filmov

tv

Security Market Line

Показать описание

The Security Market Line

Explaining the Capital Asset Pricing Model (CAPM) & Security Market Line (SML)

Capital Market Line (CML) vs Security Market Line (SML)

Security Market Line

Security Market Line (SML)

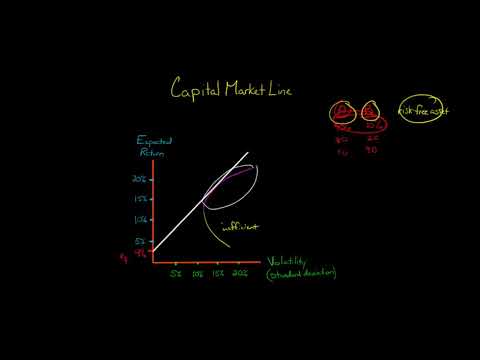

The Capital Market Line

The Security Market Line

Security Market Line - CAPM

26 january security guards pred #shortsfeed #shorts #securityguard #shortvideo #26january #shor

SECURITY MARKET LINE GRAPH IN EXCEL

Security market line / Fundamentals of investments / Episode 9

CAPM: cosa è e come si calcola la SML - Security Market Line di Sharpe. Esempio con excel

Risk, Return, and the Security Market Line

Security Market Line (SML) | Formula | Examples

CFA Level 1 - Portfolio Management - Risk and Return - Security Market Line

Security Market Line (SML)

SECURITY MARKET LINE | Dr Abhishek Maheshwari

Security Market Line | Explained in Detail With Graph & Equation | For BBA/MBA/B.Com/M.Com

Security Market Line

Excel SML (new)

Security Market Line - CFA Level1 practice question

Security Market Line & Capital Market Line | CA Final SFM (New Syllabus) Classes & Video Lec...

Security Market Line - Super Stocks Market Concepts

Security Market Line SML

Комментарии

0:03:44

0:03:44

0:08:01

0:08:01

0:11:33

0:11:33

0:09:35

0:09:35

0:10:25

0:10:25

0:05:45

0:05:45

0:08:03

0:08:03

0:06:10

0:06:10

0:00:41

0:00:41

0:02:04

0:02:04

0:11:32

0:11:32

0:08:28

0:08:28

0:51:50

0:51:50

0:10:30

0:10:30

0:07:13

0:07:13

0:05:21

0:05:21

0:09:35

0:09:35

0:06:15

0:06:15

0:04:40

0:04:40

0:03:48

0:03:48

0:03:43

0:03:43

0:14:51

0:14:51

0:00:11

0:00:11

0:04:45

0:04:45