filmov

tv

Credit Card Statement Balance vs. Current Balance

Показать описание

What's the difference between the Statement Balance and Current Balance on credit credits.

(click "show more" to see ad disclosure)

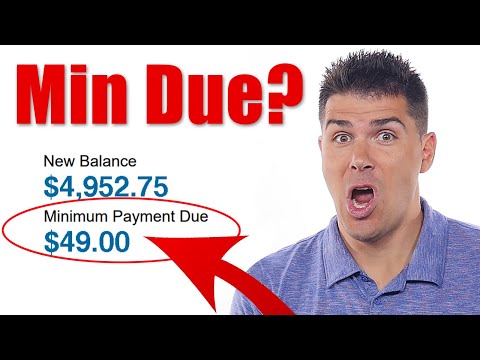

The statement balance on your credit card is simply the accumulation of everything that occurred during the billing cycle (spending, returns, payments and interest). You'll have about 25 days to pay at least the minimum payment before the final due date. The Current Balance or Total Balance is everything that's accrued since the statement balance was issued. Hopefully this video helps you understand both credit card balances a little easier.

---------------

Robinhood Free Stock (Up to $200) with Sign Up:

Webull Up to 12 Free Fracional Shares (Each $3-$3,000):

M1 Finance (perfect for IRA's):

Instagram:

Advertiser Disclosure: Honest Finance participates in affiliate sales networks and may receive compensation by clicking through the links (at no cost to you). This compensation may impact how and where links appear in this description. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. This channel does not include all financial companies or all available financial offers.

---------------

Honest Finance covers a broad range of financial topics that'll give your life and finances more value. Subscribe today for future content and be sure to give this video a like!

Disclaimer: I am not a financial advisor. These videos are for education/entertainment purposes only. Investing of any kind involves risk, so please conduct your own research.

#honestfinance #creditcards

(click "show more" to see ad disclosure)

The statement balance on your credit card is simply the accumulation of everything that occurred during the billing cycle (spending, returns, payments and interest). You'll have about 25 days to pay at least the minimum payment before the final due date. The Current Balance or Total Balance is everything that's accrued since the statement balance was issued. Hopefully this video helps you understand both credit card balances a little easier.

---------------

Robinhood Free Stock (Up to $200) with Sign Up:

Webull Up to 12 Free Fracional Shares (Each $3-$3,000):

M1 Finance (perfect for IRA's):

Instagram:

Advertiser Disclosure: Honest Finance participates in affiliate sales networks and may receive compensation by clicking through the links (at no cost to you). This compensation may impact how and where links appear in this description. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. This channel does not include all financial companies or all available financial offers.

---------------

Honest Finance covers a broad range of financial topics that'll give your life and finances more value. Subscribe today for future content and be sure to give this video a like!

Disclaimer: I am not a financial advisor. These videos are for education/entertainment purposes only. Investing of any kind involves risk, so please conduct your own research.

#honestfinance #creditcards

Комментарии

0:03:57

0:03:57

0:04:28

0:04:28

0:02:34

0:02:34

0:00:48

0:00:48

0:10:34

0:10:34

0:00:58

0:00:58

0:07:51

0:07:51

0:02:26

0:02:26

0:02:38

0:02:38

0:02:41

0:02:41

0:00:48

0:00:48

0:08:45

0:08:45

0:03:33

0:03:33

0:00:51

0:00:51

0:08:04

0:08:04

0:14:44

0:14:44

0:02:01

0:02:01

0:05:49

0:05:49

0:05:28

0:05:28

0:15:28

0:15:28

0:02:11

0:02:11

0:10:15

0:10:15

0:14:21

0:14:21

0:03:05

0:03:05