filmov

tv

Turning 65? The Medicare Part A Rule You Can't Afford to Miss! 🤔

Показать описание

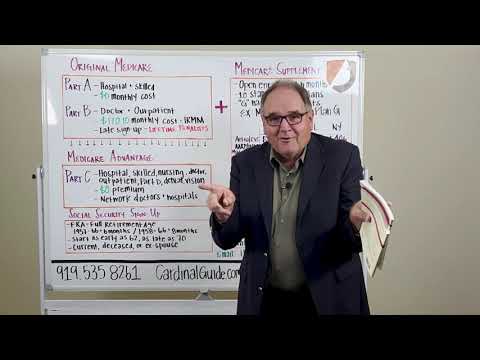

Marvin Musick from Medicare School explains the crucial but often misunderstood Medicare Part A rule many people encounter when they turn 65. He describes the eligibility criteria for premium-free Part A coverage based on work history and quarters of Medicare taxes paid.

You'll also discover the coordination of benefits between Medicare and other insurance, detailing which plan pays first based on work status and employer group size. Musick provides valuable guidance on avoiding penalties and following the proper Part A enrollment process.

Table of Contents:

00:01 Introduction

00:38 Eligibility of Part A

03:29 Enrollment Rules for Part A

09:08 Coordination of Benefits

#medicare #medicareschool #marvinmusick #medicaresupplement

You'll also discover the coordination of benefits between Medicare and other insurance, detailing which plan pays first based on work status and employer group size. Musick provides valuable guidance on avoiding penalties and following the proper Part A enrollment process.

Table of Contents:

00:01 Introduction

00:38 Eligibility of Part A

03:29 Enrollment Rules for Part A

09:08 Coordination of Benefits

#medicare #medicareschool #marvinmusick #medicaresupplement

Turning 65? The Medicare Part A Rule You Can't Afford to Miss! 🤔

Medicare Initial Enrollment Period - Sign Up for Medicare at Age 65

Medicare / Turning 65 - What to Do?

Turning 65? What You Need to Know About Medicare Enrollment

Working past 65? Avoid these HUGE Medicare mistakes.

Medicare: Why you need to sign up when you're 65, even if you're still working

Is Medicare Free At Age 65?

8 Reasons to DELAY Medicare Past 65 That Will Save You Thousands and Avoid ALL Penalties

HMSA can help answer common questions for those approaching age 65 and exploring their health pla...

Turning 65 - What you need to know about enrolling in Medicare

Is Medicare Mandatory at Age 65?

Turning 65: How to Prepare as You Approach Medicare

Turning 65 Medicare Checklist

Enroll in Medicare Part B Online (After Age 65)

Turning 65: How To Make The Right Medicare Insurance Choices

Get Started with Medicare: Your Initial Enrollment Period

Turning 65? Medicare Rules You Do NOT Want To Miss 🤯

Turning 65 and Still Working- Avoid Medicare Mistakes!

Turning 65 and Medicare | Medicare Basics and Plan Choices

3 Mistakes Veterans Make With Medicare

Turning 65 and enrolling in Medicare? Medicare Signup + Social Security Explained

New To Medicare: I’m Turning 65

Medicare Lessons for people Turning 65

Do I Automatically Get Medicare When I Turn 65?

Комментарии

0:12:24

0:12:24

0:07:19

0:07:19

0:12:24

0:12:24

0:06:12

0:06:12

0:13:38

0:13:38

0:02:28

0:02:28

0:03:39

0:03:39

0:15:37

0:15:37

0:03:39

0:03:39

0:05:18

0:05:18

0:07:25

0:07:25

0:08:19

0:08:19

0:01:22

0:01:22

0:07:58

0:07:58

0:10:52

0:10:52

0:03:00

0:03:00

0:21:51

0:21:51

0:02:55

0:02:55

0:06:36

0:06:36

0:09:12

0:09:12

0:32:19

0:32:19

0:00:16

0:00:16

0:10:01

0:10:01

0:03:48

0:03:48