filmov

tv

How to Calculate the Right-of-use Asset

Показать описание

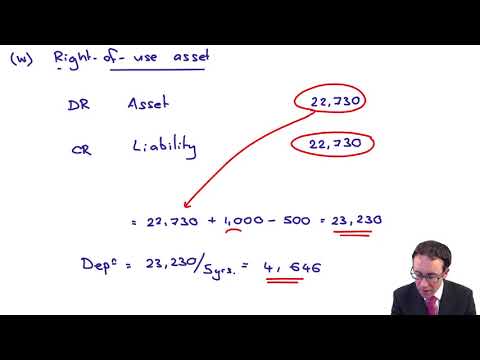

When the lessee capitalizes a lease, it doesn’t just record a liability; it also records a right-of-use asset. At the commencement of the lease, the right-of-use asset is calculated as follows:

Initial measurement of lease liability + lease prepayments + initial direct costs + costs to dismantle/remove the asset or restore the site - lease incentives received from the lessor = right-of-use asset

The right-of-use asset is then recorded on the lessee's statement of financial position and depreciated over the lease term.

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education accessible to all people.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Initial measurement of lease liability + lease prepayments + initial direct costs + costs to dismantle/remove the asset or restore the site - lease incentives received from the lessor = right-of-use asset

The right-of-use asset is then recorded on the lessee's statement of financial position and depreciated over the lease term.

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education accessible to all people.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

0:11:40

0:11:40

0:04:57

0:04:57

0:08:06

0:08:06

0:04:08

0:04:08

0:22:41

0:22:41

0:08:01

0:08:01

0:21:32

0:21:32

0:07:33

0:07:33

0:12:07

0:12:07

0:16:27

0:16:27

0:13:51

0:13:51

0:08:50

0:08:50

0:00:20

0:00:20

0:00:23

0:00:23

0:09:19

0:09:19

0:09:27

0:09:27

0:00:30

0:00:30

0:10:13

0:10:13

0:16:33

0:16:33

0:05:39

0:05:39

0:00:56

0:00:56

0:32:02

0:32:02

0:00:37

0:00:37

0:09:10

0:09:10