filmov

tv

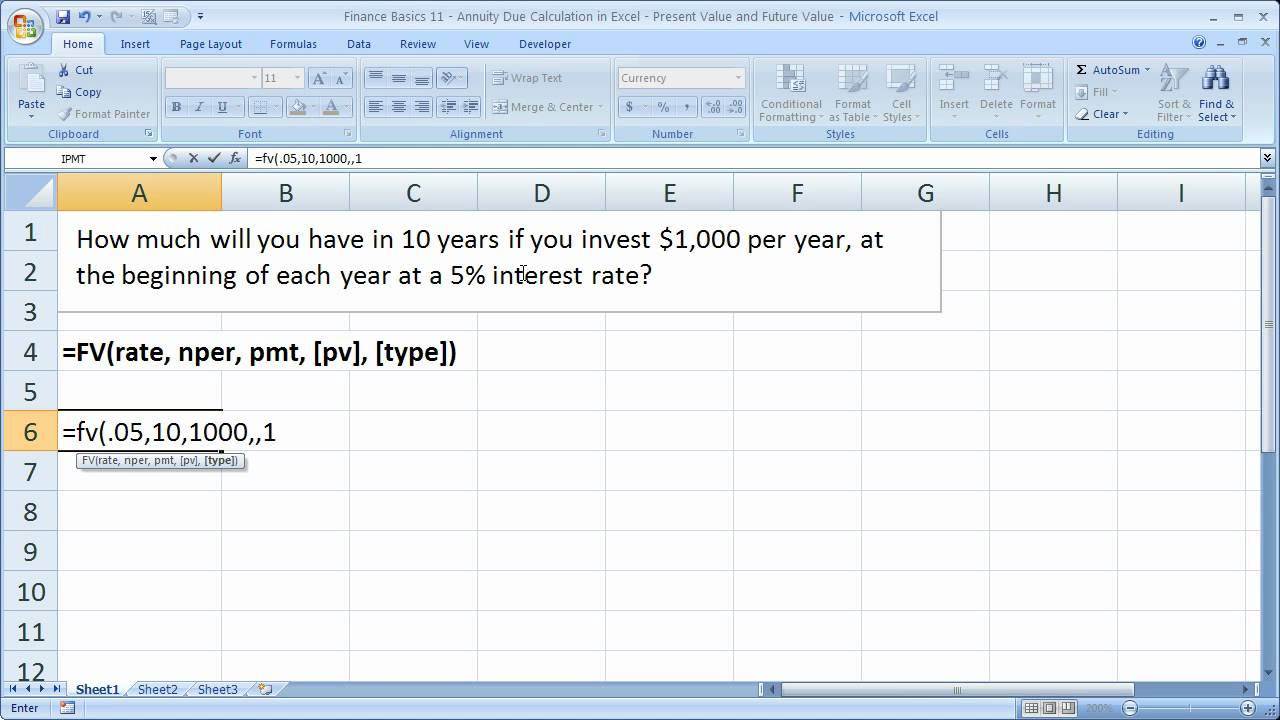

Finance Basics 11 - Annuity Due Calculation in Excel - Present Value and Future Value

Показать описание

This Excel Video Tutorial shows you how to calculate the Annuity Due in Excel. You will learn how to calculate the annuity due for the present value and future value functions in Excel.

Annuity due simply means that any annuity payments are made at the end of the period instead of the default situation where annuity payments are made at the beginning of the period. This is a great tutorial for all of those just starting out in finance or for people who need to learn how to calculate an annuity due in Excel.

Have a great day!

Finance Basics 11 - Annuity Due Calculation in Excel - Present Value and Future Value

Introduction to Annuities

What Is An Annuity And How Does It Work?

Understanding Annuity Basics – How Do Annuities Work?

FLM 11 Annuity Basics

Annuity breakdown: A look at what an annuity is and the different types available for investors

What is an annuity?

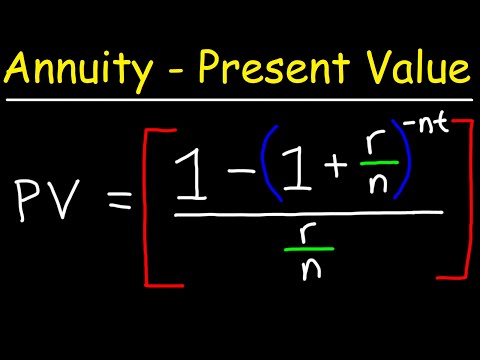

How To Calculate The Present Value of an Annuity

Retirement Annuities Explained – Introduction to Annuities

Group Plans Chapter 1 3 11 Segregated Funds and Annuities Financial education video lessons

Finance Basics 4 - Calculating Annuities in Excel - Future Value for Annuities

Warren Buffet explains how one could've turned $114 into $400,000 by investing in S&P 500 i...

PC 11 - Financial Literacy - Annuities: Investments and Loans

Annuities Explained | Your Life Simplified

Annuities: Basic Concepts

⚠️'WAIT!! Annuities ARE BAD!' (...Or Not? 🤔) #shorts

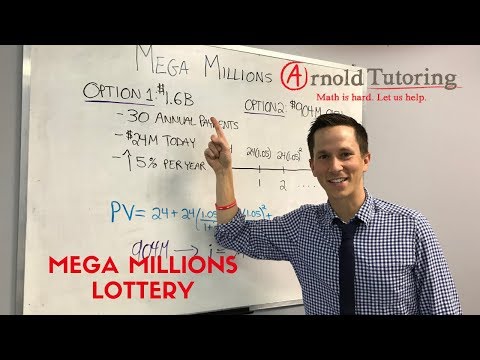

MEGA MILLIONS - CASH OR ANNUITY?

Fixed Annuities means FIXED Growth!

How To Calculate The Future Value of an Ordinary Annuity

Basic Concepts of Annuities and Present Value of Annuity | Interest and Annuities

Money and Finance: Crash Course Economics #11

Financial Calculator: Solving Annuity Due

Present Value Of Ordinary Annuity || PVa || Interest More Than Once In A Year || Time Value Of Money

Annuities in IRAs #stantheannuityman #theannuityman #annuity #money #retirement #ira

Комментарии

0:08:06

0:08:06

0:13:37

0:13:37

0:05:54

0:05:54

0:03:27

0:03:27

0:02:01

0:02:01

0:00:30

0:00:30

0:02:02

0:02:02

0:16:15

0:16:15

0:20:58

0:20:58

0:03:52

0:03:52

0:06:31

0:06:31

0:00:50

0:00:50

0:20:52

0:20:52

0:00:39

0:00:39

0:09:05

0:09:05

0:00:27

0:00:27

0:00:57

0:00:57

0:00:19

0:00:19

0:10:03

0:10:03

0:10:41

0:10:41

0:10:36

0:10:36

0:00:27

0:00:27

0:00:59

0:00:59

0:00:15

0:00:15