filmov

tv

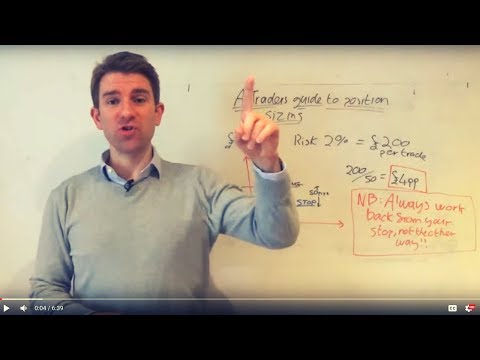

How do I position size my trades based on volatility?

Показать описание

In this video, we're breaking down the latest market trends and diving into some key stock plays. The market's been throwing out major bearish vibes, starting with a sell signal on the $SPY. Most sectors are looking weak (except for staples), so it's definitely a time to be on your toes.

Using OVTLYR, the AI-powered trading assistant, we ran through some bearish stock picks—Citibank (C), AD&T, and APO. After checking out the charts, Citibank seemed like the best bet for a short trade, but we held off due to some stalled signals. The others? Nah, too many order blocks getting in the way.

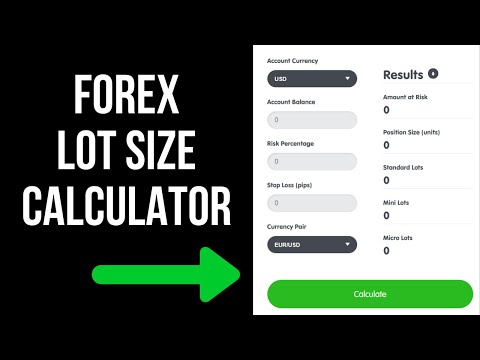

Not only do we break down which stocks are looking good for shorts, but we also drop some tips on managing risk using the ATR (Average True Range) strategy for position sizing. The goal? Find the best trades while keeping risk low. And honestly, OVTLYR makes that way easier.

If you wanna see how the analysis goes and pick up some tips for trading smarter, hit that play button! Stay tuned for more insights to help you crush it in the market.

Stocks Covered:

1. Citibank ($C): Looked solid for a short trade, but we passed due to a stalled heat map.

2. APO & ADNT: Both had potential, but got blocked by order issues.

3. SPY (S&P 500): Bearish sell signal confirmed, market's looking weak across the board.

#StockMarket #TradingSignals #MarketAnalysis #BearMarket #Citibank #StockTrading #StockMarketTips #OVTLYR #TechnicalAnalysis #SectorBreadth #SPY #SellSignal #ATR #RiskManagement #ShortTrades

NO INVESTMENT ADVICE. The information available through the Service is for general informational purposes only and references to specific securities, investment programs or funds are only for illustrative or educational purposes. No portion of the Service is a solicitation, recommendation, endorsement, or offer by OVTLYR or any third-party service provider to buy or sell any securities or financial instruments. You should not construe any such information or other material on the Service as legal, tax, investment, financial, or other advice. OVTLYR is not a fiduciary by virtue of any person's use of the Service. You alone assume the sole responsibility for evaluating the merits and risks associated with your use of any information on the Service. Nothing herein constitutes an offer or a solicitation of the purchase or sale of any security to any person in any jurisdiction in which such an offer or solicitation is not authorized. All purchases and sales of securities must and are to be made through a registered securities broker or dealer of your choosing with whom you have a contractual relationship and have agreed to accept such broker's or dealer's terms and conditions.

Using OVTLYR, the AI-powered trading assistant, we ran through some bearish stock picks—Citibank (C), AD&T, and APO. After checking out the charts, Citibank seemed like the best bet for a short trade, but we held off due to some stalled signals. The others? Nah, too many order blocks getting in the way.

Not only do we break down which stocks are looking good for shorts, but we also drop some tips on managing risk using the ATR (Average True Range) strategy for position sizing. The goal? Find the best trades while keeping risk low. And honestly, OVTLYR makes that way easier.

If you wanna see how the analysis goes and pick up some tips for trading smarter, hit that play button! Stay tuned for more insights to help you crush it in the market.

Stocks Covered:

1. Citibank ($C): Looked solid for a short trade, but we passed due to a stalled heat map.

2. APO & ADNT: Both had potential, but got blocked by order issues.

3. SPY (S&P 500): Bearish sell signal confirmed, market's looking weak across the board.

#StockMarket #TradingSignals #MarketAnalysis #BearMarket #Citibank #StockTrading #StockMarketTips #OVTLYR #TechnicalAnalysis #SectorBreadth #SPY #SellSignal #ATR #RiskManagement #ShortTrades

NO INVESTMENT ADVICE. The information available through the Service is for general informational purposes only and references to specific securities, investment programs or funds are only for illustrative or educational purposes. No portion of the Service is a solicitation, recommendation, endorsement, or offer by OVTLYR or any third-party service provider to buy or sell any securities or financial instruments. You should not construe any such information or other material on the Service as legal, tax, investment, financial, or other advice. OVTLYR is not a fiduciary by virtue of any person's use of the Service. You alone assume the sole responsibility for evaluating the merits and risks associated with your use of any information on the Service. Nothing herein constitutes an offer or a solicitation of the purchase or sale of any security to any person in any jurisdiction in which such an offer or solicitation is not authorized. All purchases and sales of securities must and are to be made through a registered securities broker or dealer of your choosing with whom you have a contractual relationship and have agreed to accept such broker's or dealer's terms and conditions.

0:09:19

0:09:19

0:06:40

0:06:40

0:00:47

0:00:47

0:09:04

0:09:04

0:16:53

0:16:53

0:05:53

0:05:53

0:16:32

0:16:32

0:04:10

0:04:10

0:00:41

0:00:41

0:08:14

0:08:14

0:05:02

0:05:02

0:01:00

0:01:00

0:19:50

0:19:50

0:02:37

0:02:37

0:05:13

0:05:13

0:19:40

0:19:40

0:07:58

0:07:58

0:01:00

0:01:00

0:10:10

0:10:10

0:13:29

0:13:29

0:00:38

0:00:38

0:03:55

0:03:55

0:06:48

0:06:48

0:08:55

0:08:55