filmov

tv

How to fit a GARCH(1, 1) Model in MATLAB

Показать описание

This video demonstrates the procedure of fitting a GARCH(1, 1) model to S&P 500 returns in MATLAB. The video assumes that the watcher already has a basic understanding of GARCH models as well as background knowledge of several statistical tests including Jarque-Bera and Ljung-Box.

How to fit a GARCH(1, 1) Model in MATLAB

GARCH Model : Time Series Talk

Fitting an ARCH or GARCH Model in Stata

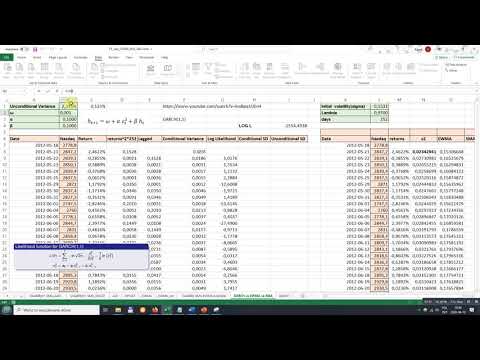

GARCH model - volatility persistence in time series (Excel)

GARCH(1,1) in MS Excel

(EViews10): How to Estimate Standard GARCH Models #garch #arch #volatility #clustering #archlm

Lecture 15 5 garch fit

An Introduction to GARCH Models

GARCH Volatility Model

R : Forecasting volatility using GARCH(1,1)

Running your first Arima/Garch Model

G#1 Introduction to ARCH/GARCH model

GARCH 1 1 Student's t (Part 8)

Coding the GARCH Model : Time Series Talk

Video 10 Estimating and interpreting a GARCH (1,1) model on Eviews

GARCH model - Eviews

GARCH(1,1) model and plot volatality and standard residuals and squared standard residuals using R

I GARCH 1 1 Normal and Student's t (Part 14)

GARCH Model

GARCH A First (and Closer) Look (FRM Part 1, Book 4, Valuation and Risk Models)

Stock Forecasting with GARCH : Stock Trading Basics

GARCH 1 1 (Part 7)

Fitting ARCH(p) and GARCH(p,q) Models to Time Series Data

TSA Lecture 24: The GARCH Process

Комментарии

0:15:00

0:15:00

0:10:25

0:10:25

0:06:07

0:06:07

0:22:22

0:22:22

0:12:29

0:12:29

0:14:25

0:14:25

0:10:37

0:10:37

0:09:57

0:09:57

0:06:32

0:06:32

0:01:12

0:01:12

0:07:17

0:07:17

0:18:37

0:18:37

0:10:43

0:10:43

0:10:08

0:10:08

0:09:27

0:09:27

0:21:30

0:21:30

0:08:03

0:08:03

0:14:35

0:14:35

0:22:16

0:22:16

0:21:30

0:21:30

0:07:26

0:07:26

0:13:18

0:13:18

0:08:18

0:08:18

1:17:06

1:17:06