filmov

tv

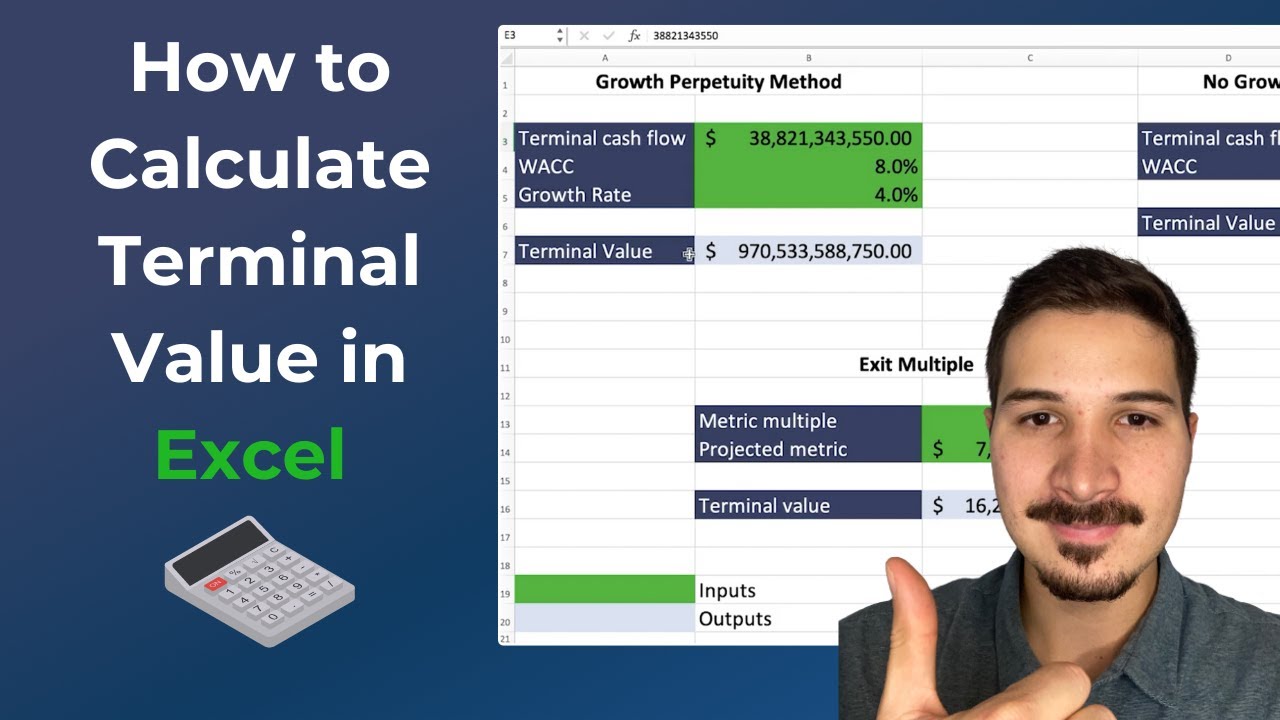

How to Calculate Terminal Value in Excel (3 Different Methods)

Показать описание

Welcome to our video tutorial on how to calculate the terminal value in Excel using three different methods. In this video, we will discuss the perpetuity growth method, exit multiple method, and no growth perpetuity method and show you how to use each one in Excel.

Terminal value is an important concept in finance that allows investors and analysts alike to project a company’s future cash flows beyond a specified period of time. While it may be difficult to accurately predict what those future cash flows will be, terminal value helps by providing an estimation of the discounted present value.

The most common methods used for calculating terminal value in Excel include the perpetuity growth method, exit multiple method, and no growth perpetuity method. We'll look at each of these methods in more detail now.

The first method we'll discuss is the perpetuity growth method. This approach uses the assumption that a company's cash flow grows at a constant rate over its lifetime. By inputting key assumptions – like discount rate, long-term growth rate, and last year’s cash flow – into an analysis tool like Excel, users can calculate the present value of all future cash flows using this equation: Terminal Value (TV) = Last Year's Cash Flow / (Discount Rate – Long-Term Growth Rate).

Next up is the exit multiple approach which is a more conservative approach than the previous one since it assumes that all future cash flows remain stable after some point in time, and then an appropriate multiple is applied as a multiplier for a given period of time. To use this formula, you need to input key assumptions such as average EBITDA multiple (or other comparable metric) and estimated EBITDA for that year. The equation looks like this: Terminal Value (TV) = Estimated EBITDA * Average EBITDA Multiple

Lastly, there’s the no-growth perpetuity model, which assumes that all future cash flows remain constant into eternity; this means that even if there are any changes or fluctuations in earnings or dividends, they are not taken into account while calculating terminal value with this approach. This model requires just two inputs: discount rate and last year's cash flow. The equation looks like this: Terminal Value (TV) = Last Year's Cash Flow / Discount Rate

📈 Free stock analysis spreadsheet templates:

🗣 Connect on social media:

#stockanalysis #financialanalysis

Terminal value is an important concept in finance that allows investors and analysts alike to project a company’s future cash flows beyond a specified period of time. While it may be difficult to accurately predict what those future cash flows will be, terminal value helps by providing an estimation of the discounted present value.

The most common methods used for calculating terminal value in Excel include the perpetuity growth method, exit multiple method, and no growth perpetuity method. We'll look at each of these methods in more detail now.

The first method we'll discuss is the perpetuity growth method. This approach uses the assumption that a company's cash flow grows at a constant rate over its lifetime. By inputting key assumptions – like discount rate, long-term growth rate, and last year’s cash flow – into an analysis tool like Excel, users can calculate the present value of all future cash flows using this equation: Terminal Value (TV) = Last Year's Cash Flow / (Discount Rate – Long-Term Growth Rate).

Next up is the exit multiple approach which is a more conservative approach than the previous one since it assumes that all future cash flows remain stable after some point in time, and then an appropriate multiple is applied as a multiplier for a given period of time. To use this formula, you need to input key assumptions such as average EBITDA multiple (or other comparable metric) and estimated EBITDA for that year. The equation looks like this: Terminal Value (TV) = Estimated EBITDA * Average EBITDA Multiple

Lastly, there’s the no-growth perpetuity model, which assumes that all future cash flows remain constant into eternity; this means that even if there are any changes or fluctuations in earnings or dividends, they are not taken into account while calculating terminal value with this approach. This model requires just two inputs: discount rate and last year's cash flow. The equation looks like this: Terminal Value (TV) = Last Year's Cash Flow / Discount Rate

📈 Free stock analysis spreadsheet templates:

🗣 Connect on social media:

#stockanalysis #financialanalysis

Комментарии

0:02:44

0:02:44

0:11:04

0:11:04

0:00:59

0:00:59

0:09:14

0:09:14

0:10:07

0:10:07

0:06:32

0:06:32

0:14:40

0:14:40

0:09:17

0:09:17

0:05:48

0:05:48

0:01:57

0:01:57

0:11:04

0:11:04

0:21:34

0:21:34

0:12:22

0:12:22

0:05:51

0:05:51

0:25:03

0:25:03

0:05:47

0:05:47

0:12:07

0:12:07

0:05:52

0:05:52

0:00:57

0:00:57

0:03:03

0:03:03

0:00:57

0:00:57

0:10:50

0:10:50

0:14:50

0:14:50

0:09:14

0:09:14