves World’s Longest Math Problem #shorts

Комментарии

0:49:14

0:49:14

0:02:44

0:02:44

0:31:22

0:31:22

0:05:37

0:05:37

0:00:14

0:00:14

0:01:30

0:01:30

1:20:29

1:20:29

0:16:51

0:16:51

0:11:03

0:11:03

0:15:54

0:15:54

0:10:24

0:10:24

0:24:18

0:24:18

0:00:57

0:00:57

0:04:57

0:04:57

1:27:31

1:27:31

0:06:43

0:06:43

0:14:11

0:14:11

0:48:26

0:48:26

0:49:52

0:49:52

0:00:15

0:00:15

1:38:10

1:38:10

0:11:33

0:11:33

0:09:53

0:09:53

0:00:34

0:00:34