filmov

tv

How to Calculate Position Sizing & Risk Per Trade - Any Trade, Any Market ✔️

Показать описание

✅ Please like, subscribe & comment if you enjoyed - it helps a lot!

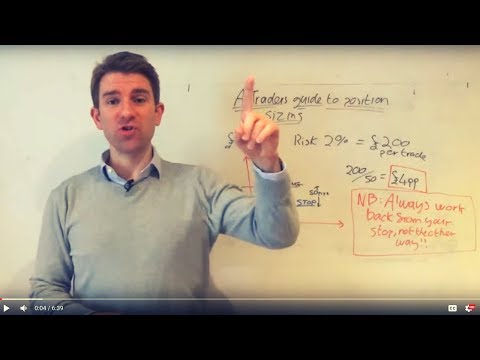

If you have GBP10,000 of capital, if you risk 2% then you risk GBP200 per trade.

If your stop loss is 50 pips then you can trade at GBP4 [GBP200 divided by 50] per point.

Always work from the market conditions at the time and don't decide the stake/trade amount before working out the stop loss. If you use a tighter stop you could be simply increasing the risk as there's more likelihood that your stop would be taken out.

N.B: Always work back from your stop, not the other way round.

Related Video

Should You Constantly Adjust Your Risk %? 🤔 Risk Per Trade?

If you have GBP10,000 of capital, if you risk 2% then you risk GBP200 per trade.

If your stop loss is 50 pips then you can trade at GBP4 [GBP200 divided by 50] per point.

Always work from the market conditions at the time and don't decide the stake/trade amount before working out the stop loss. If you use a tighter stop you could be simply increasing the risk as there's more likelihood that your stop would be taken out.

N.B: Always work back from your stop, not the other way round.

Related Video

Should You Constantly Adjust Your Risk %? 🤔 Risk Per Trade?

How to Calculate Position Sizing & Risk Per Trade - Any Trade, Any Market ✔️

How To Calculate Your Position Size In Forex...

How to Calculate the RIGHT Lot Size for Forex Trading 📈

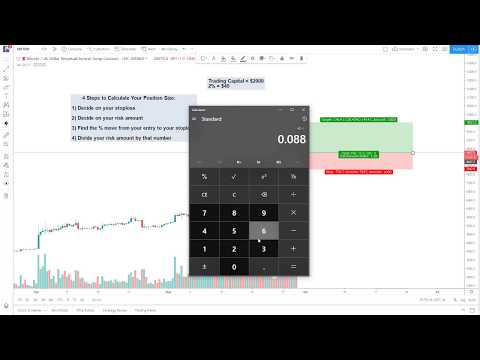

How To Calculate Position Size [Properly] Trading Bitcoin With Leverage

Position Size Calculator - How to Calculate Your Position Size

How To Calculate The Ideal Position Size For Max Profit And Minimal Risk

Calculating Lot Size #shorts

How To Calculate Lot Sizes Perfectly - Enter Forex Trades in 2 Seconds

Blueprint - Side Swapping / Calculating Position Sizes - Automated Trading

Stock Risk Management: How To Calculate Your Position Size

Position Sizing Formula By Van Tharp 🔥| Risk Management

Trading Bitcoin: 4 Steps to Calculate Your Position Size - Risk Management EXPLAINED

How to calculate the position sizing for a trade? Risk management for trading | #trading

Risk Management & Position Sizing Strategy for Trading

KELLY CRITERION | Ed Thorp | Optimal Position Sizing For Stock Trading

POSITION SIZE CALCULATOR (EASY FORMULA) 🤓 #trading #shorts

Crypto Position Size Calculator | How to Calculate Exact Leverage (Risk management tool)

How To QUICKLY Calculate Your Position Size For Forex Trades🔥 #shorts

RISK MANAGEMENT: HOW TO PROPERLY CALCULATE POSITION SIZE IN FOREX TRADING.

How to Calculate Position Size with myfxbook - Risk Management in 3 Years #forexlife #trading #how

How to calculate your position size

Lot size / Position size Calculator

FREE Forex Lot Size Calculator: How to use the Right Lot Size for your Trades!

EASIEST Way to Calculate Lot Sizes / Pips in 3 Secs! (No BS Guide)

Комментарии

0:06:40

0:06:40

0:00:47

0:00:47

0:09:19

0:09:19

0:19:40

0:19:40

0:02:39

0:02:39

0:07:00

0:07:00

0:00:41

0:00:41

0:05:53

0:05:53

0:52:38

0:52:38

0:07:58

0:07:58

0:00:59

0:00:59

0:06:19

0:06:19

0:00:29

0:00:29

0:16:53

0:16:53

0:08:13

0:08:13

0:01:00

0:01:00

0:05:20

0:05:20

0:00:38

0:00:38

0:07:43

0:07:43

0:00:21

0:00:21

0:02:52

0:02:52

0:00:57

0:00:57

0:06:48

0:06:48

0:10:03

0:10:03