filmov

tv

Estimate CAPM Beta in Excel

Показать описание

This is a supplement to the investment courses I teach.

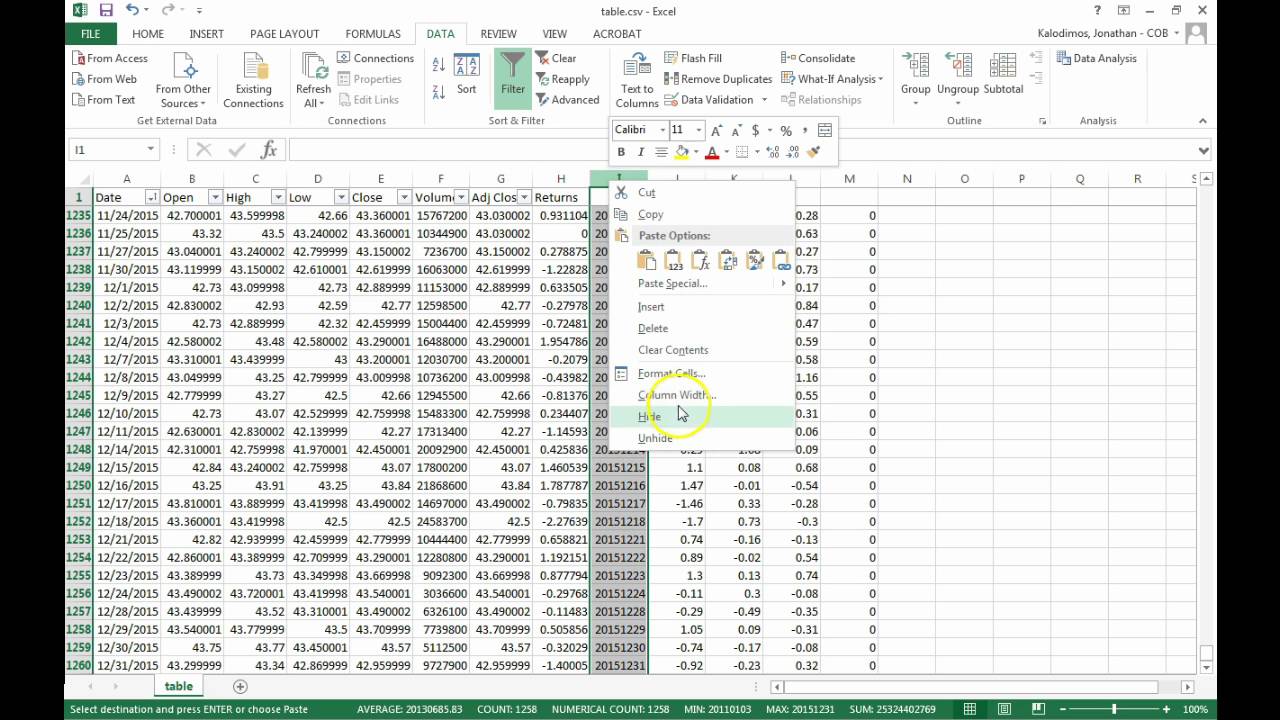

Estimate CAPM Beta in Excel

Calculate CAPM Beta in Excel

How To Calculate Beta on Excel - Linear Regression & Slope Tool

Estimate CAPM Beta in Excel

Get Data to Calculate CAPM Beta in Excel

Beta, the risk-free rate, and CAPM. Calculate the expected return of a security on Excel.

Ch 09 06 CAPM Regression in Excel

CAPM calculation (short and easy)

Estimate CAPM Beta

CAPM Beta Definition (Formula, Examples) CAPM Beta Calculation in Excel

Calculate the risk-free rate, CAPM and expected return on Excel. Assignment 3, Part-1

Microsoft Excel - Capital Asset Pricing Model (CAPM) Tutorial + Template

How to calculate beta in excel | CAPM

Calculate the Beta, the risk-free rate, CAPM, and expected return of security on Excel. Assignment 2

How to Compute CAPM Alpha and Beta

How to Estimate the Beta of a Stock in Excel

Calculating a Stock's Expected Return: Using Beta and CAPM Analysis in Excel

Estimate Fama-French 3 Factor Model in Excel

Calculating Stock Returns with Excel!

CAPM - What is the Capital Asset Pricing Model

CAPM in Excel

How to Calculate Cost of Equity through CAPM Approach in Excel Spread Sheet?

20221015 - Estimate CAPM and Excel Examples

Calculate CAPM beta for a stock

Комментарии

0:09:04

0:09:04

0:06:38

0:06:38

0:06:42

0:06:42

0:09:04

0:09:04

0:05:02

0:05:02

0:20:20

0:20:20

0:06:10

0:06:10

0:00:38

0:00:38

0:02:41

0:02:41

0:05:56

0:05:56

0:09:06

0:09:06

0:03:31

0:03:31

0:05:58

0:05:58

0:06:47

0:06:47

0:17:23

0:17:23

0:02:43

0:02:43

0:14:22

0:14:22

0:07:56

0:07:56

0:00:36

0:00:36

0:05:20

0:05:20

0:12:20

0:12:20

0:06:05

0:06:05

1:28:53

1:28:53

0:07:23

0:07:23