filmov

tv

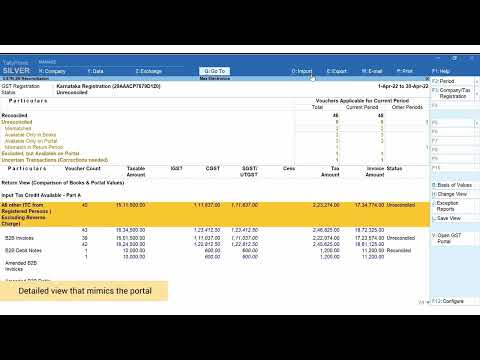

GSTR 2B - How to analyse GSTR 2B- Detailed explanation of GSTR 2B- Auto Drafted ITC Statement

Показать описание

For Following Services do call us or Whatsapp on 8000028250.

Mr. Kalpesh Shah (Popularly known as Kalp)

' GST Registration and

GST return Filing

GST legal matter

GST refund

GST ITC(input tax credit)

Duty Drawback of customs Duty

Icegate portal registration

IEC code

RCMC (Registration cum membership certificate ) of EPC

Income tax return filing and planning for business and salary

New Company incorporation New partnership Registration New LLP Incorporation

Conversion of partnership into private limited company, Conversion of LLP into private limited company, conversion of private limited company to public limited company

Digital Signature

XBRL Filing

Valuation of financial assets, plant and machinery and land and building

FEMA related compliances

Legal Agreement and Legal contract drafting

Merchant exporting and merchant exporting guidance

Export import related guidance and training

GST training

ISO certification

Link for GSTR 2B Advisory :

Important Advisory:

a. GSTR-2B is a statement which has been generated on the basis of the information furnished by your suppliers in their respective FORMS GSTR-1,5 and 6.

It is a static statement and will be made available once a month. The documents fled by the supplier in any FORMS GSTR-1,5 and 6 would refect in the next open FORM GSTR-2B of the recipient irrespective of supplier’s date of fling. Taxpayers are advised to refer FORM GSTR-2B for availing credit in FORM GSTR-3B. However, in case for additional details, they may refer to their respective FORM GSTR-2A (which is updated on near real time basis) for more details.

b. Input tax credit shall be indicated to be non-available in the following scenarios: -

i. Invoice or debit note for supply of goods or services or both where the recipient is not entitled to input tax credit as per the provisions of sub section (4) of Section 16 of CGST Act, 2017.

ii. Invoice or debit note where the Supplier (GSTIN) and place of supply are in the same State while recipient is in another State.

However, there may be other scenarios for which input tax credit may not be available to the taxpayers and the same has not been generated by the system.

Taxpayers, should self-assess and reverse such credit in their FORM GSTR-3B.

GSTR-2B is an auto-drafted ITC statement which will be generated for every registered person on the

basis of the information furnished by his suppliers in their respective GSTR-1, 5 (non-resident taxable person) and 6 (input service distributor). The statement will indicate availability of input tax credit to the registered person against each document filed by his suppliers.

3. GSTR-2B is a static statement and will be made available for each month on the 12th day of the succeeding month. For example, for the month of July 2020, the statement will be generated and made available to

the registered person on 12th August 2020.

4. GSTR-2B for a month (M) will contain the details of all the document filed by his suppliers in their respective GSTR-1, 5 and 6 between the due date of furnishing of GSTR-1 for previous month (M-1) to the due date of furnishing of GSTR-1 for the current month (M). For example, GSTR-2B generated for

the month of July, 2020 will contain the details of all the documents filed by suppliers in their GSTR-1, 5 and 6 from 00:00 hours on 12th July, 2020 to 23:59 hours on 11th August 2020.

5. There may be instances where the date of filing of GSTR-5 (Non-Resident taxable person) and GSTR-6 (Input Service Distributor) may be later than the date of generation of GSTR-2B. Under such circumstances, taxpayers are advised to avail input tax credit on self-assessment basis. However, when such document gets filed and reflected in their next GSTR-2B, taxpayers shall not avail such input tax credit.

6. GSTR-2B also contains information on import of goods from the ICEGATE system including inward supplies of goods received from Special Economic Zones Units / Developers. This will be made available from GSTR-2B of August 2020 (generated on 12th September 2020).

7. It may be noted that reverse charge credit on import of services is not a part of this statement and will be continued to be entered by taxpayers in Table 4(A)(2) of FORM GSTR-3B.

8. The documents furnished by the supplier in any GSTR-1,5 and 6 would reflect in the next open GSTR-2B of the recipient irrespective of the date of issuance of the concerned document. For example, if a supplier furnishes a document INV-1 dt. 15.05.2020 in the FORM GSTR-1 for the month of July, 2020 filed on 11th August 2020, the details of INV-1, dt. 15.05.2020 will get reflected in GSTR-2B of July 2020 (generated on 12th August 2020) and not in the GSTR-2B of May, 2020.

Mr. Kalpesh Shah (Popularly known as Kalp)

' GST Registration and

GST return Filing

GST legal matter

GST refund

GST ITC(input tax credit)

Duty Drawback of customs Duty

Icegate portal registration

IEC code

RCMC (Registration cum membership certificate ) of EPC

Income tax return filing and planning for business and salary

New Company incorporation New partnership Registration New LLP Incorporation

Conversion of partnership into private limited company, Conversion of LLP into private limited company, conversion of private limited company to public limited company

Digital Signature

XBRL Filing

Valuation of financial assets, plant and machinery and land and building

FEMA related compliances

Legal Agreement and Legal contract drafting

Merchant exporting and merchant exporting guidance

Export import related guidance and training

GST training

ISO certification

Link for GSTR 2B Advisory :

Important Advisory:

a. GSTR-2B is a statement which has been generated on the basis of the information furnished by your suppliers in their respective FORMS GSTR-1,5 and 6.

It is a static statement and will be made available once a month. The documents fled by the supplier in any FORMS GSTR-1,5 and 6 would refect in the next open FORM GSTR-2B of the recipient irrespective of supplier’s date of fling. Taxpayers are advised to refer FORM GSTR-2B for availing credit in FORM GSTR-3B. However, in case for additional details, they may refer to their respective FORM GSTR-2A (which is updated on near real time basis) for more details.

b. Input tax credit shall be indicated to be non-available in the following scenarios: -

i. Invoice or debit note for supply of goods or services or both where the recipient is not entitled to input tax credit as per the provisions of sub section (4) of Section 16 of CGST Act, 2017.

ii. Invoice or debit note where the Supplier (GSTIN) and place of supply are in the same State while recipient is in another State.

However, there may be other scenarios for which input tax credit may not be available to the taxpayers and the same has not been generated by the system.

Taxpayers, should self-assess and reverse such credit in their FORM GSTR-3B.

GSTR-2B is an auto-drafted ITC statement which will be generated for every registered person on the

basis of the information furnished by his suppliers in their respective GSTR-1, 5 (non-resident taxable person) and 6 (input service distributor). The statement will indicate availability of input tax credit to the registered person against each document filed by his suppliers.

3. GSTR-2B is a static statement and will be made available for each month on the 12th day of the succeeding month. For example, for the month of July 2020, the statement will be generated and made available to

the registered person on 12th August 2020.

4. GSTR-2B for a month (M) will contain the details of all the document filed by his suppliers in their respective GSTR-1, 5 and 6 between the due date of furnishing of GSTR-1 for previous month (M-1) to the due date of furnishing of GSTR-1 for the current month (M). For example, GSTR-2B generated for

the month of July, 2020 will contain the details of all the documents filed by suppliers in their GSTR-1, 5 and 6 from 00:00 hours on 12th July, 2020 to 23:59 hours on 11th August 2020.

5. There may be instances where the date of filing of GSTR-5 (Non-Resident taxable person) and GSTR-6 (Input Service Distributor) may be later than the date of generation of GSTR-2B. Under such circumstances, taxpayers are advised to avail input tax credit on self-assessment basis. However, when such document gets filed and reflected in their next GSTR-2B, taxpayers shall not avail such input tax credit.

6. GSTR-2B also contains information on import of goods from the ICEGATE system including inward supplies of goods received from Special Economic Zones Units / Developers. This will be made available from GSTR-2B of August 2020 (generated on 12th September 2020).

7. It may be noted that reverse charge credit on import of services is not a part of this statement and will be continued to be entered by taxpayers in Table 4(A)(2) of FORM GSTR-3B.

8. The documents furnished by the supplier in any GSTR-1,5 and 6 would reflect in the next open GSTR-2B of the recipient irrespective of the date of issuance of the concerned document. For example, if a supplier furnishes a document INV-1 dt. 15.05.2020 in the FORM GSTR-1 for the month of July, 2020 filed on 11th August 2020, the details of INV-1, dt. 15.05.2020 will get reflected in GSTR-2B of July 2020 (generated on 12th August 2020) and not in the GSTR-2B of May, 2020.

0:17:18

0:17:18

0:04:29

0:04:29

0:11:52

0:11:52

0:05:42

0:05:42

0:07:00

0:07:00

0:00:52

0:00:52

0:08:01

0:08:01

0:06:59

0:06:59

0:01:30

0:01:30

0:10:16

0:10:16

0:01:00

0:01:00

0:12:39

0:12:39

0:00:51

0:00:51

0:13:30

0:13:30

0:00:56

0:00:56

0:01:01

0:01:01

0:00:58

0:00:58

0:00:54

0:00:54

0:18:35

0:18:35

0:05:29

0:05:29

0:06:53

0:06:53

0:23:19

0:23:19

0:00:19

0:00:19

0:00:28

0:00:28