filmov

tv

Probability ALWAYS Beats Risk Reward - My Experience [IMPORTANT]

Показать описание

Subscribe to the channel and press the notification bell to be notified with uploads!

Disclaimer:

Trading is extremely risky so never risk what you cannot afford to lose. Our guarantee is based on practicing our concepts on a demo account, not with real money. The information provided by Psych FX never constitutes financial advice and is for educational purposes only. Do your due diligence.

Probability ALWAYS Beats Risk Reward - My Experience [IMPORTANT]

RISK REWARD RATIO - Trade like a professional.

How to Trade Stocks (Using Probability & Edge)

Trade With a Statistical Edge - Risk, Reward, & Probability

ICT Trader explains why 90% lose in Forex Trading. | Words of Rizdom EP.45 #shorts #ICTTrader #forex

Warren Buffett and Charlie Munger on Risk and Probability

The Truth About Risk Reward & Why You Should Use A Wider Stop Loss

Mark Douglas Probability Thinking

High Win Rate Vs High Risk Reward - The Harsh Reality + My Secret To Reducing Drawdowns

The Ugly Truth About Risk To Reward Ratio (95% Of Traders Get It Wrong)

Trading Probabilities Versus Certainties (w/ Dave Keller)

When Coin Flipping Beat The Market: The Genius Of Tom Basso

'Outperform 99% Of Investors With This Simple Strategy...' - Peter Lynch

Trading Risks Hidden in Probability

How Bad Risk to Reward Improves Your Trading

Finding The Best Risk Vs Reward Ratio

I risk $107 to make $7,500 in Trading… This is how

Why a “Bad' Risk to Reward is Better

Neg Risk to reward

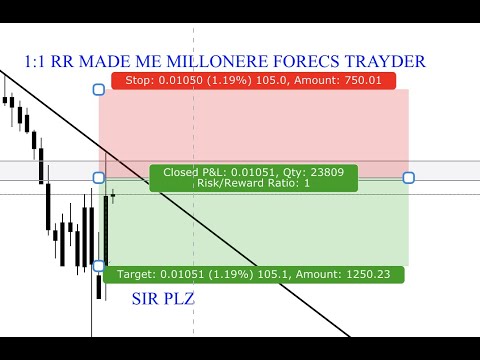

The reason trading forex with a 1:1 risk reward ratio is BEST

How To Trade With Discipline & Without Emotion

A WEIRD THEORY ABOUT RISK / REWARD

The WIN RATE & RISK REWARD RELATIONSHIP

I took 300 TRADES to find the BEST Reward/Risk Ratio | 1X vs 1.5X vs 2X Forex Day Trading Strategies

Комментарии

0:13:38

0:13:38

0:09:31

0:09:31

0:10:29

0:10:29

0:15:03

0:15:03

0:00:35

0:00:35

0:07:37

0:07:37

0:13:29

0:13:29

0:22:51

0:22:51

0:17:38

0:17:38

0:06:23

0:06:23

0:04:23

0:04:23

0:06:05

0:06:05

0:10:23

0:10:23

0:14:15

0:14:15

0:20:04

0:20:04

0:06:20

0:06:20

0:20:39

0:20:39

0:15:16

0:15:16

0:05:29

0:05:29

0:35:04

0:35:04

0:12:34

0:12:34

0:27:41

0:27:41

0:26:55

0:26:55

0:10:15

0:10:15