filmov

tv

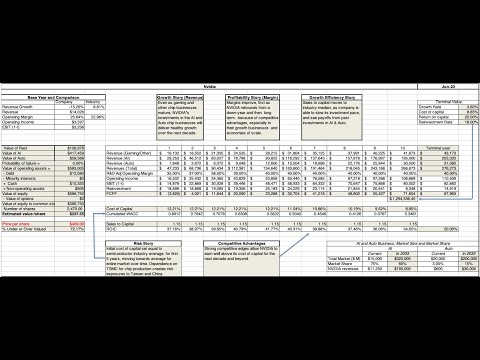

NVIDIA DCF Valuation Model Built From Scratch | FREE EXCEL INCLUDED (2023)

Показать описание

⬇️ Download the NVIDIA DCF Excel for FREE ⬇️

🖥️Wall Street Prep🖥️

► Use code RARELIQUID for 20% OFF on any course!

🚀Sign up for my courses🚀

🎥Related Videos🎥

⏱Timestamps⏱

0:00 - Agenda

4:55 - Wall Street Prep

7:05 - Income Statement & Cash Flow Line Items

48:15 - Build DCF

1:31:30 - WACC

1:41:30 - Calculating Implied Share Price

2:03:15 - Price Discussion

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

📱Interact With Me📱

🧑🎓Career Resources👩🎓

🔎Disclaimer🔎

All content in this video is for entertainment purposes only. I am not a professional financial advisor and my statements are not to be taken as instructions or directions. In addition, some of the links above are affiliate links, meaning that at no additional cost to you, I may earn a commission if you click through and make a purchase.

#nvidia #nvda #stocks #dcf

🖥️Wall Street Prep🖥️

► Use code RARELIQUID for 20% OFF on any course!

🚀Sign up for my courses🚀

🎥Related Videos🎥

⏱Timestamps⏱

0:00 - Agenda

4:55 - Wall Street Prep

7:05 - Income Statement & Cash Flow Line Items

48:15 - Build DCF

1:31:30 - WACC

1:41:30 - Calculating Implied Share Price

2:03:15 - Price Discussion

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

📱Interact With Me📱

🧑🎓Career Resources👩🎓

🔎Disclaimer🔎

All content in this video is for entertainment purposes only. I am not a professional financial advisor and my statements are not to be taken as instructions or directions. In addition, some of the links above are affiliate links, meaning that at no additional cost to you, I may earn a commission if you click through and make a purchase.

#nvidia #nvda #stocks #dcf

NVIDIA DCF Valuation Model Built From Scratch | FREE EXCEL INCLUDED (2023)

2024 NEW NVIDIA DCF Valuation Model Built From Scratch | FREE EXCEL INCLUDED

NVIDIA DCF Valuation Model (Built From Scratch By Former J.P. Morgan Investment Banking Analyst!)

NVIDIA DCF Valuation Model 2024 | $NVDA Price Prediction Discounted Cash Flow Financial Modeling

The Next NVIDIA? TSMC DCF Model | FREE EXCEL INCLUDED

How to Build a Discounted Cash Flow (DCF) | Step-By-Step Guide From Ex-JP Morgan Investment Banker

The Complete Tesla DCF Valuation Model! (2023 Edition)

Building a DCF Model for Nvidia Stock - Two Idiots Demonstrate Show You, Step-by-step!

AMD DCF Valuation Model Built From Scratch | FREE EXCEL INCLUDED (2024)

Nvidia Corporation Discounted Cash Flow Analysis (NASDAQ:NVDA)

Chipotle ($CMG) DCF Valuation Model | Built By Former JP Morgan Banker!

The DCF Model Explained - How The Pros Value Stocks/Businesses

Alphabet (Google) DCF Valuation Model Built From Scratch | FREE EXCEL INCLUDED (2023)

Berkshire Hathaway DCF Valuation Model Built From Scratch | FREE EXCEL INCLUDED (2023)

How Much Is Nvidia Stock Really Worth? A Discounted Cash Flow Valuation of Nvidia Stock | NVDA Stock

Microsoft DCF Valuation Model Built From Scratch | FREE EXCEL INCLUDED (2023)

Salesforce DCF Valuation Model (2022) | Built From Scratch By Ex-JP Morgan Investment Banker!

Tesla DCF Valuation Model - Built From Scratch By Former J.P. Morgan Investment Banking Analyst!

Amazon DCF Valuation Model (Built From Scratch By Former J.P. Morgan Investment Banking Analyst!)

Netflix DCF Valuation Model (2022) | Built From Scratch By Ex-JP Morgan Investment Banking Analyst!

Discounted Cash Flow (DCF) Method of Valuation - Tutorial for Beginners

Costco DCF Valuation Model (2022) | Built From Scratch By Ex-JP Morgan Investment Banker!

Meta / Facebook DCF Valuation Model (2022) | Built From Scratch By Ex-JP Morgan Investment Banker!

AI Winners, Losers and Wannabes: Valuing AI's Boost to NVIDIA's Value!

Комментарии

2:16:51

2:16:51

2:16:26

2:16:26

2:05:15

2:05:15

0:13:40

0:13:40

2:01:16

2:01:16

0:29:15

0:29:15

1:35:57

1:35:57

0:09:06

0:09:06

2:29:22

2:29:22

0:11:59

0:11:59

1:42:45

1:42:45

0:14:50

0:14:50

2:18:31

2:18:31

3:30:16

3:30:16

0:13:59

0:13:59

3:09:30

3:09:30

1:34:54

1:34:54

3:26:09

3:26:09

1:52:01

1:52:01

2:01:27

2:01:27

1:46:52

1:46:52

1:36:14

1:36:14

1:56:53

1:56:53

0:45:16

0:45:16