filmov

tv

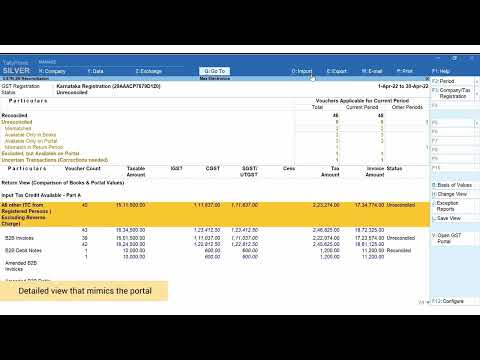

Detail GSTR 2B Analysis | GSTR 2A removed from GST Portal

Показать описание

📍In this session we will cover the important update on Sec 16(2)(aa), inserted by Finance Act 2021. As per Sec 16(2)(aa) the details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37. However please note this clause is still need to notify by the CBIC. On the other hand Rule 36(4) provides 5% provisional ITC on eligible ITC.

📍For consultancy please contact below

📞9718097735

📍For query related to course please contact below

📞8368741773

Cheers Folks

Thanks for Watching :)

Team Fintaxpro

Disclaimer- Although all provisions, notifications, updates, and live demos are analyzed in-depth by our team before presenting to the public. We hereby provide our point of view only and tax matters are always subject to frequent changes hence advisory is only for the benefit of the general public. Hence neither Fintaxpro Advisory LLP nor its designated partner is liable for any consequence that arises on the basis of YouTube videos.

©️Fintaxpro Advisory LLP

📍For consultancy please contact below

📞9718097735

📍For query related to course please contact below

📞8368741773

Cheers Folks

Thanks for Watching :)

Team Fintaxpro

Disclaimer- Although all provisions, notifications, updates, and live demos are analyzed in-depth by our team before presenting to the public. We hereby provide our point of view only and tax matters are always subject to frequent changes hence advisory is only for the benefit of the general public. Hence neither Fintaxpro Advisory LLP nor its designated partner is liable for any consequence that arises on the basis of YouTube videos.

©️Fintaxpro Advisory LLP

Комментарии

0:12:20

0:12:20

0:10:58

0:10:58

1:18:13

1:18:13

0:44:44

0:44:44

0:18:35

0:18:35

0:01:30

0:01:30

0:12:39

0:12:39

0:48:16

0:48:16

1:58:37

1:58:37

0:07:00

0:07:00

0:13:30

0:13:30

0:06:06

0:06:06

0:05:39

0:05:39

0:16:28

0:16:28

0:11:29

0:11:29

0:06:13

0:06:13

0:36:41

0:36:41

0:25:45

0:25:45

0:11:37

0:11:37

0:15:40

0:15:40

0:06:41

0:06:41

0:31:41

0:31:41

1:03:07

1:03:07

0:05:42

0:05:42