filmov

tv

Session 9: Estimating Hurdle Rates - Betas and Fundamentals

Показать описание

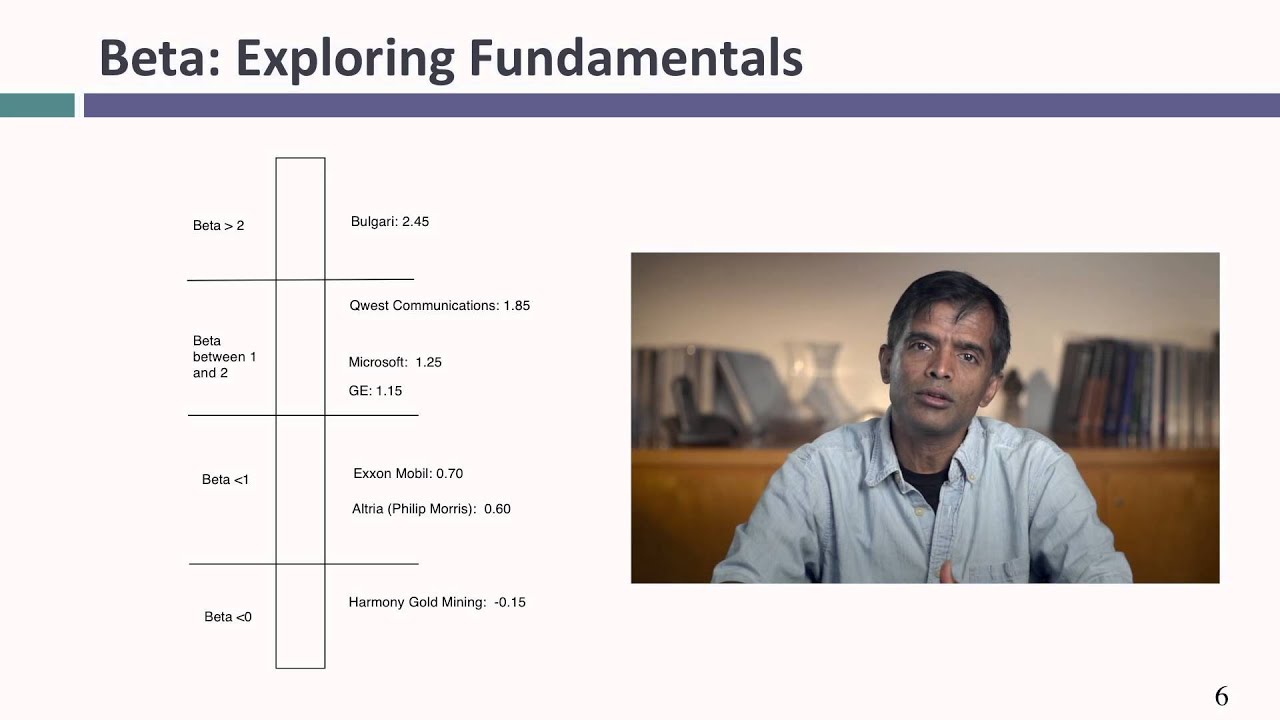

Examine the determinants of betas

Session 9: Estimating Hurdle Rates - Betas and Fundamentals

Session 10: Estimating Hurdle Rates - Bottom up Betas

Session 9: Terminal Value

Session 5: Estimating Hurdle Rates - The Risk free Rate

Session 12: Estimating Hurdle Rates - Debt & its Cost

Session 9: Estimating bottom up betas for companies

Session 9: Bottom Up Betas

Session 11: Estimating Hurdle Rates - More on bottom up betas

Session 8: Estimating Hurdle Rates - Regression Betas

Session 9: Bottom Up Betas

Session 9: Bottom Up Betas

Session 9: Historical Growth and Analyst Estimates of Growth

Session 9: Growth Rates

Session 9: Fundamental Growth

Session 9 (Undergraduate): Determinants of Betas

Session 9: Historical, Analyst & Fundamental growth

Session 7: Estimating Hurdle Rates - Implied ERP, Country Risk and Company Risk

What Is a Hurdle Rate for Investment?

Session 9: Earnings and Cash Flows

Session 9: Beta Determinants and Bottom up Betas

Session 6: Estimating Hurdle Rates - Equity Risk Premiums - Historical & Survey

Session 9: Random Walks and Momentum

Session 9 (MBA): Bottom up Betas

According to CAPM, what is the appropriate hurdle rate?

Комментарии

0:12:50

0:12:50

0:17:02

0:17:02

0:10:07

0:10:07

0:15:12

0:15:12

0:17:55

0:17:55

1:30:06

1:30:06

1:27:05

1:27:05

0:14:52

0:14:52

0:20:34

0:20:34

1:25:05

1:25:05

1:25:05

1:25:05

0:50:23

0:50:23

0:46:52

0:46:52

1:00:45

1:00:45

1:22:06

1:22:06

1:22:05

1:22:05

0:13:03

0:13:03

0:01:45

0:01:45

1:17:29

1:17:29

1:23:00

1:23:00

0:15:43

0:15:43

0:14:59

0:14:59

1:27:06

1:27:06

0:00:34

0:00:34