filmov

tv

2023 Income Tax Changes For Individuals

Показать описание

New Tax Laws For 2023 Explained! VERY DETAILED AND EASY TO FOLLOW....

Video Outline and Time Stamps so you can quickly jump to any topic:

• 1099K filing update - 0:55

• The 2023 Federal Income Tax Bracket Rates - 2:35

• 2023 capital gain rates for stocks and dividends - 3:35

• Changes to the 2023 standard deduction - 4:28

• Child tax credit rules for 2023- 6:08

•

• 2023 Education Credits and Student loan interest- 8:23

• 2023 401(K) Contribution Limits IRA Contribution Limits- 7:59

• 2023 Social Security Cost of living adjustment 10:12

• 2023 Gift tax exclusion 11:08

• Health Insurance requirement - 12:08

• 2023 Standard Mileage rate (Pending): 13:00

• 2023 QBI (199A Deduction) 13:22

Other related videos:

Video Outline and Time Stamps so you can quickly jump to any topic:

• 1099K filing update - 0:55

• The 2023 Federal Income Tax Bracket Rates - 2:35

• 2023 capital gain rates for stocks and dividends - 3:35

• Changes to the 2023 standard deduction - 4:28

• Child tax credit rules for 2023- 6:08

•

• 2023 Education Credits and Student loan interest- 8:23

• 2023 401(K) Contribution Limits IRA Contribution Limits- 7:59

• 2023 Social Security Cost of living adjustment 10:12

• 2023 Gift tax exclusion 11:08

• Health Insurance requirement - 12:08

• 2023 Standard Mileage rate (Pending): 13:00

• 2023 QBI (199A Deduction) 13:22

Other related videos:

2023 Income Tax Changes For Individuals

IRS raises income threshold and standard deduction for all tax brackets

10 New Income Tax Rules Applicable from 1st April 2023 | Tax Changes Ammendment For FY 2023-24

Important TAX CHANGES in CANADA for 2023 // TFSA, RRSP, CPP & FHSA // Canadian Tax Guide Chapter...

9 HUGE Tax Write Offs for Individuals (EVERYONE can use these)

Budget 2023 Income Tax Changes | Budget 2023 Tax Changes Come Into Effect | Budget 2023 Tax Relief

2023 Tax Changes and Updates - Individual Income Tax

New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator]

New Income Tax Changes in Budget 2023, New Changes in Direct Tax 2023, Personal income tax 2023

How to Avoid Taxes Legally in The US (Do This Now!)

Canada Income Tax Rates Changed in 2023

7 big income tax rule changes from 1 April 2023 for taxpayers | Mint Primer | Mint

Georgia's new income tax law explained

California's Shocking New Income Redistribution Scheme Exposed

The ATO has changed how you can claim tax deductions | The Business | ABC News

7 Important changes from 1st April 2023 | New Income Tax Changes in Budget 2023

UK Income Tax Explained (UK Tax Bands & Calculating Tax)

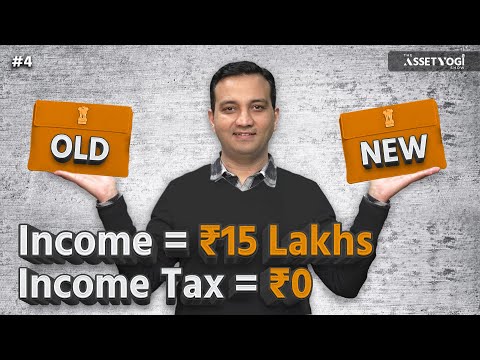

Old vs New Regime | Which is better? Tax Saving Options | Income Tax Planning Guide 2024

INCOME TAX NEW SLAB # F.YR 2023-24 # Rs.7,00,000/-= Tax ZERO # NEW TAX REGIME 115BAC OLD TAX REGIME

Income Tax Audit due date extended | Good News 🥳

2024 Income Tax Saving and Tax Planning Guide | New vs Old Regime | Assetyogi Show #4

Tax Basics For Beginners (Taxes 101)

Income Tax on Income from Salary | Salary increase in budget 2023-24 Pakistan | Tax on Salary 2023

WHY ARE TAXES SO HIGH IN INDIA? | Unfair Tax Laws of India | Abhi and Niyu

Комментарии

0:15:58

0:15:58

0:02:10

0:02:10

0:06:12

0:06:12

0:14:39

0:14:39

0:17:22

0:17:22

0:04:53

0:04:53

0:16:53

0:16:53

0:13:35

0:13:35

0:25:34

0:25:34

0:10:41

0:10:41

0:03:21

0:03:21

0:03:15

0:03:15

0:00:29

0:00:29

0:02:53

0:02:53

0:04:41

0:04:41

0:05:53

0:05:53

0:09:54

0:09:54

0:12:38

0:12:38

0:10:40

0:10:40

0:01:40

0:01:40

0:22:57

0:22:57

0:18:05

0:18:05

0:02:56

0:02:56

0:16:28

0:16:28