filmov

tv

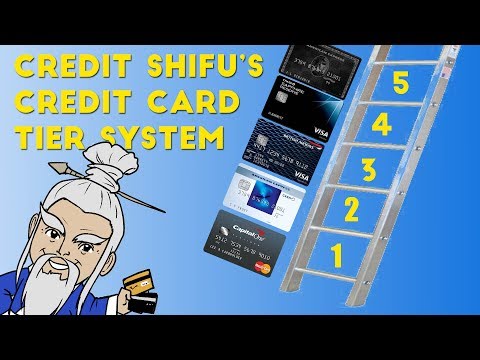

How to Climb the Credit Card Ladder Pt 2: Why we Have 13 Credit Cards

Показать описание

Click "show more" for ad disclosure

This is how to climb the credit card ladder part 2! Where we further explain our credit card tier system and show you how you can get the best credit card for the tier you are at. We look at starter cards, hotel rewards credit cards, hotel credit cards and two premium credit cards from Chase and American Express.

Advertiser Disclosure: This site is part of an affiliate sales network and receives

compensation may impact how and where links appear on this site. This site does not

include all financial companies or all available financial offers.

This is how to climb the credit card ladder part 2! Where we further explain our credit card tier system and show you how you can get the best credit card for the tier you are at. We look at starter cards, hotel rewards credit cards, hotel credit cards and two premium credit cards from Chase and American Express.

Advertiser Disclosure: This site is part of an affiliate sales network and receives

compensation may impact how and where links appear on this site. This site does not

include all financial companies or all available financial offers.

How To Climb The Credit Card Ladder [2024 Guide] | NerdWallet

How to Climb The Credit Card Ladder in 2024

How to Climb The Credit Card Ladder in 2024

How to Climb the Credit Card Tier List (2023)

How to Climb the Credit Card Ladder | 2024 Guide

How to Climb the Credit Card Ladder (Tier System Explained)

How to Climb the Credit Card Ladder in 2024

How To Climb The Credit Card Ladder (Explained)

UNRESTRICTED CLIMB!! F-22 Raptor Departing Toronto for Batvia

How To Climb The Credit Ladder (secrets no one tells you)

How to Climb the Chase Credit Card Ladder [2024 Guide]

How To Climb The Credit Card Ladder With Bad Credit in 2024

How To Climb The Credit Card Tier List in 2024

How To Climb The Credit Card Ladder | 2023 FULL Guide | (FOR BEGINNERS)

How To Climb The Credit Card Tier List in 2023 ( AS A STUDENT)

How To Climb The Credit Card Ladder 2020 UPDATE

How To Climb The Credit Ladder In 2021 - Tier System Explained (UK Edition)

How to Climb the Credit Card Ladder in 2022

How To Climb The Credit Card Latter In 3 Steps

🍁How To Climb The Canadian Credit Card Ladder

[2019] HOW to Climb The CREDIT CARD Ladder (Tier System)

How to Climb the CREDIT CARD LADDER in 2021...

How to Climb The Credit Card Ladder (Tier System)

How to climb the CREDIT CARD LADDER

Комментарии

0:08:26

0:08:26

0:15:41

0:15:41

0:22:07

0:22:07

0:12:35

0:12:35

0:08:30

0:08:30

0:12:44

0:12:44

0:09:35

0:09:35

0:12:05

0:12:05

0:01:12

0:01:12

0:52:41

0:52:41

0:18:38

0:18:38

0:23:06

0:23:06

0:15:31

0:15:31

0:11:03

0:11:03

0:12:28

0:12:28

0:17:06

0:17:06

0:23:01

0:23:01

0:10:09

0:10:09

0:01:01

0:01:01

0:07:51

0:07:51

![[2019] HOW to](https://i.ytimg.com/vi/Bn-YLtjiPcQ/hqdefault.jpg) 0:14:39

0:14:39

0:13:50

0:13:50

0:12:48

0:12:48

0:22:41

0:22:41