filmov

tv

Intrinsic Value and Extrinsic Value | Options Trading For Beginners

Показать описание

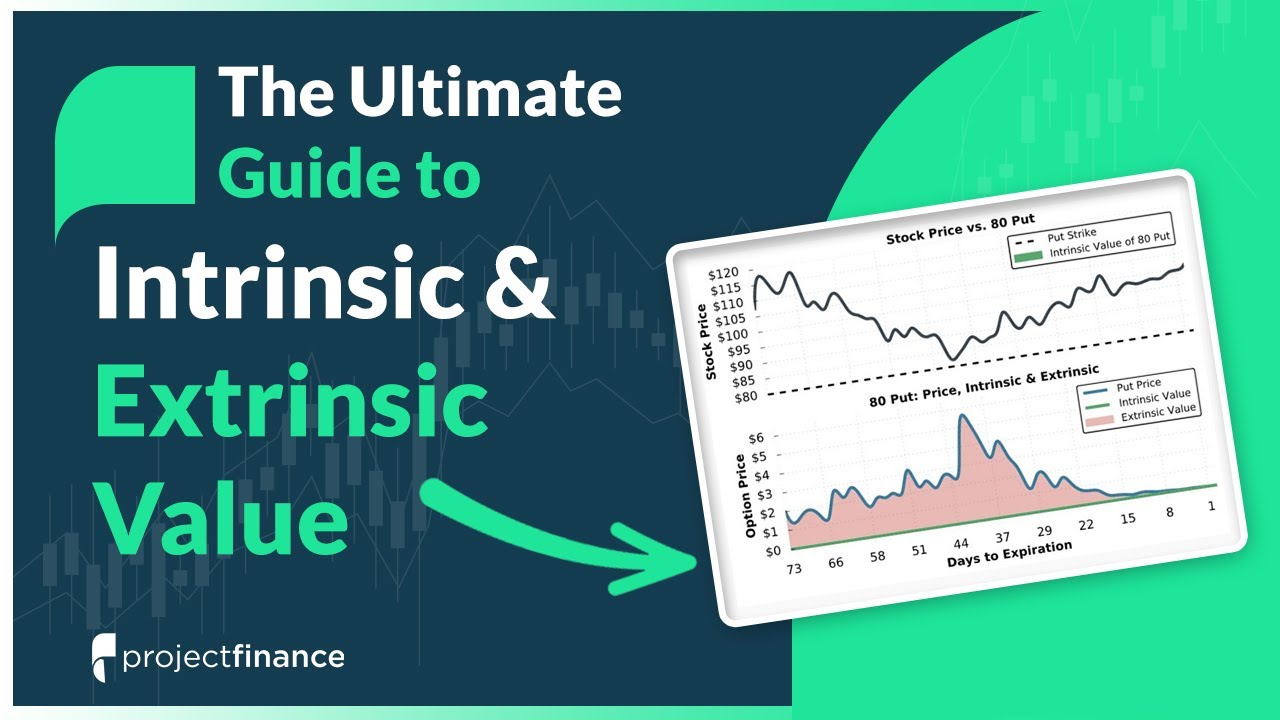

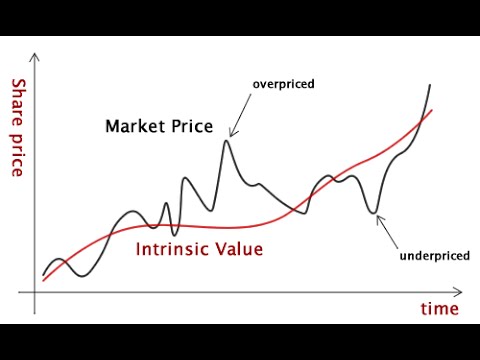

Every option's price consists of the sum of its intrinsic value and extrinsic value.

A call's intrinsic value is the difference between the stock price and the call's strike price (when the call is in-the-money). A put's intrinsic value is the difference between the put's strike price and the stock price (when the put is in-the-money).

An option's extrinsic value is any value in the option's price that exceeds its intrinsic value. Extrinsic value is sometimes referred to as "time value," and can be conceptualized as the value associated with the potential for that option to become valuable before expiration.

Additionally, we've included four visualizations of real call and put examples to demonstrate how intrinsic and extrinsic value change relative to shifts in the stock price.

Lastly, we discuss the factors that determine how much extrinsic value an option has.

Intrinsic Value and Extrinsic Value | Options Trading For Beginners

INTRINSIC VALUE vs EXTRINSIC VALUE (What Are They & Why Are They Important For Options Traders)

Intrinsic Or Extrinsic Value?

Options Basics: Intrinsic vs. Extrinsic Value of Option Contracts

What are Options Intrinsic and Extrinsic Values?

Trading Options Like A Pro - Lesson 6 Intrinsic vs Extrinsic Value

Profit and Loss Diagrams: Intrinsic vs. Extrinsic Value

Understanding Options Pricing | Fidelity Investments

Option Pricing Explained | Intrinsic Value And Extrinsic Value

Price Of Call Option - Intrinsic Value and Extrinsic Value Explained - With Examples

Intrinsic Value Of Options | What Is It And How To Calculate | Simple Option Trading

What Is an Option's Extrinsic Value

The Hidden Value of Extrinsic Value

Extrinsic Value Explained: Options Trading for Beginners

Good: Intrinsic vs. Instrumental

Difference Between Intrinsic Value And Extrinsic Value?

Intrinsic and extrinsic value

OPTIONS | EP. 8: Intrinsic & Extrinsic Value

Intrinsic & Extrinsic Value Explained (What Robinhood Doesn't Tell You)

EXTRINSIC VALUE AND INTRINSIC VALUE

What is Intrinsic Value?

Intrinsic and extrinsic value

What is Intrinsic Value?

Intrinsic Value Explained: What is it & How to Calculate it

Комментарии

0:17:08

0:17:08

0:11:15

0:11:15

0:02:16

0:02:16

0:06:09

0:06:09

0:05:36

0:05:36

0:02:49

0:02:49

0:08:44

0:08:44

0:06:59

0:06:59

0:13:07

0:13:07

0:06:46

0:06:46

0:05:47

0:05:47

0:04:25

0:04:25

0:10:01

0:10:01

0:11:56

0:11:56

0:02:14

0:02:14

0:00:19

0:00:19

0:01:42

0:01:42

0:20:02

0:20:02

0:16:19

0:16:19

0:05:44

0:05:44

0:01:46

0:01:46

0:07:06

0:07:06

0:00:24

0:00:24

0:09:59

0:09:59