filmov

tv

The Key Risk for Bond Investors Right Now

Показать описание

Sonal Desai, Chief Investment Officer of Franklin Templeton Fixed Income, offers her perspective on the market for US Treasuries, as well as corporate and municipal bonds heading into the second half of 2024.

Get more on the Bloomberg Surveillance Podcast:

--------

Watch Bloomberg Radio LIVE on YouTube

Weekdays 7am-6pm ET

Subscribe to our Podcasts:

Listen on Apple CarPlay and Android Auto with the Bloomberg Business app:

Visit our YouTube channels:

Get more on the Bloomberg Surveillance Podcast:

--------

Watch Bloomberg Radio LIVE on YouTube

Weekdays 7am-6pm ET

Subscribe to our Podcasts:

Listen on Apple CarPlay and Android Auto with the Bloomberg Business app:

Visit our YouTube channels:

The Key Risk for Bond Investors Right Now

The Key Risk for Bond Investors Right Now

Financial Education | Key Risks in Bond Investment

Why Bond Yields Are a Key Economic Barometer | WSJ

Macro Minute -- Bond Prices and Interest Rates

What happens to my bond when interest rates rise? | Financial Fundamentals

Bond Duration and Bond Convexity Explained

Bond Valuation: Interest Rate Risk, Price Risk and Reinvestment Risk

How to Invest in 2024: 9 Best Short-Term Investments for August 2024

Key risk for Asian bond investors in 2018

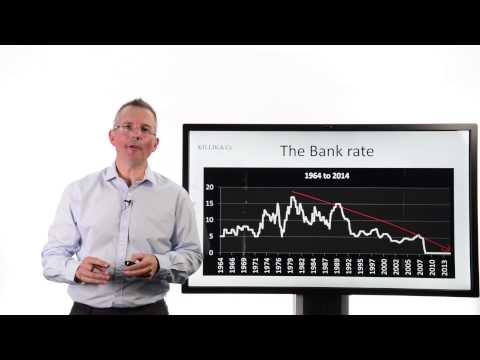

Killik Explains: Duration - The word every bond investor should understand

Bond Investing For Beginners 2023 | Complete Guide

Analysis of Investment - Risk Associated With Bond

Video 12.1 - Bond Risks part 1: Interest Rate Risk

Basic Analysis of Risk and Return of a Bond

CATHIE WOOD: How Bond Market Works

Bond Valuation - A Quick Review

Risks in bond investing

The Bond Market Is Calling BS #shorts

Calculate Bond Convexity and Duration in Excel | Interest Rate Risk

Callable Bond Explained - Definition, Benefits & Risks

Bond Risk Measures - Duration and PV01

Part 5 – Key Risks – Astrea 7 Management Presentation

Understanding credit spread duration and its impact on bond prices

Комментарии

0:02:27

0:02:27

0:02:27

0:02:27

0:04:45

0:04:45

0:05:17

0:05:17

0:02:48

0:02:48

0:03:07

0:03:07

0:09:18

0:09:18

0:13:16

0:13:16

0:13:21

0:13:21

0:01:14

0:01:14

0:10:17

0:10:17

0:54:28

0:54:28

0:03:25

0:03:25

0:09:50

0:09:50

0:05:46

0:05:46

0:00:32

0:00:32

0:11:08

0:11:08

0:04:58

0:04:58

0:00:56

0:00:56

0:11:03

0:11:03

0:04:44

0:04:44

0:16:37

0:16:37

0:03:41

0:03:41

0:04:02

0:04:02