filmov

tv

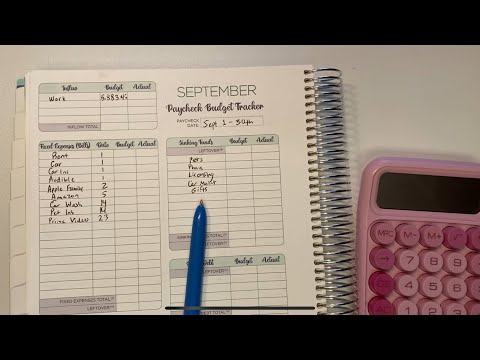

Physician Assistant $5800 Monthly Budget | September 2024

Показать описание

LisaMarieBudgets

POB 191224

Little Rock, AR 72219

VanLilysStickers

Use Code Lisa15 for 15%off

Ally Bank referral code:

Happy Planner Referral Link:

Get $10 off your order of $50 or more!

Disclosure: I only recommend products I would use myself and all opinions expressed here are our own. This post contains affiliate links that at no additional cost to you, I may earn a small commission.

Disclaimer: I am not a financial advisor. I cannot give financial advice. I’m sharing my personal experience being in debt $70,000 to being debt free and financially secure.

Physician Assistant $5800 Monthly Budget | August 2024

Physician Assistant $5800 Monthly Budget | September 2024

Physician Assistant June 2024 Budget Closeout | $5800 Monthly Budget Closeout

medical test 🪖🇮🇳#army #shorts #indianarmy #sainikvijay

Building a PC… Using Only the Top Result on Amazon

Lauren Simmons Reacts To 25-Year-Old With Most Of His Money In Crypto | Millennial Money

Medical expenses in Singapore || How much we paid for my stay? || Medical insurance & benefits

IBPS CLERK RECRUITMENT 2021 | Tamil | BANK CLERK RECRUITMENT 2021 | Latest Government Jobs 2021

UK companies offering visa sponsorship | List of companies sponsoring work visa in UK

The BIGGEST Gaming Setup Upgrade! 😯

Don't Make this Mistake while Applying for a Job #shorts #job

💰Take Your Part-Time Business Full Time and Make BIG 💰💰

5 Fully Remote Companies That Pay the Most for Work-From-Home Jobs 2022

$20k Upfront! $100k/Year! Non-Phone Work-From-Home Job with Flexible Hours Free Laptop Sign-On Bonus

HackTheBox Cache Walkthrough

$100k/Year Virtual Assistant Jobs from Home 2022 with Free Laptop Provided

21 Successful Affiliate Marketing Website Examples

AMD Says You’re Doing it Wrong. - Best settings for AMD GPUs

Wireguard: Gateway to free self-hosted Netflix/Spotify!

Proposals and Budgets

Budget 2018 Highlights

$200/Day Worldwide Work-From-Home Job for Beginners No Experience or Degree Required 2022

COST OF LIVING for expats in MAURITIUS

Best Cold Press Juicer for Celery in 2021 [Expert Picks]

Комментарии

0:18:20

0:18:20

0:19:50

0:19:50

0:33:05

0:33:05

0:00:11

0:00:11

0:20:03

0:20:03

0:07:08

0:07:08

0:11:41

0:11:41

0:12:12

0:12:12

0:06:57

0:06:57

0:10:34

0:10:34

0:01:00

0:01:00

0:21:59

0:21:59

0:13:07

0:13:07

0:05:20

0:05:20

1:31:30

1:31:30

0:08:56

0:08:56

1:10:44

1:10:44

0:09:16

0:09:16

0:12:44

0:12:44

0:59:44

0:59:44

0:14:17

0:14:17

0:07:28

0:07:28

0:09:04

0:09:04

0:04:53

0:04:53