filmov

tv

Two Variable Data Table - How to do Two dimensional Data Sensitivity in excel?

Показать описание

"Two-Variable Data Table Sensitivity Analysis (Valuation)

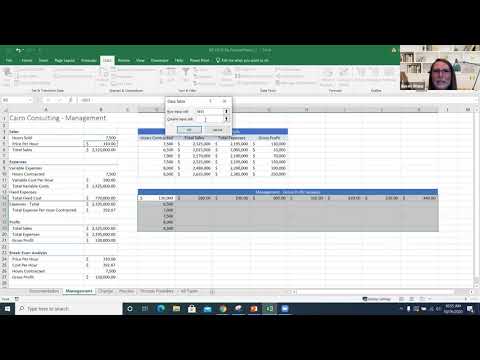

In this video, we look at two-variable data table or two-dimensional data table for sensitivity analysis in excel.

Two variable data table is where we can see the senstivity analysis in excel with changes in two variables and its corresponding impact on the output variable.

Two variable data table example

-------------------------------------------------------

Here we take an example of Alibaba Discounted Cash Flow sensitivity analysis. In DCF approach, we find the price of the stock using Free Cash Flow to firm approach where we require WACC (weighted average cost of capital) and Growth Rate (g) as the two variables.

By using the base case assumption of WACC and g, we get the fair price of the stock.

However, we can change the assumptions of WACC as well as g and find the effect on stock price using two variable Data Table.

Two variable data table in sensitivity analysis is the most useful function. It provides the effect of changing two variables at one time. Such a data table is extremely useful for Financial Analysts and their clients.

Connect with us!

In this video, we look at two-variable data table or two-dimensional data table for sensitivity analysis in excel.

Two variable data table is where we can see the senstivity analysis in excel with changes in two variables and its corresponding impact on the output variable.

Two variable data table example

-------------------------------------------------------

Here we take an example of Alibaba Discounted Cash Flow sensitivity analysis. In DCF approach, we find the price of the stock using Free Cash Flow to firm approach where we require WACC (weighted average cost of capital) and Growth Rate (g) as the two variables.

By using the base case assumption of WACC and g, we get the fair price of the stock.

However, we can change the assumptions of WACC as well as g and find the effect on stock price using two variable Data Table.

Two variable data table in sensitivity analysis is the most useful function. It provides the effect of changing two variables at one time. Such a data table is extremely useful for Financial Analysts and their clients.

Connect with us!

Комментарии

0:04:04

0:04:04

0:04:03

0:04:03

0:05:20

0:05:20

0:07:24

0:07:24

0:13:28

0:13:28

0:04:36

0:04:36

0:08:42

0:08:42

0:04:41

0:04:41

0:58:35

0:58:35

0:02:47

0:02:47

0:02:11

0:02:11

0:08:01

0:08:01

0:05:08

0:05:08

0:04:24

0:04:24

0:12:14

0:12:14

0:05:55

0:05:55

0:05:00

0:05:00

0:12:14

0:12:14

0:03:24

0:03:24

0:05:56

0:05:56

0:06:36

0:06:36

0:12:25

0:12:25

0:03:52

0:03:52

0:05:36

0:05:36