filmov

tv

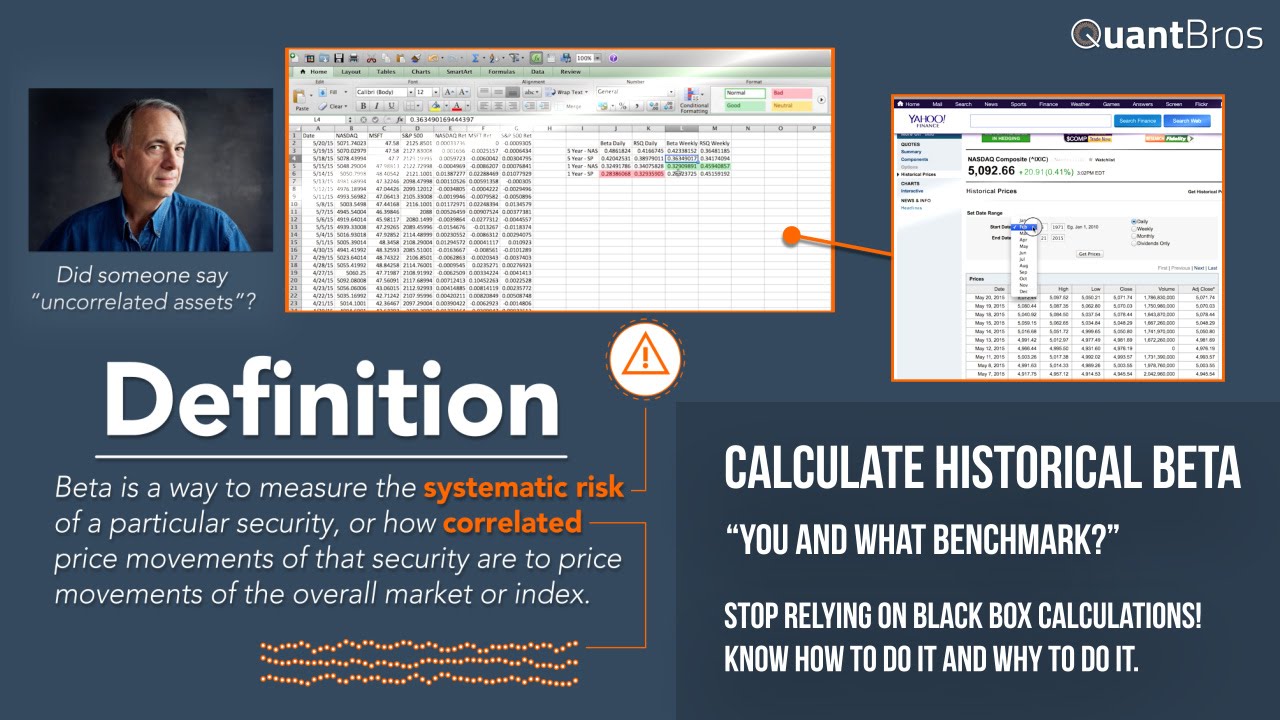

Easily Calculating Beta in Excel Using Regression

Показать описание

What is beta? Learn how and why to calculate historical beta for any security in Excel. We'll teach you how Yahoo Finance does it, too!

Not enough for you? Want to learn more R? Our friends over at DataCamp will whip you into shape real quick if you need help:

Or if you're more of a Python guy, we have an intro to finance for Python course live on DataCamp right now:

Not enough for you? Want to learn more R? Our friends over at DataCamp will whip you into shape real quick if you need help:

Or if you're more of a Python guy, we have an intro to finance for Python course live on DataCamp right now:

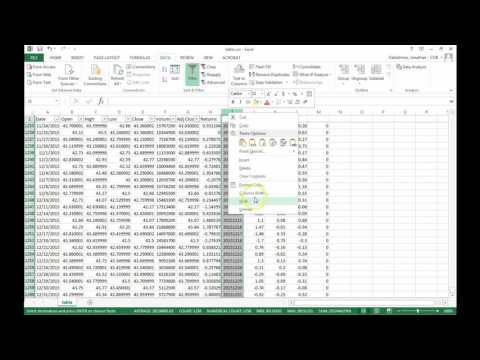

How To Calculate Beta on Excel - Linear Regression & Slope Tool

How to Calculate Beta In Excel - All 3 Methods (Regression, Slope & Covariance)

Easily Calculating Beta in Excel Using Regression

How to Estimate the Beta of a Stock in Excel

How to calculate Beta in Excel

Top three methods for calculating security's beta in excel

Calculating Beta in Excel

Calculating Beta using Excel

Calculate The Beta Of A Portfolio In Excel - The Excel Hub

Calculating beta in Excel / Analyzing stock returns / Episode 6

How Do You Calculate Beta In Excel?

Easily calculate Beta using historical stock data on Excel

How to calculate Beta Using Excel | Financial Statistics

Beta calculation in Excel – Tips and Tricks

Stock's beta in excel! 📉

How to Calculate BETA on Excel - Slope Tool

How To Calculate BETA Using Excel (Linear Regression)

How To Calculate Stock Beta Using Excel - 2 Methods

Three Ways to Calculate Beta in Excel

How to write beta symbol in excel

Estimate CAPM Beta in Excel

Add & Remove Border in Excel || Excel Tips & Tricks || @todfodeducation

Beta Interpretation and Calculation in Excel

How to calculate beta in excel

Комментарии

0:06:42

0:06:42

0:04:57

0:04:57

0:13:30

0:13:30

0:02:43

0:02:43

0:05:45

0:05:45

0:04:34

0:04:34

0:15:02

0:15:02

0:04:30

0:04:30

0:04:00

0:04:00

0:14:13

0:14:13

0:01:24

0:01:24

0:11:24

0:11:24

0:03:40

0:03:40

0:14:30

0:14:30

0:00:07

0:00:07

0:05:35

0:05:35

0:06:53

0:06:53

0:12:00

0:12:00

0:05:27

0:05:27

0:00:30

0:00:30

0:09:04

0:09:04

0:00:11

0:00:11

0:10:08

0:10:08

0:03:34

0:03:34