filmov

tv

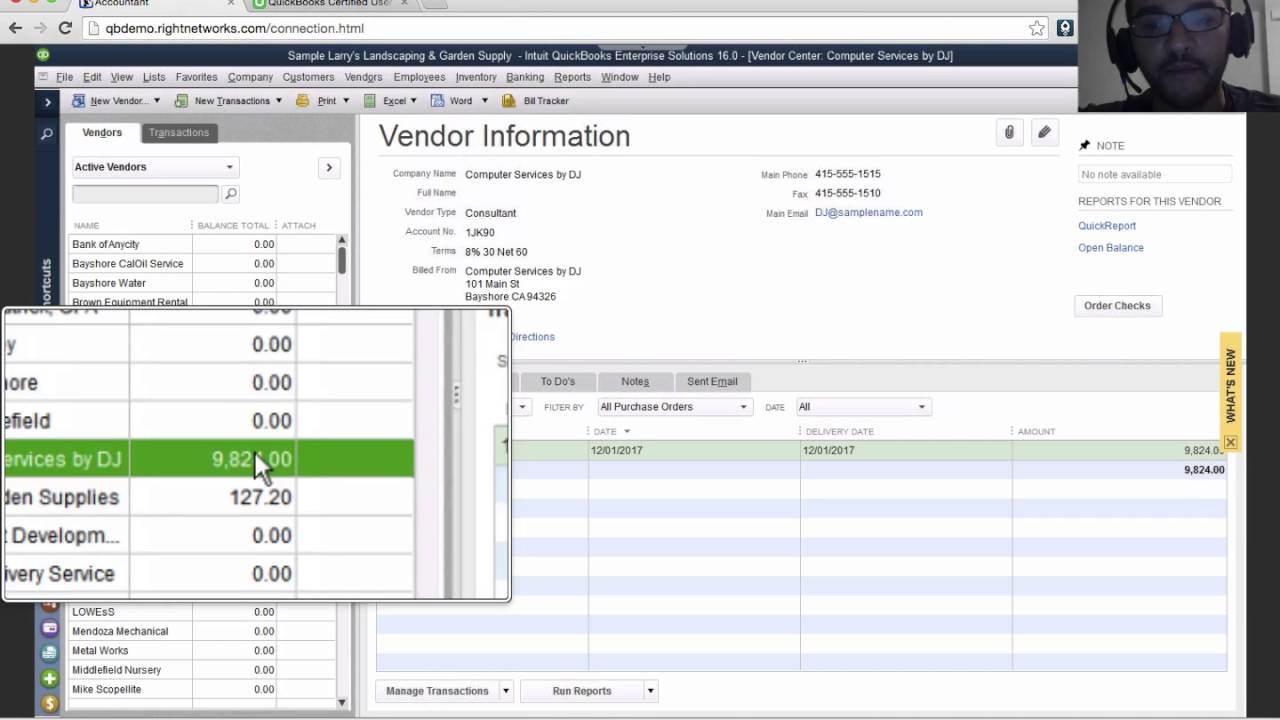

QuickBooks Desktop Tutorial: Purchase Workflow - Purchase Orders, Item Receipts, and Bills

Показать описание

QuickBooks 30-day free trial + 30% off for 12 months:

(30% discount offer to expire 9/30/2021)

presents typical workflows in QuickBooks Purchase Orders, Item Receipts, and Bills

Topics contained in this video:

00:00:11 – Intro to purchase orders in QuickBooks Desktop, receive inventory (with bill or without bill), enter bills against inventory, pay bill

00:02:04 – Purchase order and how it works

00:03:05 – Receive inventory and how it works

00:05:21 – Enter bills against inventory and how it works (select item receipt)

00:07:18 – Pay bills

00:08:51 – Bill/credit

(30% discount offer to expire 9/30/2021)

presents typical workflows in QuickBooks Purchase Orders, Item Receipts, and Bills

Topics contained in this video:

00:00:11 – Intro to purchase orders in QuickBooks Desktop, receive inventory (with bill or without bill), enter bills against inventory, pay bill

00:02:04 – Purchase order and how it works

00:03:05 – Receive inventory and how it works

00:05:21 – Enter bills against inventory and how it works (select item receipt)

00:07:18 – Pay bills

00:08:51 – Bill/credit

QuickBooks Desktop Tutorial: Purchase Workflow - Purchase Orders, Item Receipts, and Bills

QuickBooks Desktop Enterprise: Purchase Order & Bill approval workflows

QuickBooks Desktop: Basic Inventory Purchase and Receiving Workflow

How to set up custom approval workflows in QuickBooks Desktop Enterprise

QuickBooks Desktop | Purchase and Record Fixed Assets

Quickbooks 2021 Tutorial for Beginners - How to Create a Purchase Order

How to Record, Track, and Process Purchase Orders in QuickBooks | Introduction to QuickBooks Online

Quickbooks Desktop Accounts Payable Tutorial 2021 - Understanding AP in Quickbooks Desktop

QuickBooks Desktop 2016 Fundamentals - Purchase Orders

QuickBooks Desktop: Partial Purchase Order Item Receipts. Separate Bills from Item Receipts

How to Create Purchase Orders in QuickBooks Desktop

Purchase Office Supplies with a Check - QuickBooks Desktop

How to record Purchase Discount in QuickBooks Accounting Software

How to set up custom bill approval workflows in QuickBooks Desktop Enterprise

Quickbooks: How to Approve a Purchase Order

How to receive and pay for inventory in QuickBooks Desktop

Quickbooks Desktop Tutorial - How to Pay Bills Properly

Learn about Creating a Purchase Order in Intuit QuickBooks Desktop Pro 2022: A Training Tutorial

How to set up vendors in QuickBooks Desktop

How to Record Cash Sales in QuickBooks Desktop

QuickBooks Desktop: Linking Sales Orders to Purchase Orders

Use QuickBooks Desktop & Tradogram's Purchase Order System [Guide]

The workflow I used to pass the QuickBooks Desktop Advanced Certification Test (2015)

How To Make Purchase Order In QuickBooks Desktop

Комментарии

0:09:56

0:09:56

0:19:58

0:19:58

0:11:44

0:11:44

0:03:53

0:03:53

0:06:03

0:06:03

0:08:33

0:08:33

0:03:37

0:03:37

0:12:18

0:12:18

0:07:25

0:07:25

0:22:27

0:22:27

0:10:03

0:10:03

0:01:52

0:01:52

0:11:00

0:11:00

0:02:18

0:02:18

0:02:21

0:02:21

0:04:08

0:04:08

0:11:45

0:11:45

0:03:11

0:03:11

0:02:38

0:02:38

0:05:01

0:05:01

0:16:12

0:16:12

0:25:33

0:25:33

0:05:10

0:05:10

0:07:26

0:07:26