filmov

tv

What does it mean to add an additional insured to my policy? | Front Row Insurance Brokers, Inc.

Показать описание

Let’s talk about what adding an additional insured means.

To start: we need to make a distinction between additional insureds and the named insured. If this is your policy, then you are the named insured. Being the named insured on a policy confers certain rights and obligations; for instance, you have the right to modify aspects of the policy, like the limits, coverages, or mailing address. It’s also your responsibility as the named insured to provide the insurance company with accurate information about the risks they are taking on, and to pay the policy premiums.

Normally, only a named insured is covered under an insurance policy. If someone else suffers a loss, they cannot claim that loss through your policy. An additional insured, then, is someone or something that is also, or additionally, covered by your insurance policy. It extends your coverage to these additional insureds for losses that they sustain, but only insofar as those losses relate to your activities.

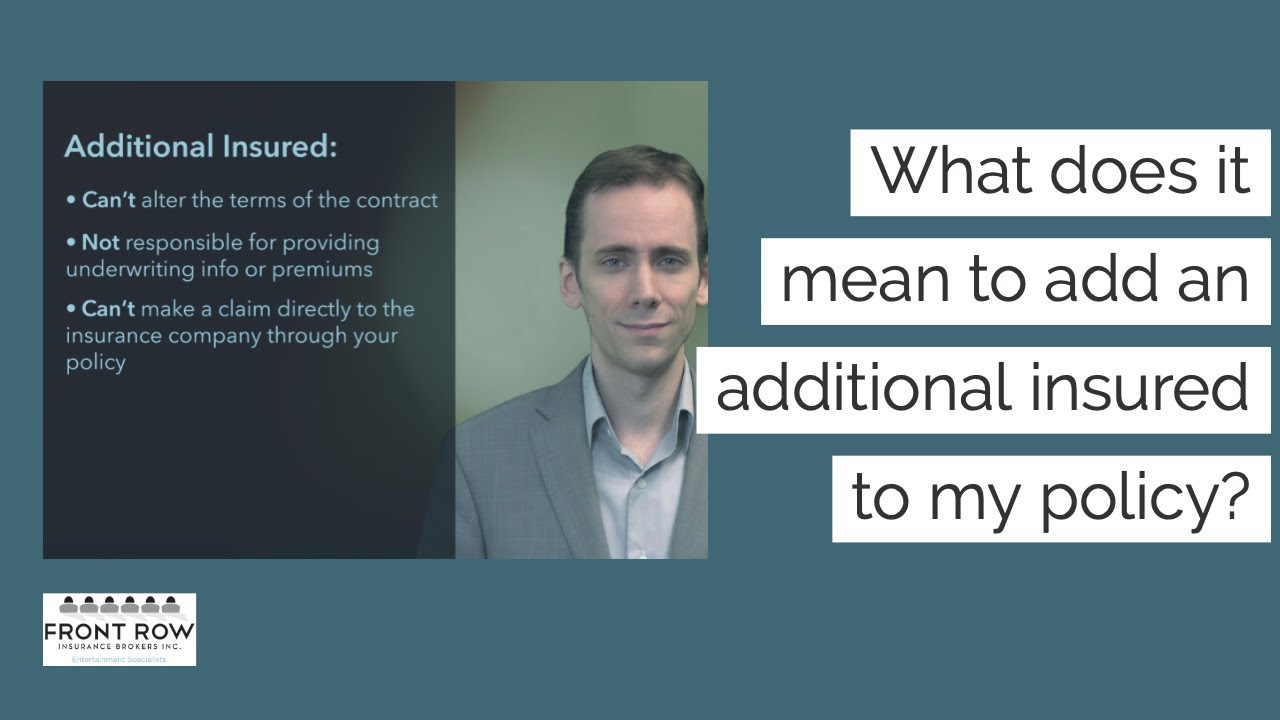

Additional insureds do not have the same rights and responsibilities as a named insured. They can’t alter the terms of the contract, and they’re not responsible for providing underwriting information or paying premiums. Importantly: they also can’t make a claim directly to the insurance company through your policy. You still need to submit the claim on their behalf. Otherwise, they are afforded all the same coverages under your policy as you are.

Let’s look at a few examples to see how this works in practice. Say you rent out a venue for your wedding, and your guests damage the venue. Maybe they accidentally break a beautiful stained glass window. You don’t own the window, so it’s not property that you could have covered through your own insurance. You don’t have what’s called an “insurable interest” in the window. The loss is sustained by the venue, and it would have to be covered under the venue owner’s insurance.

Now, you could offer to pay for the damages out of the goodness of your heart; but what if the repairs cost hundreds of thousands? Are you really going to feel that charitable? And why should the venue take the risk of relying on your goodwill? If you’re not willing to pay for the damages, the venue owners could try to sue you or your guests to recover their losses, but that could be costly, and the outcome might still be uncertain.

A much more simple and straightforward solution is for the venue to ask for a certificate of insurance that will protect their property from damages that you and your guests may cause. In that case, if your guests accidently break a window, all you would need to do is make a claim on your policy and have the insurance company pay the venue directly for the replacement of the window, because now the venue would additionally be insured under your policy.

---

Disclaimer: Informational statements regarding insurance coverage are for general description purposes only. This video does not make any representations that coverage does or does not exist for any particular claim or loss, or type of claim or loss, under any policy. Whether coverage exists or does not exist for any particular claim or loss under any policy depends on the facts and circumstances involved in the claim or loss and all applicable policy wording.

To start: we need to make a distinction between additional insureds and the named insured. If this is your policy, then you are the named insured. Being the named insured on a policy confers certain rights and obligations; for instance, you have the right to modify aspects of the policy, like the limits, coverages, or mailing address. It’s also your responsibility as the named insured to provide the insurance company with accurate information about the risks they are taking on, and to pay the policy premiums.

Normally, only a named insured is covered under an insurance policy. If someone else suffers a loss, they cannot claim that loss through your policy. An additional insured, then, is someone or something that is also, or additionally, covered by your insurance policy. It extends your coverage to these additional insureds for losses that they sustain, but only insofar as those losses relate to your activities.

Additional insureds do not have the same rights and responsibilities as a named insured. They can’t alter the terms of the contract, and they’re not responsible for providing underwriting information or paying premiums. Importantly: they also can’t make a claim directly to the insurance company through your policy. You still need to submit the claim on their behalf. Otherwise, they are afforded all the same coverages under your policy as you are.

Let’s look at a few examples to see how this works in practice. Say you rent out a venue for your wedding, and your guests damage the venue. Maybe they accidentally break a beautiful stained glass window. You don’t own the window, so it’s not property that you could have covered through your own insurance. You don’t have what’s called an “insurable interest” in the window. The loss is sustained by the venue, and it would have to be covered under the venue owner’s insurance.

Now, you could offer to pay for the damages out of the goodness of your heart; but what if the repairs cost hundreds of thousands? Are you really going to feel that charitable? And why should the venue take the risk of relying on your goodwill? If you’re not willing to pay for the damages, the venue owners could try to sue you or your guests to recover their losses, but that could be costly, and the outcome might still be uncertain.

A much more simple and straightforward solution is for the venue to ask for a certificate of insurance that will protect their property from damages that you and your guests may cause. In that case, if your guests accidently break a window, all you would need to do is make a claim on your policy and have the insurance company pay the venue directly for the replacement of the window, because now the venue would additionally be insured under your policy.

---

Disclaimer: Informational statements regarding insurance coverage are for general description purposes only. This video does not make any representations that coverage does or does not exist for any particular claim or loss, or type of claim or loss, under any policy. Whether coverage exists or does not exist for any particular claim or loss under any policy depends on the facts and circumstances involved in the claim or loss and all applicable policy wording.

Комментарии

0:04:00

0:04:00

0:03:51

0:03:51

0:00:26

0:00:26

0:00:17

0:00:17

0:00:05

0:00:05

0:00:22

0:00:22

0:01:26

0:01:26

0:03:30

0:03:30

0:00:17

0:00:17

0:00:28

0:00:28

0:00:49

0:00:49

0:03:44

0:03:44

0:00:36

0:00:36

0:00:15

0:00:15

0:16:34

0:16:34

0:12:08

0:12:08

0:00:18

0:00:18

0:00:06

0:00:06

0:01:00

0:01:00

0:07:35

0:07:35

0:02:17

0:02:17

0:00:39

0:00:39

0:00:31

0:00:31

0:04:10

0:04:10