filmov

tv

Session 9: Growth Rates - Historical, Outside and Fundamental

Показать описание

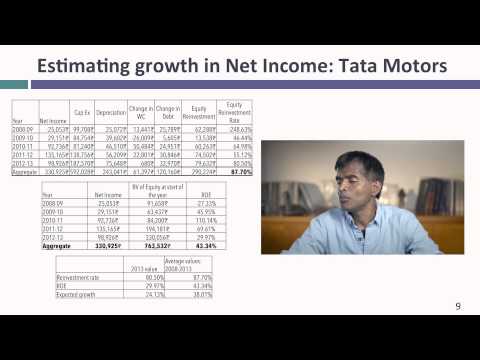

In this session, we continued our discussion of growth by completing our assessment of past growth , looking at the limitations of analyst estimates of growth and then examining the fundamentals that drive growth. Starting with a very simple algebraic proof that growth in earnings has to come either from new investments or improved efficiency, we looked at how best to estimate growth in three measures of earnings: earnings per share, net income and operating income. With each measure of earnings, the estimation of growth boiled down to answering two questions: (1) How much is this company reinvesting to generating for future growth? (2) How well is it reinvesting? (3) How much growth is added or lost by changes in returns on existing investments?

Session 9: Growth Rates - Historical, Analyst and Fundamental

Session 9: Growth Rates

Session 9: Growth Rates

Session 9: Growth Rates - Historical, Outside and Fundamental

Session 9: Terminal Value

Session 9 (Val MBA): FCFE and Growth Rates

Session 9: FCFE and Growth Rates

Session 9: Quiz and Analyst/Fundamental Growth Rates

Town of Carmel Town Board Work Session - Wednesday, October 9, 2024

Session 9: Historical Growth and Analyst Estimates of Growth

Session 9: Fundamental Growth

Session 9: Analyst Estimates of Growth & Fundamental Growth

Session 9: Analyst Estimates of Growth & Fundamental Growth

Session 9: Analyst Estimates of Growth & Fundamental Growth first steps

Do not make these mistakes when investing | Session 9

Session 9: Historical, Analyst & Fundamental growth

Terminal Value Myth 4: Negative Growth Rates are impossible

Session 9: Random Walks and Momentum

GC Theory and Key Principles: Session 9

Session 31: Cash Flows & Growth Rates

Session 8: Estimating Growth

Standing Finance Committee - 5th Session - October 11, 2024 - Day 1 of 5

Session 9: Estimating Hurdle Rates - Betas and Fundamentals

Session 9: Earnings and Cash Flows

Комментарии

0:59:16

0:59:16

0:46:52

0:46:52

1:01:47

1:01:47

1:20:05

1:20:05

0:10:07

0:10:07

0:51:09

0:51:09

1:20:05

1:20:05

1:25:05

1:25:05

1:01:55

1:01:55

0:50:23

0:50:23

1:00:45

1:00:45

0:46:37

0:46:37

1:01:07

1:01:07

0:52:38

0:52:38

0:44:46

0:44:46

1:22:05

1:22:05

0:09:01

0:09:01

0:14:59

0:14:59

0:31:32

0:31:32

0:14:56

0:14:56

0:15:09

0:15:09

7:45:40

7:45:40

0:12:50

0:12:50

1:17:29

1:17:29