filmov

tv

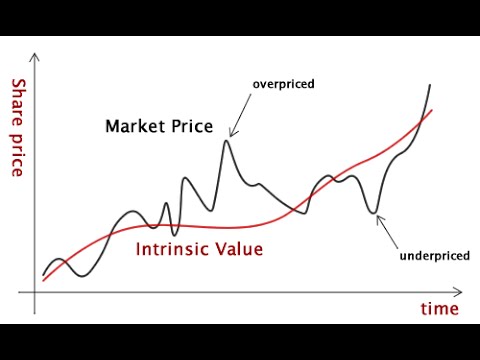

intrinsic value and time value of options | time value in options trading | being trader | in hindi

Показать описание

Org code is (aeqkx)

Hi everyone our intention is to show you practical stock market and provide some knowledge.

In this channel we are giving you about chart reading data reading how to understand the market in simple way stock market for beginner how to use technical tools how to use all about option what is ce pe call put explain what is option greeks strike price what is option trading options trading for beginners expiry day and some option strategy covers call strategy call selling strategy expiry day strategy butterfly strategy iron condor ratio spread what is positional option trading option selling strategy weekly expiry strategy monthly expiry bank nifty option trading nifty option trading fin nifty option trading and all about option trading option hedging option selling hedging hedging strategy hedging for trading FOR EDUCATIONAL PURPOSE ONLY.

#beingtrader #option #optionselling #stockmarket

DISCLAIMER - WE ARE NOT SEBI REGISTERED all these videos uploaded on this channel is only for practical knowledge and educational purpose.

We never give any direct / indirect any advice / suggestions on any investment or trade.{ if anyone is giving you any kind of financial advice in our name then beware they are fake people don’t take any advice / recommendations on our name we never do this } plz consult your financial advisor before make any financial decisions.

* Equity: Investments in securities market are subject to market risks, read all the related documents carefully before investing. Please read the SEBI prescribed Combined Risk Disclosure Document prior to investing.

Risk Disclosures on Derivatives

* 9 out of 10 individual traders in Equity, Futures & Options segment incurred net losses.

* On an average, loss makers registered net trading loss close to ₹ 50,000.

* Over and above the net trading losses incurred, loss makers expended an additional 28% of net trading losses at transaction costs.

* Those making net trading profits, incurred between 15% to 50% of such profits as transaction cost.

For more information:

SEBI study dated January 25, 2023, on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options (F&O) Segment”, wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity F&O during FY 2021-22.

Комментарии

0:06:30

0:06:30

0:00:56

0:00:56

0:06:12

0:06:12

0:03:36

0:03:36

0:00:59

0:00:59

0:08:31

0:08:31

0:05:47

0:05:47

0:08:40

0:08:40

0:05:47

0:05:47

0:12:07

0:12:07

0:24:15

0:24:15

0:07:02

0:07:02

0:00:57

0:00:57

0:17:08

0:17:08

0:10:04

0:10:04

0:09:59

0:09:59

0:06:41

0:06:41

0:01:46

0:01:46

0:11:20

0:11:20

0:14:00

0:14:00

0:15:28

0:15:28

0:07:31

0:07:31

0:23:04

0:23:04

0:33:39

0:33:39