filmov

tv

Your 84 Month Car Loan Is Making You Poor

Показать описание

It took me along time to understand this, just because you can afford the payments doesn’t mean you can afford the item itself. I learned this the hard way back in college. I wanted to buy a $3000 Mac Book computer, and my mom gave me $1000 and I borrowed the other $2000 on a credit card and I said, I can afford the payments, so I’ll be fine.

Well, the story has a happy ending, which I learned my lesson. But alone the way I lost my job, the computer lost value, and there were times where I was sure I was going to be able to make those payments. The computer turned from a dream come true, to a problem.

👨🏽💻Financial Freedom Course👨🏽💻$100 OFF CODE: LONGTERM

💰MY M1 FINANCE PORTFOLIO💰 PLUS $10

Average car payment: $500 over 84 months (7 years)

1. I can Afford it Illusion and everyone else does it

-Well most people are broke don’t forget that

-You get talked into a more expensive car (savvy sales men focus on payments instead of price)

2. It takes your Money ( you’re thinking Short term and it keeps you in debt longer )

-You get what you want now

-By subscriber to a loan term string of negative payments

3. Flexibility – Its yours, they can't take it, it's less stress

4. Solution

-Built up to the car you want

Forbes

1. You end up under water ( value goes down by 25% while you pay 12-15% down )

-If you want to sell but owe more than its worth it’s a problem

-During covid a lot of ppl got an exit opportunity and didn’t take it

2. Trade-in short fall to keep you negative

-Car worth 10k but you owe 15k

-They will give you 10k and add the 5k to your new loan

-It's so toxic

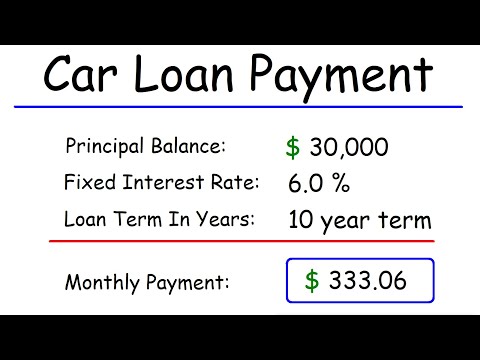

3. You end up paying big bucks

-Retail price, interest and opportunity cost

Forget about the interest rate focus on

-Can you cash

-Do you more half your income in cars

* PRO TIP*

INFORMATION IS EVERYTHING

💲1 on 1 Talk + My Budget + Stock Investments💲

👕Merch👕

✅2 FREE AUDIOBOOKS✅

💰M1 FINANCE $10💰

🎁ACORN FREE $5🎁

⚡FREE KINDLE UNLIMITED⚡ (traditional reading)

👨🏽💻DISCORD PRIVATE GROUP👨🏽💻

😎All My Social Media😎

*Some of the links and other products that appear on this video are from companies in which Tommy Bryson will earn an affiliate commission or referral bonus. Tommy Bryson is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. I'm an Accountant but I'm not your Accountant, always review information with your Accountant/CPA and your Financial Advisor.

Well, the story has a happy ending, which I learned my lesson. But alone the way I lost my job, the computer lost value, and there were times where I was sure I was going to be able to make those payments. The computer turned from a dream come true, to a problem.

👨🏽💻Financial Freedom Course👨🏽💻$100 OFF CODE: LONGTERM

💰MY M1 FINANCE PORTFOLIO💰 PLUS $10

Average car payment: $500 over 84 months (7 years)

1. I can Afford it Illusion and everyone else does it

-Well most people are broke don’t forget that

-You get talked into a more expensive car (savvy sales men focus on payments instead of price)

2. It takes your Money ( you’re thinking Short term and it keeps you in debt longer )

-You get what you want now

-By subscriber to a loan term string of negative payments

3. Flexibility – Its yours, they can't take it, it's less stress

4. Solution

-Built up to the car you want

Forbes

1. You end up under water ( value goes down by 25% while you pay 12-15% down )

-If you want to sell but owe more than its worth it’s a problem

-During covid a lot of ppl got an exit opportunity and didn’t take it

2. Trade-in short fall to keep you negative

-Car worth 10k but you owe 15k

-They will give you 10k and add the 5k to your new loan

-It's so toxic

3. You end up paying big bucks

-Retail price, interest and opportunity cost

Forget about the interest rate focus on

-Can you cash

-Do you more half your income in cars

* PRO TIP*

INFORMATION IS EVERYTHING

💲1 on 1 Talk + My Budget + Stock Investments💲

👕Merch👕

✅2 FREE AUDIOBOOKS✅

💰M1 FINANCE $10💰

🎁ACORN FREE $5🎁

⚡FREE KINDLE UNLIMITED⚡ (traditional reading)

👨🏽💻DISCORD PRIVATE GROUP👨🏽💻

😎All My Social Media😎

*Some of the links and other products that appear on this video are from companies in which Tommy Bryson will earn an affiliate commission or referral bonus. Tommy Bryson is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. I'm an Accountant but I'm not your Accountant, always review information with your Accountant/CPA and your Financial Advisor.

Комментарии

0:11:08

0:11:08

0:14:16

0:14:16

0:06:11

0:06:11

0:00:35

0:00:35

0:05:45

0:05:45

0:00:45

0:00:45

0:02:25

0:02:25

0:06:46

0:06:46

0:02:51

0:02:51

0:00:09

0:00:09

0:00:06

0:00:06

0:05:04

0:05:04

0:03:07

0:03:07

0:00:46

0:00:46

0:04:07

0:04:07

0:10:44

0:10:44

0:11:06

0:11:06

0:03:21

0:03:21

0:05:45

0:05:45

0:05:19

0:05:19

0:04:15

0:04:15

0:00:08

0:00:08

0:00:29

0:00:29

0:06:19

0:06:19